Forex Sentiment Do Not Chase

Contents:

Over the past 12 months 67% of NSFX Limited’s forex ig client sentiment investor accounts lose money when trading CFDs with NSFX Limited. If you’re looking for low spreads, a wide range of instruments, up-to-date news, industry-leading research tools and education, then IG might be your go-to. To provide transparency to the over-the-counter forex market, many forex brokers publish the aggregate percentage of traders or trades that are currently long or short in a particular currency pair. Client sentiment, which looks at the number of long and short trades on a particular market, is a useful tool in a trading strategy. It is often said that clients look to sell into rising markets and buy into falling ones.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

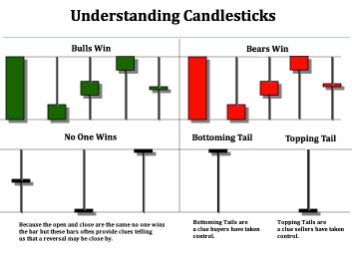

Of course, you will need pretty good coding experience to use such interfaces effectively. Also, retail traders often buy right at market tops or sell right at market bottoms, without realizing this could be in strong support or resistance zones. Since these areas feel ‘safe,’ this can create another trap for the ‘big boys’ to take price the other way. To understand why this type of indicator can be powerful, one needs to grasp the sentiment concept. In any tradable financial market, the two most common strands of analysis are technical and fundamental.

IG’s Trading Instruments

Having a sentiment-based approach can help you decide whether you should go with the flow or not. Advanced research tools are one of the most useful things you can find on the IG online platform. There’s a number of different trading courses that users can access online on the IG platform. In terms of security, the app offers both touch, and face login recognition features, which are more advanced than others available in the industry. If you want to trade on the go, IG mobile app is designed to completely facilitate mobile trading.

These include COT reports, open interest, and brokers’ position summaries. With so many participants—most of whom are trading for speculative reasons—gaining an edge in the forex market is crucial. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018.

For instance, if 57% of clients are long in a market while 43% are short, the natural inclination would be to assume bullish sentiment because of the numerical difference. While this may be true in some cases, IG’s index may conclude the trading bias as ‘mixed’ based on changes between the longs and shorts from the last day. There’s a belief in forex that most retail investors trade against the trend by picking tops and bottoms.

Among sentiment indicators there is the VIX, the CoT Report, Put-Call Ratios, the Ted Spread, Mutual Funds statistics, Margin Balances and Investor Polls- such as FXStreet’s weeklyFX Forecast Poll. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey.

Non-UK/non-European traders will not be subject to UK and EU protections, such as negative balance protection. The company boasts a couple of reputable awards and is widely seen as one of the top overall forex brokers across the globe. Traders around the world have chosen IG as their number one trusted broker, placing them at the top of the board in world rankings for spread betting and CFD trading. In January 2019, IG re-established its operations in the U.S., and launched IG U.S., on a mission to offer U.S. traders more than their current limited competition does.

How to interpret the IG Client Sentiment Indicator

Following his tenure as Chief Financial Officer, Tim Hawkins was appointed CEO in October 2006, retiring 9 years later in 2015. Following the departure of Tim Howkins, Peter Hetherington became CEO in October 2015, having started at the company as a graduate trainee in January 1994. In May 2005, after two years of private ownership, IG Group and CVC Capital Partners re-floated the company on the main list of the London Stock Exchange with a valuation of £393 million. In October 2008, IG Group acquired FXOnline Japan KK, a Japanese retail FX business.

Fundamental analysis is a way to forecast an assets value by examining economic and financial factors. This section has many articles that describe how the price of an asset will be reacting the following week based off of the events that are happening. Before opening a trade, it is important to analyze current market sentiment. For example, estimate how many traders prefer holding long and short positions now. The web based trading platform features include; over 100 technical indicators, the ability to deal directly from charts, flexibility for all markets, price improvement technology, and more. Although IG U.S. lacks a DMA platform, both the online platform and MT4 offer a crisp and highly-customizable trading experience.

The typical school of thought for making trading decisions is using a combination of technical and fundamental analysis. While these methodologies are helpful, sentiment analysis is often overlooked yet could be a valuable addition. Sentiment analysis is rarely a topic typically discussed in trading communities, although it does deserve merit. The sentiment is strange because it’s inherently based on the emotion of market participants and crowd psychology, whose attitudes are an accumulation of various fundamental and technical factors. This tool covers some of the most popular forex markets like EURUSD, EURJPY, AUDUSD, USDJPY, and other well-known non-forex markets such as Bitcoin, Ethereum, US crude oil, and the S&P 500.

IG Client Sentiment Data Sending Bearish Signals for USD/JPY, AUD/USD, GBP/USD | Webinar

Equities face a minimum commission of 0.10% at both, while the minimums are lower at IG Markets. Markets.com has less additional costs, but frequent traders will find IG Markets superior from a pricing standpoint. Yes, In the UK IG Group and IG Markets is regulated by the FCA so if they go bust your money (up to £85k) is protected by the FSCS. However, your money is not safe from you making bad investment decisions or picking a bad trader to copy trade.

This was basically a time when the trading industry became uber-competitive and brokers were offering big bonuses, sometimes up to £5,000 to new clients to sign up. The catch of course was that you had to generate more than that in trading commission before you could withdraw it or use it. IG’s stance on that was, “No, that’s not for us” clients trade with us because of what our service offers” and didn’t get into the murky business of incentives. Interestingly enough, the FCA banned new account bonuses because it all got a bit out of hand as the more unscrupulous platforms were running too heavy B-books.

ForexFactory

Still, this tool is not necessarily a leading indicator as the behaviors of buyers and sellers in currencies can change in a flash. Of course, IG is not the only broker publishing summaries of their client’s positions in the markets, though only a handful does. The data suggests about 61% of traders are presently long while the rest are short. The natural assumption would presume the overall sentiment is bullish, but this works in reverse as explained.

You must understand that Forex trading, while potentially profitable, can make you lose your money. CFDs are leveraged products and as such loses may be more than the initial invested capital. Trading in CFDs carry a high level of risk thus may not be appropriate for all investors. FXCM is another Forex broker that offers a sentiment indicator of its traders’ positions — via the web-based version of its Trading Station 2.0 platform. In reality, the sentiment analysis tool is an expert advisor, not an indicator and is called OANDA Sentiment Trader. It can be used to place trades and to track existing positions across currency pairs.

Okay so, we’ve highlighted the benefits of IG’s products and services, as well as some areas where they could improve. The UK customer service team was helpful, and calls made to the number provided were swiftly answered quickly. Questions that require more comprehensive answers can be received through email. The IG Academy includes step-by-step courses allowing you to go at your own pace, and provide learning opportunities through video, interactive exercises.

It is a program that connects two https://g-markets.net/lications – for example, your IG trading account and your custom-built platform. Trading with APIs enables you to gain direct access to IG’s ecosystem, providing you with faster order execution and more control, enhancing your trading experience. Points through current will give traders even more control of their execution by allowing them to trade through the current IG price. This feature will reduce your chance of a price rejection in volatile market conditions, and increase the likelihood of successful execution when trading in large sizes. Once this step is done, we were asked to complete a short form that helped IG understand the state of our finances and trading knowledge. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

Forex Market Sentiment: Week of February 27, 2023 – ig.com

Forex Market Sentiment: Week of February 27, 2023.

Posted: Mon, 27 Feb 2023 08:00:00 GMT [source]

Because of the active internal client protection policies and processes, strong regulation, and acclaim from the industry, we consider IG a safe and trustworthy broker. While IG will still fill an order at the best possible price, the chance of a successful execution is increased when using ‘points through current. If you choose to use this feature, IG will only ever partially fill your order as an alternative to outright rejection. IG will never partially fill your order as an alternative to filling it in its entirety. So if you trade in a size so large that we cannot fill your entire order rather than reject your entire order IG will be able to fill you in the maximum size possible. Overall, at IG, withdrawal and deposit costs are low, and withdrawal and deposit times are average for the industry.

AUD/USD IG Client Sentiment: Our data shows traders are now net-long AUD/USD for the first time since Jan 20, 2023 when AUD/USD traded near 0.70. – DailyFX

AUD/USD IG Client Sentiment: Our data shows traders are now net-long AUD/USD for the first time since Jan 20, 2023 when AUD/USD traded near 0.70..

Posted: Tue, 31 Jan 2023 08:00:00 GMT [source]

Clients were significantly net long at the lows of the downtrend, for example at $1.13 and then $1.125, and then short positions increased at the lower highs at $1.15 and $1.14. This has been a volatile currency pair, with dramatic swings over the past few months. What stands out is that at the peak in early November 2018 clients were only around 35% net long . Clients had reduced their long positions and short positions had increased as the price rose from mid-October. Then, the sharp turnaround in the price, which began a steady downtrend, was accompanied by a steady rise in long positions, so that the net long figure rose to over 60%.

About the Author