The Power of Compound Interest: Calculations and Examples

This is the most efficient way to maximise your returns and get the most out of your money. By understanding how compound interest works and acting on it by investing in the right set of investments, you can achieve high returns. Once you have these figures, you can quickly understand how much you will earn from an investment that uses the power of compounding interest. This article about the compound interest formula has expanded and evolved based upon your requests for adapted formulae and examples.

The interest on a loan or deposit calculated based on the initial principal, and the collective interest from previous periods is called compound interest. It is basically ‘interest earned on money that was previously earned as interest’. This allows your sum and interest to grow at a faster rate compared to the simple interest which is calculated only on the principal amount. This type of interest rate is more commonly used in the real life. The loans given as investments are mostly given in this method of payment. In this type, the interest is not calculated not only for the principal but the last term’s interest is also added to the principal and is then calculated.

A credit card balance of $20,000 carried at an interest rate of 20% compounded monthly would result in a total compound interest of $4,388 over one year or about $365 per month. For example, monthly capitalization with interest expressed as an annual rate means that the compounding frequency is 12, with time periods measured in months. Compound interest is an interest calculated on the principal and the existing interest together over a given time period. The interest accumulated on a principal over a period of time is also added to the principal and becomes the new principal amount for the next time period. Again, the interest for the next time period is calculated on the accumulated principal value.

In fact, Compound interest is the biggest reason most people find it difficult to pay back their student loans even years after passing out of school/college . Compound interest is the interest on both the initial principal amount, as well as the interest accumulated over the past periods. If you’re investing or saving money in a bank, Compound Interest is the magical formula that is going to help you reach your money goals faster. This calculation is also useful for calculating the inflated value of our money, i.e. it gives in how many years the value of our asset gets halved if it gets depreciated annually. To get the rate we use the annual rate / periods, or C6/C8. As we already have a formula for future value amount, let us substitute the values in the compound interest formula in maths.

Human Life Value Calculator

Compound interest accrues and is added to the accumulated interest of previous periods, so borrowers must pay interest on interest as well as principal. Is called “interest on interest.” It is calculated on the principal amount, and of the time period, it changes with time. A borrower borrows $1000 from a lender for nine months at an interest rate of 12%.

Some banks also offer something called continuously compounding interest, which adds interest to the principal at every possible instant. For practical purposes, it doesn’t accrue that much more than daily compounding interest unless you want to put money in and take it out on the same day. Interest can be compounded on any given frequency schedule, from continuous to daily to annually. Compounding multiplies money at an accelerated rate and the greater the number of compounding periods, the greater the compound interest will be. Is the interest rate on a continuous compounding basis, andr is the stated interest rate with a compounding frequency n.

It gives the interest on 100 lire, for rates from 1% to 8%, for up to 20 years. Wherer1 is the interest rate with compounding frequency n1, andr2 is the interest rate with compounding frequency n2. The force of interest is less than the annual effective interest rate, but more than the annual effective discount rate. In mathematics, the accumulation functions are often expressed in terms of e, the base of the natural logarithm. This facilitates the use of calculus to manipulate interest formulae.

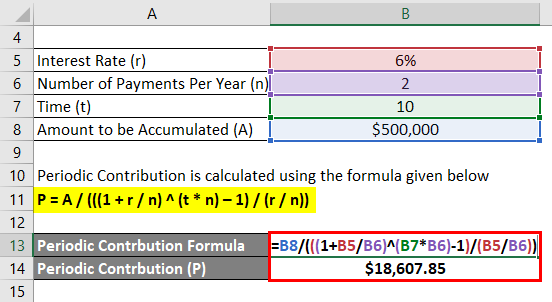

Calculating Compound Interest in Excel

So you’d need to put $30,000 into a savings account that pays a rate of 3.813% per year and compounds interest daily in order to get the same return as the investment account. We provide answers to your compound interest calculations and show you the steps to find the answer. You can also experiment with the calculator to see how different interest rates or loan lengths can affect how much you’ll pay in compounded interest on a loan. Compound interest calculator Law of compoundingis the backbone of financial returns through investment and security through insurance. Albert Einstein once referred to the law of compounding as the “eighth wonder of the world”.

This is because the interest is not fixed and is added to the investment amount in each period. Many investments provide compounding benefits like savings account, insurance products, stocks, mutual funds, bonds, CDs, REITs, treasury securities, and rental properties others. Compound refers to the ability of a sum of money to grow exponentially over time by the repeated addition of earnings to the principal invested.

- Once you have these figures, you can quickly understand how much you will earn from an investment that uses the power of compounding interest.

- As you move from year to year, the principal amount continues to grow.

- Interest can be compounded on any given frequency schedule, from continuous to daily to annually.

- Get your free compound interest formula worksheet of 20+ questions and answers.

- Let’s say the bank offers an annual interest of 5%, which is compounded semi-annually .

It is a short term interest rate which is used by the central banks to issue loans. Compound InterestCompound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. It plays a crucial role in generating higher rewards from an investment.

What are Compound Interest Formulas?

We have now covered what happens to a value as time goes by … But what if we have a series of values, like regular loan payments or yearly investments? To calculate annual compound interest, multiply the original amount of your investment or loan, or principal, by the annual interest rate.

Compound interest is the method of calculation of interest used for all financial and business transactions across the world. The power of compounding is that it is always greater than or equal to the other methods like simple interest. You can calculate compound interest with a simple formula. It is calculated by multiplying the first principal amount by one and adding the annual interest rate raised to the number of compound periods subtract one. The total initial amount of your loan is then subtracted from the resulting value. If you’re wondering what kind of interest rate you need, you can check out our compound interest calculator.

Thanks to all authors for creating a page that has been read 400,771 times. Calculating how much an amount will grow under compound interest is simple with the right equations. The income earned on this product will be 161,154.51 + 10,783.90, which formula of compound interest is equal to 171,938.41. Let’s take an example to understand the calculation of Compound Interest in a better manner. BondsBonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period.

Additionally, the value will grow even faster if the interest is compounded multiple times per year. Compound interest is offered on a variety of investment products and also charged on certain types of loans, like credit card debt. Invest Corp has launched a new investment product that has piqued Shankar’s interest. To invest in this scheme, Shankar needs to put in an initial amount of 50,000, and the investment will mature after 15 years.

Thus, interest calculation of each term takes place on the inflated principal value, giving a different and enhanced return every single time. Banks typically opt for compound interests for a savings account, whereby interests earned on the bank balance are added back to it. Thus, the interest amount of each period keeps increasing after being calculated on a growing bank balance that is accumulating all the interests.

How Do you Calculate Compound Interest for Half Year?

I’ve been using Excel for quite some time now, and I’ve scoured dozens of sources that gave useless advice you’d have to squint to properly see and understand. I’ve hit two of your pages in two google searches in the past five minutes and am kinda cross with myself for not finding it sooner. By convention, the present value is input as a negative value, since the $1000 “leaves your wallet” and goes to the bank during the term. To derive CI, students have to use simple interest formula.

Solved Examples of Compound Interest

Compounding will always work best when the interval of compounding is short. An investment of ₹ 1,00,000 at a 12% rate of return for 5 years compounded annually will be ₹ 1,76,234. From the graph below we can see how an investment of ₹ 1,00,000 has grown in 5 years. The longer you leave your money untouched, the greater it will grow because compound interest grows over time which means your money keeps on multiplying over a period of time. If you are repaying a loan on compound interest, you should not ignore paying the interest or if there is any delay in paying the loan, then the interest burden will be high. To take advantage of compounding, one must aim at increasing their frequency of loan payments.

About the Author