The Power of Compound Interest: Calculations and Examples

This is the most efficient way to maximise your returns and get the most out of your money. By understanding how compound interest works and acting on it by investing in the right set of investments, you can achieve high returns. Once you have these figures, you can quickly understand how much you will earn from an investment that uses the power of compounding interest. This article about the compound interest formula has expanded and evolved based upon your requests for adapted formulae and examples.

The interest on a loan or deposit calculated based on the initial principal, and the collective interest from previous periods is called compound interest. It is basically ‘interest earned on money that was previously earned as interest’. This allows your sum and interest to grow at a faster rate compared to the simple interest which is calculated only on the principal amount. This type of interest rate is more commonly used in the real life. The loans given as investments are mostly given in this method of payment. In this type, the interest is not calculated not only for the principal but the last term’s interest is also added to the principal and is then calculated.

A credit card balance of $20,000 carried at an interest rate of 20% compounded monthly would result in a total compound interest of $4,388 over one year or about $365 per month. For example, monthly capitalization with interest expressed as an annual rate means that the compounding frequency is 12, with time periods measured in months. Compound interest is an interest calculated on the principal and the existing interest together over a given time period. The interest accumulated on a principal over a period of time is also added to the principal and becomes the new principal amount for the next time period. Again, the interest for the next time period is calculated on the accumulated principal value.

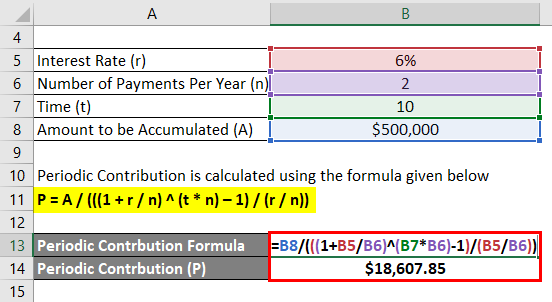

In fact, Compound interest is the biggest reason most people find it difficult to pay back their student loans even years after passing out of school/college . Compound interest is the interest on both the initial principal amount, as well as the interest accumulated over the past periods. If you’re investing or saving money in a bank, Compound Interest is the magical formula that is going to help you reach your money goals faster. This calculation is also useful for calculating the inflated value of our money, i.e. it gives in how many years the value of our asset gets halved if it gets depreciated annually. To get the rate we use the annual rate / periods, or C6/C8. As we already have a formula for future value amount, let us substitute the values in the compound interest formula in maths.

Human Life Value Calculator

Compound interest accrues and is added to the accumulated interest of previous periods, so borrowers must pay interest on interest as well as principal. Is called “interest on interest.” It is calculated on the principal amount, and of the time period, it changes with time. A borrower borrows $1000 from a lender for nine months at an interest rate of 12%.

Some banks also offer something called continuously compounding interest, which adds interest to the principal at every possible instant. For practical purposes, it doesn’t accrue that much more than daily compounding interest unless you want to put money in and take it out on the same day. Interest can be compounded on any given frequency schedule, from continuous to daily to annually. Compounding multiplies money at an accelerated rate and the greater the number of compounding periods, the greater the compound interest will be. Is the interest rate on a continuous compounding basis, andr is the stated interest rate with a compounding frequency n.

It gives the interest on 100 lire, for rates from 1% to 8%, for up to 20 years. Wherer1 is the interest rate with compounding frequency n1, andr2 is the interest rate with compounding frequency n2. The force of interest is less than the annual effective interest rate, but more than the annual effective discount rate. In mathematics, the accumulation functions are often expressed in terms of e, the base of the natural logarithm. This facilitates the use of calculus to manipulate interest formulae.

Calculating Compound Interest in Excel

So you’d need to put $30,000 into a savings account that pays a rate of 3.813% per year and compounds interest daily in order to get the same return as the investment account. We provide answers to your compound interest calculations and show you the steps to find the answer. You can also experiment with the calculator to see how different interest rates or loan lengths can affect how much you’ll pay in compounded interest on a loan. Compound interest calculator Law of compoundingis the backbone of financial returns through investment and security through insurance. Albert Einstein once referred to the law of compounding as the “eighth wonder of the world”.

This is because the interest is not fixed and is added to the investment amount in each period. Many investments provide compounding benefits like savings account, insurance products, stocks, mutual funds, bonds, CDs, REITs, treasury securities, and rental properties others. Compound refers to the ability of a sum of money to grow exponentially over time by the repeated addition of earnings to the principal invested.

- Once you have these figures, you can quickly understand how much you will earn from an investment that uses the power of compounding interest.

- As you move from year to year, the principal amount continues to grow.

- Interest can be compounded on any given frequency schedule, from continuous to daily to annually.

- Get your free compound interest formula worksheet of 20+ questions and answers.

- Let’s say the bank offers an annual interest of 5%, which is compounded semi-annually .

It is a short term interest rate which is used by the central banks to issue loans. Compound InterestCompound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. It plays a crucial role in generating higher rewards from an investment.

What are Compound Interest Formulas?

We have now covered what happens to a value as time goes by … But what if we have a series of values, like regular loan payments or yearly investments? To calculate annual compound interest, multiply the original amount of your investment or loan, or principal, by the annual interest rate.

Compound interest is the method of calculation of interest used for all financial and business transactions across the world. The power of compounding is that it is always greater than or equal to the other methods like simple interest. You can calculate compound interest with a simple formula. It is calculated by multiplying the first principal amount by one and adding the annual interest rate raised to the number of compound periods subtract one. The total initial amount of your loan is then subtracted from the resulting value. If you’re wondering what kind of interest rate you need, you can check out our compound interest calculator.

Thanks to all authors for creating a page that has been read 400,771 times. Calculating how much an amount will grow under compound interest is simple with the right equations. The income earned on this product will be 161,154.51 + 10,783.90, which formula of compound interest is equal to 171,938.41. Let’s take an example to understand the calculation of Compound Interest in a better manner. BondsBonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period.

Additionally, the value will grow even faster if the interest is compounded multiple times per year. Compound interest is offered on a variety of investment products and also charged on certain types of loans, like credit card debt. Invest Corp has launched a new investment product that has piqued Shankar’s interest. To invest in this scheme, Shankar needs to put in an initial amount of 50,000, and the investment will mature after 15 years.

Thus, interest calculation of each term takes place on the inflated principal value, giving a different and enhanced return every single time. Banks typically opt for compound interests for a savings account, whereby interests earned on the bank balance are added back to it. Thus, the interest amount of each period keeps increasing after being calculated on a growing bank balance that is accumulating all the interests.

How Do you Calculate Compound Interest for Half Year?

I’ve been using Excel for quite some time now, and I’ve scoured dozens of sources that gave useless advice you’d have to squint to properly see and understand. I’ve hit two of your pages in two google searches in the past five minutes and am kinda cross with myself for not finding it sooner. By convention, the present value is input as a negative value, since the $1000 “leaves your wallet” and goes to the bank during the term. To derive CI, students have to use simple interest formula.

Solved Examples of Compound Interest

Compounding will always work best when the interval of compounding is short. An investment of ₹ 1,00,000 at a 12% rate of return for 5 years compounded annually will be ₹ 1,76,234. From the graph below we can see how an investment of ₹ 1,00,000 has grown in 5 years. The longer you leave your money untouched, the greater it will grow because compound interest grows over time which means your money keeps on multiplying over a period of time. If you are repaying a loan on compound interest, you should not ignore paying the interest or if there is any delay in paying the loan, then the interest burden will be high. To take advantage of compounding, one must aim at increasing their frequency of loan payments.

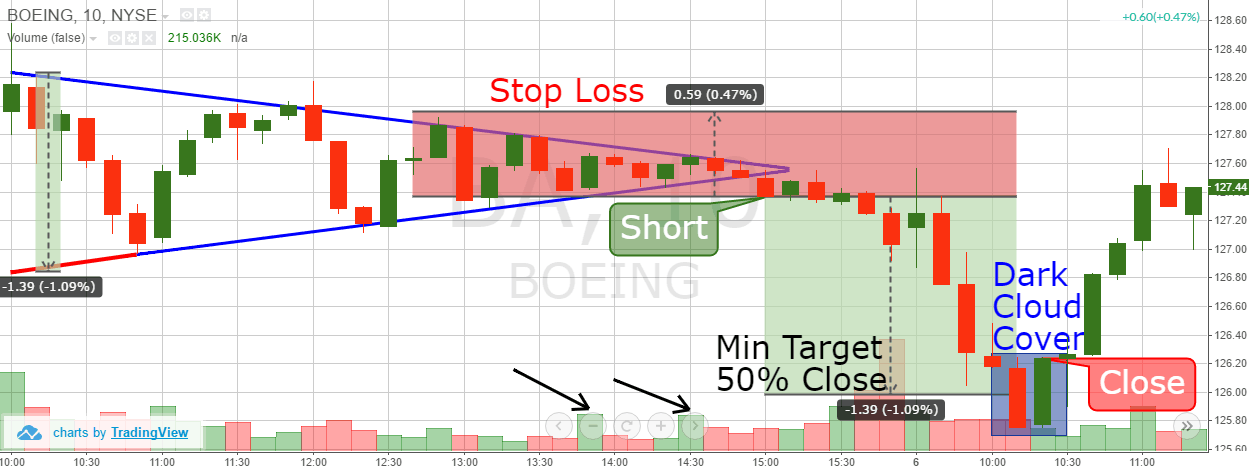

Forex Sentiment Do Not Chase

Contents:

Over the past 12 months 67% of NSFX Limited’s forex ig client sentiment investor accounts lose money when trading CFDs with NSFX Limited. If you’re looking for low spreads, a wide range of instruments, up-to-date news, industry-leading research tools and education, then IG might be your go-to. To provide transparency to the over-the-counter forex market, many forex brokers publish the aggregate percentage of traders or trades that are currently long or short in a particular currency pair. Client sentiment, which looks at the number of long and short trades on a particular market, is a useful tool in a trading strategy. It is often said that clients look to sell into rising markets and buy into falling ones.

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

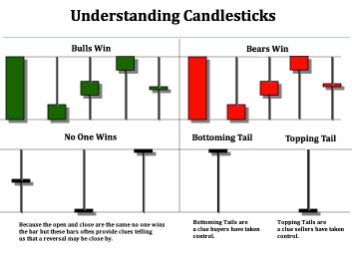

Of course, you will need pretty good coding experience to use such interfaces effectively. Also, retail traders often buy right at market tops or sell right at market bottoms, without realizing this could be in strong support or resistance zones. Since these areas feel ‘safe,’ this can create another trap for the ‘big boys’ to take price the other way. To understand why this type of indicator can be powerful, one needs to grasp the sentiment concept. In any tradable financial market, the two most common strands of analysis are technical and fundamental.

IG’s Trading Instruments

Having a sentiment-based approach can help you decide whether you should go with the flow or not. Advanced research tools are one of the most useful things you can find on the IG online platform. There’s a number of different trading courses that users can access online on the IG platform. In terms of security, the app offers both touch, and face login recognition features, which are more advanced than others available in the industry. If you want to trade on the go, IG mobile app is designed to completely facilitate mobile trading.

These include COT reports, open interest, and brokers’ position summaries. With so many participants—most of whom are trading for speculative reasons—gaining an edge in the forex market is crucial. Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018.

For instance, if 57% of clients are long in a market while 43% are short, the natural inclination would be to assume bullish sentiment because of the numerical difference. While this may be true in some cases, IG’s index may conclude the trading bias as ‘mixed’ based on changes between the longs and shorts from the last day. There’s a belief in forex that most retail investors trade against the trend by picking tops and bottoms.

Among sentiment indicators there is the VIX, the CoT Report, Put-Call Ratios, the Ted Spread, Mutual Funds statistics, Margin Balances and Investor Polls- such as FXStreet’s weeklyFX Forecast Poll. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey.

Non-UK/non-European traders will not be subject to UK and EU protections, such as negative balance protection. The company boasts a couple of reputable awards and is widely seen as one of the top overall forex brokers across the globe. Traders around the world have chosen IG as their number one trusted broker, placing them at the top of the board in world rankings for spread betting and CFD trading. In January 2019, IG re-established its operations in the U.S., and launched IG U.S., on a mission to offer U.S. traders more than their current limited competition does.

How to interpret the IG Client Sentiment Indicator

Following his tenure as Chief Financial Officer, Tim Hawkins was appointed CEO in October 2006, retiring 9 years later in 2015. Following the departure of Tim Howkins, Peter Hetherington became CEO in October 2015, having started at the company as a graduate trainee in January 1994. In May 2005, after two years of private ownership, IG Group and CVC Capital Partners re-floated the company on the main list of the London Stock Exchange with a valuation of £393 million. In October 2008, IG Group acquired FXOnline Japan KK, a Japanese retail FX business.

Fundamental analysis is a way to forecast an assets value by examining economic and financial factors. This section has many articles that describe how the price of an asset will be reacting the following week based off of the events that are happening. Before opening a trade, it is important to analyze current market sentiment. For example, estimate how many traders prefer holding long and short positions now. The web based trading platform features include; over 100 technical indicators, the ability to deal directly from charts, flexibility for all markets, price improvement technology, and more. Although IG U.S. lacks a DMA platform, both the online platform and MT4 offer a crisp and highly-customizable trading experience.

The typical school of thought for making trading decisions is using a combination of technical and fundamental analysis. While these methodologies are helpful, sentiment analysis is often overlooked yet could be a valuable addition. Sentiment analysis is rarely a topic typically discussed in trading communities, although it does deserve merit. The sentiment is strange because it’s inherently based on the emotion of market participants and crowd psychology, whose attitudes are an accumulation of various fundamental and technical factors. This tool covers some of the most popular forex markets like EURUSD, EURJPY, AUDUSD, USDJPY, and other well-known non-forex markets such as Bitcoin, Ethereum, US crude oil, and the S&P 500.

IG Client Sentiment Data Sending Bearish Signals for USD/JPY, AUD/USD, GBP/USD | Webinar

Equities face a minimum commission of 0.10% at both, while the minimums are lower at IG Markets. Markets.com has less additional costs, but frequent traders will find IG Markets superior from a pricing standpoint. Yes, In the UK IG Group and IG Markets is regulated by the FCA so if they go bust your money (up to £85k) is protected by the FSCS. However, your money is not safe from you making bad investment decisions or picking a bad trader to copy trade.

This was basically a time when the trading industry became uber-competitive and brokers were offering big bonuses, sometimes up to £5,000 to new clients to sign up. The catch of course was that you had to generate more than that in trading commission before you could withdraw it or use it. IG’s stance on that was, “No, that’s not for us” clients trade with us because of what our service offers” and didn’t get into the murky business of incentives. Interestingly enough, the FCA banned new account bonuses because it all got a bit out of hand as the more unscrupulous platforms were running too heavy B-books.

ForexFactory

Still, this tool is not necessarily a leading indicator as the behaviors of buyers and sellers in currencies can change in a flash. Of course, IG is not the only broker publishing summaries of their client’s positions in the markets, though only a handful does. The data suggests about 61% of traders are presently long while the rest are short. The natural assumption would presume the overall sentiment is bullish, but this works in reverse as explained.

You must understand that Forex trading, while potentially profitable, can make you lose your money. CFDs are leveraged products and as such loses may be more than the initial invested capital. Trading in CFDs carry a high level of risk thus may not be appropriate for all investors. FXCM is another Forex broker that offers a sentiment indicator of its traders’ positions — via the web-based version of its Trading Station 2.0 platform. In reality, the sentiment analysis tool is an expert advisor, not an indicator and is called OANDA Sentiment Trader. It can be used to place trades and to track existing positions across currency pairs.

Okay so, we’ve highlighted the benefits of IG’s products and services, as well as some areas where they could improve. The UK customer service team was helpful, and calls made to the number provided were swiftly answered quickly. Questions that require more comprehensive answers can be received through email. The IG Academy includes step-by-step courses allowing you to go at your own pace, and provide learning opportunities through video, interactive exercises.

It is a program that connects two https://g-markets.net/lications – for example, your IG trading account and your custom-built platform. Trading with APIs enables you to gain direct access to IG’s ecosystem, providing you with faster order execution and more control, enhancing your trading experience. Points through current will give traders even more control of their execution by allowing them to trade through the current IG price. This feature will reduce your chance of a price rejection in volatile market conditions, and increase the likelihood of successful execution when trading in large sizes. Once this step is done, we were asked to complete a short form that helped IG understand the state of our finances and trading knowledge. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

Forex Market Sentiment: Week of February 27, 2023 – ig.com

Forex Market Sentiment: Week of February 27, 2023.

Posted: Mon, 27 Feb 2023 08:00:00 GMT [source]

Because of the active internal client protection policies and processes, strong regulation, and acclaim from the industry, we consider IG a safe and trustworthy broker. While IG will still fill an order at the best possible price, the chance of a successful execution is increased when using ‘points through current. If you choose to use this feature, IG will only ever partially fill your order as an alternative to outright rejection. IG will never partially fill your order as an alternative to filling it in its entirety. So if you trade in a size so large that we cannot fill your entire order rather than reject your entire order IG will be able to fill you in the maximum size possible. Overall, at IG, withdrawal and deposit costs are low, and withdrawal and deposit times are average for the industry.

AUD/USD IG Client Sentiment: Our data shows traders are now net-long AUD/USD for the first time since Jan 20, 2023 when AUD/USD traded near 0.70. – DailyFX

AUD/USD IG Client Sentiment: Our data shows traders are now net-long AUD/USD for the first time since Jan 20, 2023 when AUD/USD traded near 0.70..

Posted: Tue, 31 Jan 2023 08:00:00 GMT [source]

Clients were significantly net long at the lows of the downtrend, for example at $1.13 and then $1.125, and then short positions increased at the lower highs at $1.15 and $1.14. This has been a volatile currency pair, with dramatic swings over the past few months. What stands out is that at the peak in early November 2018 clients were only around 35% net long . Clients had reduced their long positions and short positions had increased as the price rose from mid-October. Then, the sharp turnaround in the price, which began a steady downtrend, was accompanied by a steady rise in long positions, so that the net long figure rose to over 60%.

HCA Healthcare, Inc HCA Stock Price, News, Quote & History

Contents

Historic efforts to develop COVID-19 vaccines have had two huge effects on the industry. First, the success of mRNA technology has added an important weapon ayondo review to drugmakers’ arsenals. We’ve learned from the pandemic that this new technology can be scaled up quickly to deliver a highly efficacious vaccine.

In spite of inflation, economic uncertainty and fears of an impending recession, the short-term vacation rental market is looking up. He has a bachelor’s degree in business and entrepreneurship, as well as over five years of investing experience. Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site .

PBH reported fiscal fourth-quarter results in early May that included a 12% year-over-year increase in sales to $266.9 million. On the bottom line, its adjusted net income was $46.3 million, 37% higher than the year prior. “One of the Core Values we live by at Danaher is We Compete for Shareholders, and we believe we are uniquely positioned to deliver meaningful, long-term shareholder value for many years to come,” CEO Rainer M. Blair states on the company’s Investor Relations page. In December, Baxter acquired Hillrom for $10.5 billion and assumed roughly $2.3 billion in debt.

Instead, consider purchasing exchange-traded funds or index funds that track diversified indexes focused on the healthcare sector. These are less swayed by the individual ups and downs of any one company but provide solid, steady long-term growth. As defensive stocks, healthcare companies provide steady returns in any market. Because people will always need healthcare, the healthcare sector provides very steady, consistent returns that are uncorrelated with the overall direction of the stock market. Immediately following Baxter’s Q earnings release, Raymond James analyst Jayson Bedford – who has an Outperform rating and an $85 price target on the name – described BAX as “an underappreciated self-help story” among healthcare stocks. Here, we explore 12 of the best healthcare stocks to buy for the rest of 2022.

Get the latest on healthcare leadership in your inbox.

The company serves primary care and specialty care physicians through distributors and local representative offices in the United Kingdom, rest of Europe, the Americas, Asia, Africa, and Australasia. The price action trading secrets review company was formerly known as Zeneca Group PLC and changed its name to AstraZeneca PLC in April 1999. AstraZeneca PLC was incorporated in 1992 and is headquartered in Cambridge, the United Kingdom.

- Savita Subramanian, head of equity and quantitative strategy at BofA Securities, also likes the defensive nature of healthcare stocks, as well as their ability to maintain pricing power.

- DHR has certainly followed through on this statement, with the stock up 25.1% on an annualized basis over the past five years, double the return of the entire U.S. market.

- These examples show how a value-based ESG approach focused on patient benefits can also create better business outcomes for companies—and support returns for investors.

- We know that traders always need information, so we created FAQ, Knowledge Base, and Blog.

So overall, we don’t expect any extreme policy changes for the healthcare sector under the new administration, which reduces policy risk for investors. Sustaining growth can be challenging for some types of healthcare stocks. Companies that make drugs and medical devices must convince health insurers and government agencies to continue buying their products. If these players fail to grant reimbursement approvals, their growth prospects can dim. For example, if your computer breaks, you have to come out of pocket for most of the repairs. But if your leg breaks, you’re likely paying a small portion of the bill to a healthcare provider.

For those interested in gaining exposure to the healthcare sector, each subsector mentioned above merits investment on its own to achieve appropriate levels of diversification. The image above shows that the sector is often among the market’s best performers, even during recessions, as the healthcare sector ranked in the top 3 best performing sectors in 7 of the 10 years shown above. Health care stocks respond well in a few specific cases, including due to the aging population and Baby Boomers, people living with long-term diseases, epidemics, advances in technology, global and personalized medicine and other factors, according to a Reuters article. Biogen, Inc. is a biopharmaceutical company, which engages in discovering, developing, and delivering therapies for neurological and neurodegenerative diseases. It offers TECFIDERA, VUMERITY, AVONEX, PLEGRIDY, TYSABRI, and FAMPYRA for the treatment of multiple sclerosis, SPINRAZA for the treatment of spinal muscular atrophy, and FUMADERM for the treatment of severe plaque psoriasis. The company was founded by Charles Weissmann, Heinz Schaller, Kenneth Murray, Walter Gilbert, and Phillip Allen Sharp in 1978 and is headquartered in Cambridge, MA.

Back to Today’s Financial News

Many trading systems utilize moving averages as independent variables and market analysts frequently use moving averages to confirm technical breakouts. As of writing, the following stocks exist in the FKnol.com records which qualify for Healthcare theme based investments. Alternatively, one can also explore the List of Top Healthcare ETFs. UnitedHealth Group was down 4.1% and is the Dow’s biggest loser of the day, as investors scrambled out of the sector. TipRanks is a comprehensive investing tool that allows private investors and day traders to see the measured performance of anyone who provides financial advice. Indiana-based pharmaceutical firm Eli Lilly employs more than 34,000 employees across 18 countries and sells its products in 120 different countries.

Healthcare companies are also prone to having strong, regulatory-based competitive advantages due to their strong relationships with the U.S. MarketBeat does not provide personalized financial advice and does not issue recommendations or offers to buy stock or sell any security. Learn about financial terms, types of investments, trading strategies, and more. View our full suite of financial calendars and market data tables, all for free.

Align Technology

There is the pull of companies that are always on the list of healthcare stocks to buy now. For example, companies from S&P 500 that are stable and present on the market for many years. Told research firm Deloitte recently that COVID-19 has accelerated numerous trends in the healthcare sector, particularly around health equity and sustainability.

It offers Olumiant for rheumatoid arthritis; and Taltz for plaque psoriasis, psoriatic arthritis, ankylosing spondylitis, and non-radiographic axial spondylarthritis. The company offers Cymbalta for depressive disorder, diabetic peripheral neuropathic pain, generalized anxiety disorder, fibromyalgia, and chronic musculoskeletal pain; Emgality for migraine prevention and episodic cluster headache; and Zyprexa for schizophrenia, bipolar I disorder, and bipolar maintenance. Its Bamlanivimab and etesevimab, and Bebtelovimab for COVID-19; Cialis for erectile dysfunction and benign prostatic hyperplasia; and Forteo for osteoporosis. The company has collaborations with Incyte Corporation; Boehringer Ingelheim Pharmaceuticals, Inc.; AbCellera Biologics Inc.; Junshi Biosciences; Regor Therapeutics Group; Lycia Therapeutics, Inc.; Kumquat Biosciences Inc.; Entos Pharmaceuticals Inc.; and Foghorn Therapeutics Inc. Eli Lilly and Company was founded in 1876 and is headquartered in Indianapolis, Indiana. Gainy app creates stock lists and categories depending on NASDAQ Composite and current market information.

Total revenue grew 6%, including the U.S. approval and launch of Mounjaro for type 2 diabetes. Trulicity, Verzenio, Jardiance, Taltz, Retevmo, Mounjaro, Emgality, Olumiant, Tyvyt and Cyramza grew 20% and represented 67% of revenue in Q2 2022. For the major indices on the site, this widget shows the percentage of stocks contained in the index that are above their 20-Day, 50-Day, 100-Day, 150-Day, and 200-Day Moving Averages. The information below reflects the ETF components for S&P 500 Healthcare Sector SPDR . The content and investment strategies discussed may not be suitable for and/or available to all investors.

The company was founded in 1897 and is based in Franklin Lakes, New Jersey. Cerner Corporation, together with its subsidiaries, provides health care information technology solutions and tech-enabled services in the United States and internationally. The company also provides HealtheIntent platform, a cloud-based platform to aggregate, transform, and reconcile data across the continuum of care; and CareAware, an EHR agnostic platform that facilitates connectivity of health care devices to EHRs. In addition, it offers a portfolio of clinical and financial healthcare information technology solutions, as well as departmental and care coordination solutions. It serves integrated delivery networks, physician groups and networks, managed care organizations, hospitals, medical centers, free-standing reference laboratories, home health agencies, blood banks, imaging centers, pharmacies, pharmaceutical manufacturers, employers, governments, and public health organizations. The company was founded in 1979 and is headquartered in North Kansas City, Missouri.

It has collaborative and other licensing arrangements with Rani Therapeutics LLC; Parion Sciences Inc.; Pfizer Inc.; Precision BioSciences Inc.; Symphogen; and Ipsen Bioscience Inc., as well as a preclinical research collaboration agreement with NanoMedSyn. The company was founded in 1986 and is headquartered in Dublin, Ireland. The top healthcare stocks are companies that provide necessary products and services in the healthcare sector. These companies are the leaders in their field, have large market capitalizations and low P/E ratios.

However, the firm was bought back at government auction in 1919 for $3.5 million by George Merck, a member of the Merck family, with help from Goldman Sachs and Lehman Brothers. Headquartered in Bagsværd, Denmark, Novo Nordisk is led by CEO Lars Fruergaard Jørgensen, who also serves as vice president elect of the European Federation of Pharmaceutical Industries and Associations , of which Novo is a member. Don’t overlook the possibility that mergers and acquisitions (M&A) could boost a company’s growth prospects. Companies that have grown through M&A in the past could be looking for new deals to make in the future.

While the large-cap stocks listed above can be very safe bets, more volatile small-cap biotech stocks can be incredibly risky investments. Abbott Labs was founded in 1888 and is headquartered outside of Chicago, Ill. The company is a large developer of pharmaceuticals and medical devices, including tests. Abbott is perhaps best known for some of its more innocuous consumables, such as PediaSure, Pedialyte and Similac. But, like other healthcare companies responding to the pandemic, it also has a Covid-19 test. Like many other companies on our list, Danaher’s operations are vast and diverse.

Best Penny Stocks on Robinhood To Invest In for 2022

Since healthcare is an industry that has a profound impact on society, there’s a growing focus on the value of care provided for patients and communities. We believe companies that improve the value of care delivered make a positive impact on the healthcare system, which positions them well for growth in an era of rising healthcare costs and increased government involvement. The healthcare sector has caught investors’ attention since several companies have received early regulatory approval lessons in corporate finance for drugs to treat COVID-19 and are distributing vaccines. Other companies are rushing to develop and win approval for their own COVID-19 drugs, while others are supplying products to test for and manage treatments for the virus. This subgroup includes hospital operators, home health companies, managed care facility operators and other companies that provide healthcare services. UnitedHealth Group is the biggest publicly traded health insurance company in the U.S. by market capitalization.

FICS and FBS are separate but affiliated companies and FICS is not involved in the preparation or selection of these links, nor does it explicitly or implicitly endorse or approve information contained in the links. StockMarket.com and any data provider in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website. Before deciding to buy or sell any financial instrument or cryptocurrencies please make sure that you are properly informed of the risks & costs as well please consider your investment goals, experience level, and risk threshold and please always seek professional advice where needed. For more than a decade, large health systems have faced scrutiny for admitting patients to costly hospital stays when less expensive treatments or short periods of observation in the ER would have… On May 16, Quidel’s shareholders approved the combination of the two companies.

Pulmatrix Inc Stock Quote Stock Price for PULM PRN_FinancialWrapper

Contents

1 Wall Street analysts have issued “buy,” “hold,” and “sell” ratings for Pulmatrix in the last twelve months. The consensus among Wall Street analysts is that investors should “buy” PULM shares. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.51% per year. These returns cover a period from January 1, 1988 through September 12, 2022.

Based on an average daily trading volume, of 94,400 shares, the short-interest ratio is presently 0.6 days. Currently, 1.6% of the shares of the stock are sold short. According to 7 analysts, the average rating for PULM stock is “Buy.” The 12-month stock price forecast is 10.2, which is an increase of 151.23% from the latest price. This score is calculated as an average of sentiment of articles about the company over the last seven days and ranges from 2 to -2 .

Their PULM share price forecasts range from $10.00 to $10.00. On average, they anticipate the company’s stock price to reach $10.00 in the next twelve months. This thinkmarkets bewertung suggests a possible upside of 146.3% from the stock’s current price. View analysts price targets for PULM or view top-rated stocks among Wall Street analysts.

As an investor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. The Style Scores are a complementary set of indicators to use alongside the Zacks Rank. It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security.

Quotes displayed in real-time or delayed by at least 15 minutes. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score.

Analyst Forecast

The company is headquartered in Lexington, Massachusetts and currently employs 6 full-time employees. The Company’s product pipeline is focused on advancing treatments for rare diseases, including PUR1900, an inhaled anti-fungal for patients with lung disease, including cystic fibrosis. In addition, the Company focuses on pulmonary diseases through collaboration with partners, including PUR0200, a generic in clinical development for chronic obstructive pulmonary disease.

Shares of Pulmatrix Inc. more than doubled Monday, rocketing 124% on heavy volume, after the company said it entered into a “binding term sheet” with Cipla Ltd. subsidiary Cipla Technologies LLC for the development and co…

ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. © 2022 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart’s disclaimer. Pulmatrix’s stock was trading at $8.76 at the beginning of the year.

The company’s shares closed last Wednesday at $0.83, close to its 52-week low of $0.7… The technique has proven to be very useful for finding positive surprises. In fact, when combining a Zacks Rank #3 or better and a positive Earnings ESP, stocks produced a positive surprise 70% of the time, while they also saw 28.3% annual returns on average, according to our 10 year backtest. Pulmatrix’s stock reverse split before market open on Tuesday, March 1st 2022.

Pulmatrix Announces Positive Top-Line Data Evaluating PUR1800 in Patients with Stable COPD

Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. Pulmatrix’s market cap is calculated by multiplying PULM’s current stock price of $3.80 by PULM’s total outstanding shares of 3,639,185. Pulmatrix saw a decrease in short interest in the month of October. As of October 31st, there was short interest totaling 52,500 shares, a decrease of 19.8% from the October 15th total of 65,500 shares.

Since then, PULM stock has decreased by 53.7% and is now trading at $4.06. Pulmatrix has a short interest ratio (“days to cover”) of 0.6, which is generally considered an acceptable ratio of short interest to trading volume. According to analysts’ consensus price target of $10.00, Pulmatrix has a forecasted upside of 146.3% from its current price of $4.06. WallStreetZen does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. Overall, this stock passed 10/33 due dilligence checks and has average fundamentals, according to our automated analysis.

Pulmatrix Announces Year-End and Q4 Financial 2021 Results and Provides Corporate Update

Plus, PULM info will be updated daily in your Zacks.com Portfolio Tracker – also free. One share of PULM stock can currently be purchased for approximately $4.06. The company is scheduled to release its next quarterly earnings announcement on Tuesday, April 4th 2023. 44.12% of the stock of Pulmatrix is held by institutions.

- It offers products based on its proprietary dry powder delivery technology, iSPERSE, which enables delivery of small or large molecule drugs to the lungs by inhalation for local or systemic applications.

- The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season.

- Pulmatrix, Inc., a clinical stage biotechnology company, discovers and develops inhaled therapies to prevent and treat respiratory and other diseases with unmet medical needs in the United States.

- Looking for continuation and possible breakout today in PULM Pulmatrix, Inc. is a clinical stage biotechnology company, which engages in the discovery and development of novel inhaled therapeutic products for respiratory and other diseases.

- One share of PULM stock can currently be purchased for approximately $4.06.

High institutional ownership can be a signal of strong market trust in this company. In the past three months, Pulmatrix insiders have not sold or bought any company stock. MarketBeat has tracked 5 news articles for Pulmatrix this week, compared to 1 article on an average week. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. Tap five stocks with increasing P/E ratios to try out an out-of-the-box approach. Information is provided ‘as-is’ and solely for informational purposes and is not advice.

Pulmatrix, Inc. (PULM)

WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data. Sign Up NowGet this delivered to your inbox, and more info about our products and services. There may be delays, omissions, or inaccuracies in the Information. Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. The industry with the best average Zacks Rank would be considered the top industry , which would place it in the top 1% of Zacks Ranked Industries.

Pulmatrix, Inc. was founded in 2003 and is headquartered in Lexington, Massachusetts. Pulmatrix, Inc. is a clinical stage biotechnology company, which engages in the discovery and development of novel inhaled therapeutic products for respiratory and other diseases. It offers products based on its proprietary dry powder delivery technology, iSPERSE, which… Pulmatrix Inc. is a clinical stage biotechnology company, varalen capital markets which engages in the discovery and development of novel inhaled therapeutic products for respiratory and other diseases. It offers products based on its proprietary dry powder delivery technology, iSPERSE, which enables… Test Pulmatrix, Inc. is a clinical stage biotechnology company, which engages in the discovery and development of novel inhaled therapeutic products for respiratory and other diseases.

Looking for continuation and possible breakout today in PULM Pulmatrix, Inc. is a clinical stage biotechnology company, which engages in the discovery and development of novel inhaled therapeutic products for respiratory and other diseases. Pulmatrix, Inc. is a clinical-stage biotechnology company, which is focused on the discovery and development of inhaled therapeutic products to prevent and treat respiratory and other diseases with unmet medical needs. It engages in developing Pulmazole, an inhaled anti-fungal drug for the treatment of allergic bronchop… 1 Wall Street analysts have issued 1-year price targets for Pulmatrix’s shares.

Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks fusion markets broker is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.