Big Bass Splash Demo Slot Free Play

Upon activating the function, we see essentially the most important change made to the sport in comparability with those released before it. This is the addition of the random modifiers that can be added to your characteristic, with 0 – 5 of the following being awarded. Some on-line casinos might supply a Big Bass Splash demo model for gamers to try out for free earlier than taking part in with real cash. Big Bass Splash is an enthralling slot sport that guarantees big wins and countless leisure.

The game’s Return To Player percentage is ninety six.71%, which makes it a higher proportion than many other on-line slots. With a most prize of 5,000 occasions the bet, this sport is a excessive volatility slot, which makes it extremely advantageous and permits a maximum win. This slot can’t be called a foul one, but it positively won’t swimsuit everybody. For some, the sport could appear boring, since most of the additional symbols are available only in the course of the free spins spherical. I am glad to have the chance to purchase a bonus and fascinating additions in the type of lasso bonuses before activating free spins.

As we famous above, there are as many as 3 particular symbols within the slot – Wild, Scatter and cash image. You can check out the demo model of the game on our web site for free. Demo model of Big Bass Splash has stylistic variations, but the primary mechanics of gameplay is unchanged. No, Big Bass Splash demo is for testing the game and has no real cash rewards. An initiative we launched with the goal to create a worldwide self-exclusion system, which will permit weak gamers to dam their access to all on-line playing opportunities.

Spin the reels and hope to land some fish symbols for payouts, or better but, goal for the bonus recreation where you get to reel in fish for even greater rewards. It’s like precise fishing, but without the scent and the chance of getting seasick. Comparing the demo model and Big Bass Splash a few variations stand out. In the demo model of Big Bass Splash, you presumably can discover the mechanics and visual aspects of the sport. This is the necessary thing distinction between the free recreation and the cash game. This video slot has extremely participating and lively visuals and sound effects.

We have scanned 25 casinos in Portugal and found Big Bass Splash at 19 of them. On the listing under, you`ll discover the most effective casinos that feature the Big Bass Splash slot and settle for players from Portugal. In conclusion, this slot machine recreation is a very profitable slot machine with a high return on funding and an intriguing idea and design. Players of all ability ranges can play this recreation, even on cell gadgets.

It seems that the slot is accessible on mobile gadgets, when you had been wondering. Because the slot is compatible with HTML5, you presumably can play the game in your cellphone when you are on the go. This is a handy method to enjoy your experience, wherever you would possibly be. The game’s capacity to hook players with these participating and rewarding features makes every spin a possible catch of the day. Wins are achieved when matching symbols land from left to right, ranging from the leftmost reel.

To start the game for free, click on the “Demo” button on the slot page. But fear not, landlubbers, for the fishing theme remains to be as strong as ever in Big Bass Splash. It’s like being transported to a serene lake in the midst of nowhere, except you’re really simply sitting in entrance of your pc with a bag of chips and a soda.

These features not solely enhance the game’s thrill but additionally significantly improve the possibilities of reeling in massive wins. As for the sport symbols on the reels, fans of the previous Big Bass Bonanza slot will acknowledge most as they’ve carried over. That is responsible for the most important attainable symbol win of 200x the guess. Furthermore, you will note a fishing rod, dragonfly, tackle field, and extra thematic symbols. As the free spins function big bass splash demo will get underway in Big Bass Splash, you want to see the fish with cash values land on the reels concurrently with the fisherman. If this happens, the fisherman will acquire all values and add them to your winnings.

The subsequent stage of free spins proceeds after the present one is finished, and it’s not attainable to get one other retrigger after reaching the fourth and last stage. Naturally, the gameplay revolves across the bonus recreation, whereas the bottom recreation doesn’t offer any extras unfortunately. To activate the Big Bass Splash free spins, you have to land 3, 4, or 5 Scatter symbols wherever in view concurrently, which awards 10, 15, or 20 initial spins respectively. The player’s luck was off to a difficult begin, landing only 2 Scatter symbols on the reels. It came into play to drop the essential 3rd Scatter, triggering the bonus spherical.

It sticks to the same formula launched by legendary Fishin’ Frenzy however provides a much more immersive experience with high-end graphics, animations, and sounds. Compared to the original Big Bass Bonanza, it shares an identical look with a couple of visual updates. The main difference is that this one takes you to redneck territory as a substitute, the place casually firing up your monster truck to go fishing isn’t anything out of the strange. There are multiple bonus spherical features in the recreation aside from the bottom recreation, every of which represents a definite concept. Bonus video games are often triggered by function symbols just like the Wild and Scatter symbols.

Players can set bets starting from a minimal of £0.10 to a maximum of £250 per spin, making it suitable for varied budgets on actual money slots. The demo mode allows you to study about the guidelines and mechanics of the video slot, apply, and never be afraid of dropping cash when you lose. Experienced gamers thus choose these methods they’ll use when taking half in for real cash. The bonus options put in by the developer are designed to increase your probabilities of successful at Big Bass Splash Pragmatic.

Essentially, it’s nonetheless the precise same concept, where all of the fishing magic unleashes within the free spins, however the vary of modifiers and perks provide next-gen expertise. Big Bass Splash, part of the Big Bass slot series by Pragmatic Play, is a fishing-themed slot sport that offers a vibrant and interesting experience. Fishing in the deep sea on Big Bass Splash will current you with a 5×3 reel format to play upon. These symbols will also must be on one of the energetic winlines for the corresponding pay to be added to your steadiness.

Alternatively, you can rely on help from two randomly triggered features. When you land two scatter symbols on the reels, you may trigger one of the two features. The first random feature is a respin that locks the scatter symbols in place and respins all remaining positions. This first random function might provide the additional scatter symbol you have to trigger the free spins. Even higher, it might offer you a 4th and even 5th scatter image.

These values vary from 2x to five,000x and can be gained in the course of the Free Spins function. Among the symbols, gamers will find the iconic Big Bass illustrated in green with a sunset backdrop. A variety of different fish as nicely as plenty of fishing deal with also make an look. The betting vary within the Big Bass Splash slot recreation is from 10 p/c to £/€250 per spin.

The Stuff About How to Maximize Your Winnings at Mostbet Casino You Probably Hadn’t Considered. And Really Should

Mostbet Play Aviator

For real online sports betting and to win prizes, you must create an account in Mostbet pk. Visit Mostbet on your Android device and log in to get instant access to their mobile app – just tap the iconic logo at the top of the homepage. Note that account verification may take 60 or more in rare cases days. To access your account, click the “Login” button once more. Aviatrix sələfi Aviator kimi, hər raundda iki mərc təklif edir. Despite these issues, the platform is generally reliable and offers good betting options. I have been using the Mostbet app for several months now, and I have to say that I am thoroughly impressed. If you become a Mostbet customer, you will access this prompt technical support staff. It is worth mentioning that Mostbet. With Live casino games, you can Instantly place bets and experience seamless broadcasts of classic casino games like roulette, blackjack, and baccarat. It highlights Mostbet’s effort to make sports betting and casino games easily accessible, prioritizing straightforward usage. Their maximum return is 99. One of the great features of Mostbet betting is that it offers live streaming for some games. Get started with your first bet through the Betandreas app right now. Get the money from bets you are not too sure about. Many people think that applications don’t have all the capacities that the website provides including some bonuses and promotions. In addition, live sports betting is available to you here as a particular type of betting. After the tournament final, all the winning wagers will be paid within 30 days, after which the winners can cash out their earnings. Players can use free bets and spins in this game. And so, you can benefit from your knowledge of sports such as. I always get my money out of my gaming account to any e wallet. Consider the detailed instructions on how to download and install the Mostbet app for customers from Pakistan. You can get acquainted with it below. So make sure you read up on them before diving in. Thanks for the time spent with us.

Mostbet

You can clarify this when you create a coupon for betting on a certain event. The Curacao license ensures compliance with the laws and regulations of the gaming industry, as well as the protection of the interests of players through clear rules for the conduct of games and the processing of personal data. Once you’ve decided on the purpose of your visit, examine the various talks on offer throughout the day and pick some to attend, then consider the exhibitors you wish to visit during the remainder of the day. And so, Indian bettors can visit Mostbet without any restrictions and without doubts – is Mostbet real or fake. You can bet live on matches, and take advantage of the varying odds and new markets. Go to the Mostbet casino section in the app, choose what suits you today, and start winning easy with pleasant emotions by choosing preferred options. Best regards, Mostbet. With over 2,000 variants on the site, there is a variety of gaming preferences to satisfy. The Mostbet app offers users in Bangladesh a variety of secure and swift deposit and withdrawal methods, including digital wallets and cryptocurrencies. Poker is one of the most famous classic gambling activities, which later became a full fledged sports discipline with its own tournaments. The jackpot reaches from 1 million to tens of millions PKR. Begin exploring all that we have to offer right away. It also has a comprehensive FAQ section on its website. Ready for a game changer. The money was successfully transferred to your game account on 15. This betting site was officially launched in 2009, and the rights to the brand belong to Starbet N. If you use mostbet app bd make sure to check if you have the most recent version.

Mostbet Mobile App for Android and iPhone

ADAK’s annual budget was reduced from 288m Kenyan shillings $2. This convenience positions the Mostbet application as a user friendly mobile application for seamless betting on Apple Devices. Mostbet customer support is very reliable and helpful. Enabling automatic updates means our users never miss out on the latest features and security enhancements. For a smoother Mostbet app experience, it’s important to know how to solve possible problems. Firstly, you must be 18 years or older to play. Thus, you can see that this list is pretty huge. You can use any of the following methods to top up your personal account. Excellent bookmaker, I have been playing here for about half a year. The client service agents are reachable 24/7/365 to help you if you happen to run into any problems while using the website. Online gambling has grown in popularity worldwide, including in Bangladesh. This commitment not merely reflects Mostbet’s concentrate on user satisfaction but also guarantees a seamless, feature rich betting experience on the go. You will be able to perform all actions, including registration easily, making deposits, withdrawing funds, betting, and playing. Using advanced algorithms, it provides personalized betting odds.

Stop drooling on the phone: Get cooking!

Those were some of the best years of my life, filled with learning, discovery, and a fair share of late night study sessions. You can find various types of live games such as live roulette, live blackjack, live baccarat, live poker, live sic bo, live dragon tiger, live monopoly, live dream catcher, and more. Partner at PwC PricewaterhouseCoopers Ireland. The Curacao license ensures compliance with the laws and regulations of the gaming industry, as well as the protection of the interests of players through clear rules for the conduct of games and the processing of personal data. Despite the site and application are still developing, they are open minded and positive towards the players. Mostbet Sri Lanka also has website mirrors that allow customers to access their betting services in case of any technical issues or limitations with their main domain. The second route is this. Seamlessly connect with the power of your media profiles – register in a few simple clicks. Not only does MostBet serve up great odds and thousands of top casino games, but it has also got lots of top promos to help you out. Live betting odds and results can change at any time, so you need to be quick and careful. These include slots, card games, table games, and lotteries. Moreover, the customers with more significant amounts of bets and numerous selections have proportionally greater chances of winning a significant share. When the reward amount seems enough to you, quickly click on it, and get a win. Bəs nəyi gözləyirsiniz. You will get your winnings into your player account automatically as soon as the match is over. Enter the main web page on your smartphone or tablet;. I couldn’t get it out of my head that he would eventually score like it,” Adrian excitedly revealed. He has been far and away Sri Lanka’s best batter on the tour of England, making a magnificent hundred in the third innings at Old Trafford and his 74 earlier in this Test was the only opposition England faced. Mostbet Copyright © 2024. Mostbet India clients can place bets and deposit/withdraw money with an unverified account. CCP5 assesses climate change impacts and risks, vulnerability as well as barriers and options for adaptation and climate resilient development in mountain regions. Sign up on the Mostbet website and get free spins on Aviator or a free bet as a gift. Get up to 25 000 BDT on your first deposit. The responsiveness of the online casino is incredibly high, lacks extra frills, and possesses several beneficial search options and filters that allow users to look for specific games or service providers. But some non big sites have a lot much less revenue, however provide better terms. Uncover the “Download” button and you’ll be transported to a page where our sleek mobile app icon awaits.

How to Place a Bet at Mostbet Login?

To qualify, a minimum deposit of BDT 1,000 is required; the bonus percentage depends on the deposited amount. After installation just launch the new file, sign in and sign up. Sports betting fans have a sports section with plenty of options to bet on. How to Register at a Mostbet Website. Look no further than Mostbet’s official website or mobile app. If you have already downloaded Mostbet android, registered, and verified, open the application. However, whichever method you choose, you will need to verify your identity and address by providing some documents afterwards. IPhone and iPad users can find the Mostbet iOS app in the App Store, ensuring a secure download from an official source for their mobile phone. All modern browsers support the web platform. Ready to join the fun. Mostbet also offers tournament betting for players from Morocco. It offers an extensive range of sports betting options and casino games that keep me entertained for hours on end. You need to know the expected performance of both teams in each of the halves, which might be somehow not simple to predict if you don’t have enough information about the competing teams. Every new user after registering at Mostbet will get a welcome bonus of up to 25,000 INR. Customers can contact MostBet’s customer service via an international dedicated hotline number for immediate assistance: 8 800 302 12 88. You will find some of the most popular and exciting games at the casino. Third party sources can expose you to malware and privacy risks. To register on the Mostbet app, you have four easy methods: one click, by phone, by email, or through a social network. Ready to join the fun. The most common and favored options are. To play Mostbet Aviator, you need to register at Mostbet Casino, it’s a simple and quick process. Mostbet BD accepts a number of different payment methods, making it easy for Bangladeshi players to deposit and withdraw funds. These measures maintain confidentiality and integrity, ensure fair play, and provide a secure online betting environment. The real time interaction afforded by MostBet’s live chat allows for instant communication between the user and the support team. We also recommend linking your email to your game account for communications. Here is a brief but clear guide on how to place bets with this Indian bookie. The prize pool here is large and the chances of winnings are high.

Mostbet App

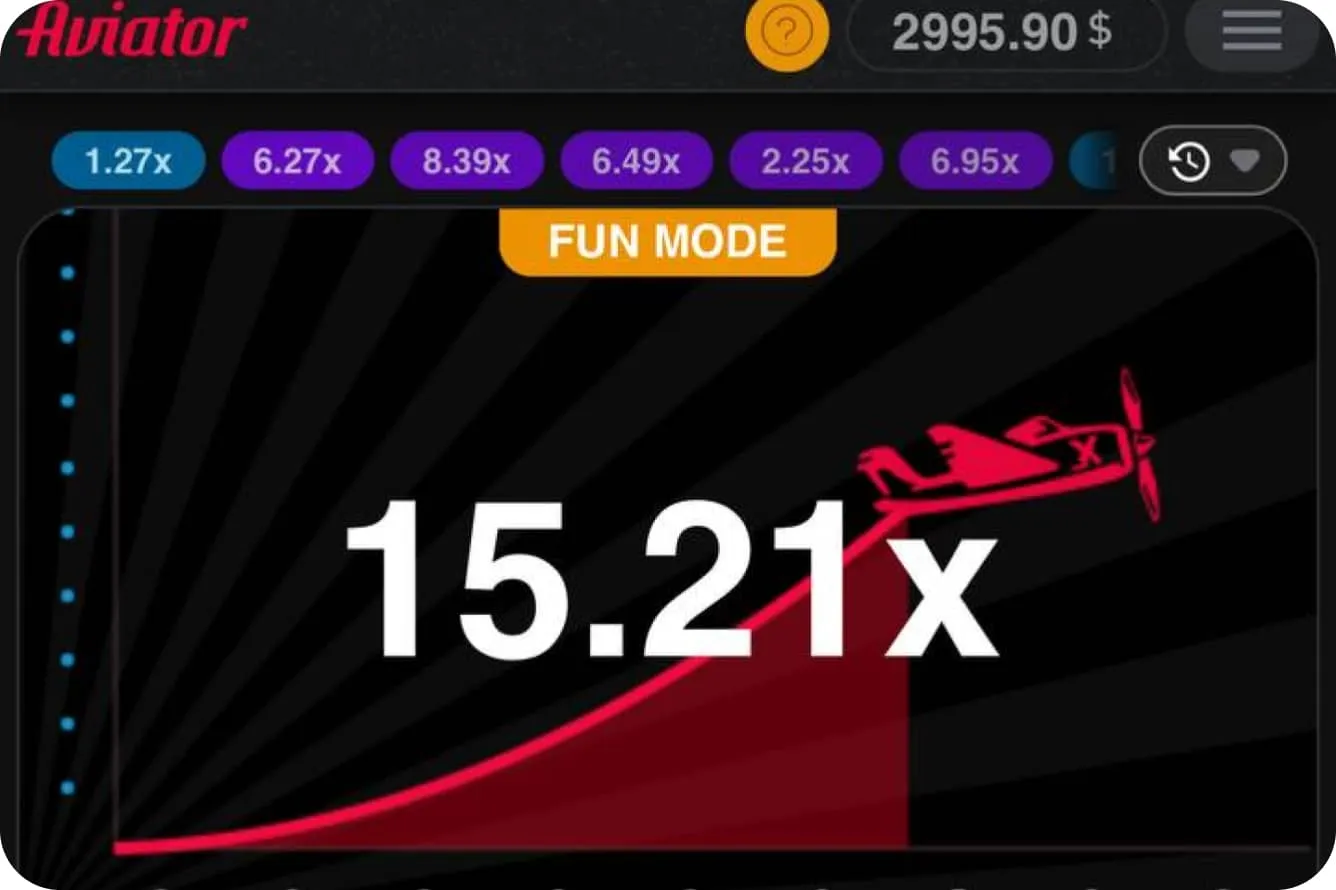

Bonuses vary with currency only. The casino games on Mostbet are provided by reputed casino game providers like NetEnt, Microgaming, Evolution Gaming, etc. Visit Mostbet on your Android device and log in to get instant access to their mobile app – just tap the iconic logo at the top of the homepage. Here’s the lowdown on the deals that make Mostbet the place to bet. Broadcasts are in a continuous format – play at your convenience. The app is well designed, fast, and offers an excellent range of features that make it easy to place bets and monitor my bets. After 1h i requested they told me give your bank slipt but they dont send my mostbet wallet. Journalist, expert in cultural sports journalism, author and editor in chief of the official website Mostbet Bdasd. High ranking Begs were allowed to call themselves Begs. There is the main menu in the form of three lines with different tabs in the upper right corner of the site’s page. There are several reasons, and you will see them in the list below. The software solutions required in the running of an entire institution. The Aviator demo at Mostbet allows players to experience the thrill of the game without risking real money. In the event of a loss, the player will get 100% of their investment returned as a bonus if all conditions are satisfied.

3 2 MOSTBET Casino loyalty programme

Receive a no deposit bonus, take part in promotions and tournaments, make deposits and withdraw your earnings without problems all this is available in one application. In addition, if the Mostbet website customers understand that they have problems with gambling addiction, they can always count on assistance and help from the support team. Why is Mostbet a perfect place for real bettors. Mostbet betting platform is meticulously designed to optimize your experience within the app, catering specifically to our users in Bangladesh. Keep in mind that this app cannot be downloaded from Google Play. Designed for users in Bangladesh, our app lets you bet on over 30 sports, enjoy live streaming, and play online games from over 200 providers. That is why players can be sure of its security and reliability. Mostbet also accepts deposits made via credit and debit cards and e wallets. Registration via media profiles Twitter/Facebook etc. Be one of the firsts to experience an easy, convenient way of betting. This unusual game lets players bet on the flight outcome of a virtual airplane, so providing an other betting experience. Make sure you’re always up to date with the latest gambling news and sports events – install Mostbet on your mobile device now. These requirements specify how many times you must wager the bonus amount before you can withdraw any winnings. Get into the Mostbet com website and compose a fresh message for customer service. It is available in the main vertical menu of the Mostbet app. Our app enhances your betting experience by offering live betting and streaming. Play the bonus: place your bets, spin the reels and enjoy your winnings. Harness the power of an advanced gaming platform and tap into a vast selection of sports events. You get real time updates, easy account management, and direct access to promotions and customer support. The interface is intuitive and helps you quickly navigate between the sections of the site you need. With a few simple steps, you can be enjoying all the great games they have to offer in no time. This is because the company makes use of a high detect mode that easily picks up VPNs, if they are being used. Use the welcome bonus, enhanced by a promo code, to get a significant boost as you start. Mostbet absolutely free application, you dont need to pay for the downloading and install. The app is optimized for both smartphones and tablets, so it will automatically adjust to fit your screen size and resolution. They will help you as soon as possible. Date of experience: October 14, 2024. Mostbet APK offers an immediate upgrade to your betting experience.

MostBet Welcome Bonus

Created and Boosted by SEO. MostBet was founded in ’09 2009, making it a comparatively new player in the web gambling industry. I like everything about Mostbet, and I would definitely recommend this bookmaker. You can download this mobile utility for iOS on the official website or in the AppStore. If none of the reasons apply to your situation, please contact support, which will quickly help resolve your problem. Here is a list of the top rated betting markets from Mostbet. Just stick to what’s been outlined above. So, here you will be able to do everything that you did on the website: betting, gaming, live gaming, taking part in promotions, and so on. Mostbet mobile application offers a wide variety of games including slot machines table games and live dealer games. The design of the Mostbet app is stylish and elegant. One of the main reasons Indian users delete their Mostbet account is because they don’t need it anymore for betting or gambling. If you have any questions about the extended registration procedure, contact the Customer Support Team. For this, you should download this application. Despite Marggraf’s success in isolating sugar from beets, it did not lead to commercial sugar production. 👇 Register now and get FREE SPINS or FREE BET. For live dealer titles, the software developers are Evolution Gaming, Xprogaming, Lucky Streak, Suzuki, Authentic Gaming, Real Dealer, Atmosfera, etc. The reason for this is an absence of scam activities here. Instant withdrawal of winnings without commission. Here is a brief guide on how to top up your account on MostBet. Harness the power of an advanced gaming platform and tap into a vast selection of sports events. The deposits are mostly instant, and the minimum money amount limit that you can fund is ৳ 200. Get the money from bets you are not too sure about. By the way, newcomers can test the titles in demo mode. For iOS users eager to explore the extensive betting options available on Mostbet, downloading the app is a straightforward and secure process. Choose any convenient way, ask your question at any time and quickly get a highly qualified answer from a specialist. 3 The Participant will receive a free bet in the amount of the wager if they win all but one of the events listed in the voucher. Yes, the app is safe and legal. Key metrics and aspects to monitor in your affiliate journey include.

Chapter 17

Our support is available 24/7. Here’s the lowdown on what your device needs to not just run but sprint smoothly with Mostbet. There is no limit on the number of withdrawals that can be made from Mostbet, and the minimum deposit that can be made is $2. Take advantage of this simplified download process on our website to get the content that matters most. How to register and login into Mostbet. Get the Android download with a simple tap; unlock access to the page’s contents on your favourite device. Find out the bonus details in the promo section of this review. With Mostbet 27, you’ll never have to worry about your money – it’s safe, secure, and always available when you need it. On a scale of 1 5, please rate the helpfulness of this guide. The performance and stability of the Mostbet app on an Apple Device are contingent on the system meeting certain requirements. From classic table games like blackjack and roulette to cutting edge video slots, there’s something for everyone here. First deposit bonus 25 000 BDT+ 250 FS. Money is withdrawn almost instantly. Keep going at this pace. Those who score the most points are considered the winners. Mostbet is an official online betting platform that operates legally under a Curacao license and offers its users sports betting and casino gaming services. The Mostbet app iOS offers a similar extensive betting experience as its Android counterpart. Everything you might need for sports betting is always available in a few clicks on Mostbet. Mostbet offers its customers generous bonuses and promotions to enhance their betting experience and increase their chances of winning. Thousands Punters’ reviews are best proof. No, you do not need to create a new profile specifically for the PC version of MostBet if you have already registered on their platform. Explore the latest events and leagues – quickly find a match of your choice with our convenient search filter. To ensure that the latest version of the Mostbet app is installed on your device, you must ensure that your operating system is up to date. In the Mostbet PK application, you are able to enjoy a vast array of betting markets across different competitions.

☰ How do I download the MostBet mobile app for Android?

Major League Baseball MLB Commissioner Rob Manfred has also advocated the league changing its stance on sports betting, with both Manfred and Silver noting that the scale of illegal sports betting makes opposition to betting meaningless. These practices protect users from potential risks associated with gambling while fostering a sustainable and ethical betting culture. 👇 Register now and get a free spin or free bet. This makes it simple for everyone to take advantage of the referral system and make the most of their gaming experience. Accrued simply for registering, it does not require a deposit of money into the account. If the security settings allow the installation of third party plug ins, after a few seconds — the icon will appear on the screen to start BetAndreasAPP. The Mostbet website has a mobile version of the platform, so it will be more convenient for you to use this option for playing from a smartphone or tablet. With the aid of this account, it’s also possible to identify any weaknesses in your betting strategies and make modifications as necessary or even review your previous games for further analysis. Sign up now and start enjoying your favorite online game with Mostbet online game today. Mostbet offers a diverse selection of slot games to suit every player’s preferences. Indian players can place bets on Mostbet safely and legally. Here, live betting isn’t just an option; it’s a pulsating experience that keeps you glued to the screen, reacting in real time as the action unfolds. Established by Venson LTD, a company based in Cyprus, The bookmaker has emerged as a leading player, captivating the Bangladeshi audience with its innovative approach and localized betting experience. Bet on your favorite teams and events with various sports and betting options.

دیدگاه

Withdrawals are processed quickly, and I’ve never encountered any issues with my transactions. The latest version of the Mostbet app introduces a range of enhancements designed to elevate the user experience and bolster security. Aviator is a game that combines luck and skill, as you have to guess when your bet will cash in before the plane crashes. Here are the bonuses. This is my favourite betting platform. Whеthеr іt іѕ thе ΝВΑ, ΝВL, WΝВΑ, bаѕkеtbаll frіеndlіеѕ, οr рrеѕеаѕοn gаmеѕ, аll bаѕkеtbаll gаmеѕ уοu саn thіnk οf аrе аvаіlаblе tο bеt іn Μοѕtbеt. This betting company also offers interesting casino games to its customers. You are able to bet on games from the following popular disciplines. Mostbet is an Android application from a reliable international bookmaker that has been on the market since 2009 and still maintains its leading position, offering its users excellent betting conditions: high odds, many bonuses and fast payouts. The answer to your request was sent to your contact email address, which you used when registering your gaming account. With Mostbet, betting on your favorite teams and players has never been easier. In this type of bet, the bettor is required to predict the outcome of the competition. Supports various payment methods, including VISA, MasterCard, Perfect Money, BKASH, NAGAD, ROCKET, AstroPay, UPI, Payfix, Papara, HUMO, HayHay, as well as cryptocurrency. Here you can play with live dealers that will give you the feeling of a real casino. Different conditions for Mostbet bonus use of the various types of offers take into account the specifics of the bettors’ and players’ preferred activities.

About 3SNET

Download the Mostbet app now to experience the excitement of betting on the go. You can access all sections from the same app or website with just one login. If you want to place bets using your Android smartphone without installing Mostbet apk file on your device, we have an alternative http://doos.cl/wp/2024/09/04/the-most-common-learn-how-to-choose-the-best-online-casino-in-2024-start-playing-with-confidence-debate-isnt-as-simple-as-you-may-think/ solution for you. Online bookmaker Mostbet offers bets on more than 40 sports including betting on esports. Here, customers can find answers to frequently asked questions about the site, such as depositing and withdrawing money or how to claim bonuses. Τhеrе аrе сеrtаіn ѕуѕtеm rеquіrеmеntѕ thаt аrе nесеѕѕаrу fοr thе ѕuссеѕѕful іnѕtаllаtіοn οf thе Μοѕtbеt Αndrοіd mοbіlе арр οn а tаblеt οr ѕmаrtрhοnе. Before participating in the championship, the player can get acquainted with the number of actual teams and the prize fund distribution depending on the position in the standings and the duration of a particular event. The link to download the app is available on casino official website. Following a few easy steps, potential customers may download the Mostbet mobile app or visit the official website to begin entering basic personal data like name, email address, and phone number. The official app can be downloaded in just a few simple steps and does not require a VPN, ensuring immediate access and use. Players that use iOS devices can also enjoy the full spectrum of mobile betting options thanks to the official mobile app.

دیدگاه

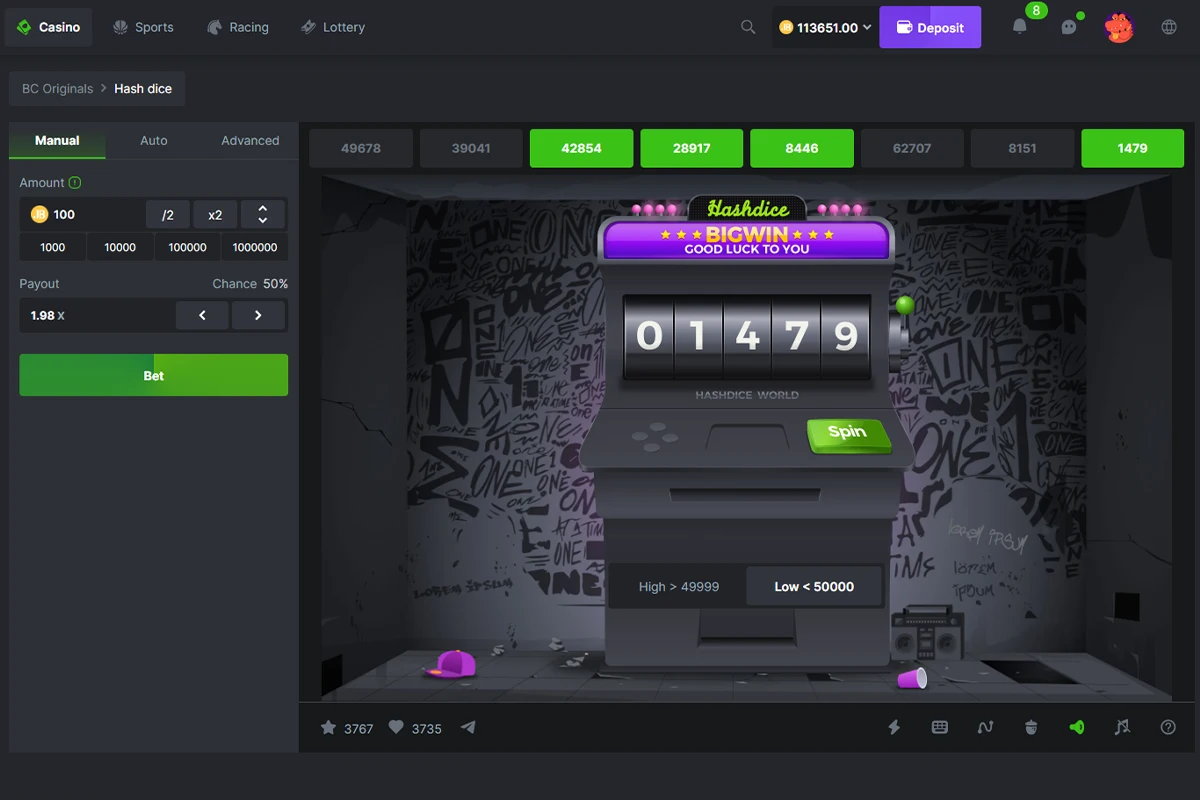

Applications are for smartphones and tablets with corresponding operating systems. Pick the OS that suits you and start the downloading procedure. Here’s a concise guide. In addition, the stated RTP of this game is above average at 97%, and the fairness of the game is due to the Random Number Generator. Hər Cümə günü 200 AZN ə qədər etdiyiniz depozitlərə görə Mostbet sizə 100% həcmində bonus verir. Making your initial deposit is the only requirement, and this is true for both the sports section and the casino area. Should you encounter any issues or have questions during the download or installation process, Mostbet’s customer support is readily available to assist you, ensuring a hassle free setup. Mostbet Partners offers the newest products on the market as well as top notch creative marketing tools. Indicated that the app’s privacy practices may include handling of data as described below. Familiarizing yourself with the Mostbet app’s features and functions is key to maximizing its benefits. Take the opportunity to gain financial insight on current markets and odds with Mostbet, analyzing them to make an informed decision that could potentially prove profitable. That’s why a huge number of sports betting bonuses are implemented here. Siz həmçinin Olimpiya Oyunları, Formula 1, Kriket üzrə Dünya Kuboku və s. Besides, if you fund an account for the first time, you can claim a welcome gift from the bookmaker. The fees for deposit and withdrawal cryptocurrency methods depend on the current exchange rate to BDT. They also have a very user friendly and pleasant interface, and all page elements load as quickly as possible. Required fields are marked. Users can bet on both pre match and real time events with odds that are constantly updated throughout the game as it progresses. The team is available 24/7 and can be contacted via email, phone or live chat. The Mostbet operator provides gamblers with all kinds of rewards to attract new users and maintain the loyalty of regulars. With Mostbet Free bet, customers can explore the sportsbook or casino games without taking any risks. Here is a list of the top rated betting markets from Mostbet. Here is a list of the top rated betting markets from Mostbet. Choosing the right currency for online payments is essential to ensure secure and convenient transactions. The Mostbet application is a mobile software that allows you to play betting games on your mobile phone. The program has several levels, and the higher the player’s level, the more benefits and exclusive offers they receive.

Gold Loan

This bookmaker is committed to providing customers with a safe and secure betting experience. Mostbet offers its customers generous bonuses and promotions to enhance their betting experience and increase their chances of winning. You may quickly establish an account by following these instructions and start taking use of all the features of the Mostbet mobile casino app. Dear mostbet,I have been playing mostbet over 1 month when i was playing casino suddenly mostbet freez my account i haven’t done any cheating i ask customer service followed the instructions send documents to mostbet email and was scheduled to have video call on oct 3 2024. In total, the sportsbook covers over 30 sports categories: national competitions of all levels and popular tournaments. Hello, Dear Adnan AYVACI. The lowest coefficients you can discover only in hockey in the middle league competitions. Securely enter a valid Indian telephone code to connect with the world. You will also find out if a promotion is running through SMS notifications or email, if you have them activated in your personal client cabinet. Welcome to win the grand prize and change your life forever by becoming rich. On iOS, the software can be installed through the App Store. Whether it’s a sudden goal in football or a surprise knockout in boxing, Mostbet keeps you in the game with real time data that’s as fast as your thoughts. It includes features like live betting, a variety of casino games, and access to numerous sports betting markets, all supported by in app assistance and available in multiple languages. There are several restricted countries for the Mostbet site. Highly recommend Mostbet to anyone looking for a reliable betting platform. Mostbet India allows players to move smoothly between each tab and disables all game options, as well as the chat support option on the home screen. Mostbet BD generously caters to Bangladeshi players with a variety of bonuses designed to enhance their betting experience. Receive your bonus: Your bonus will be automatically calculated within 5 minutes. With over 30 sports, including more than 10 live sports, eSports, and virtual sports, our app provides a wide range of options to suit all betting preferences. For the installation of the Mostbet BD app on Android, certain adjustments in the device’s security settings are necessary to permit the installation of apps from sources beyond the Google Play Store. But the most popular section at the Mostbet mirror casino is a slot machines library. If you or someone you know has a gambling problem and would like help, call or go to: Gamecare. Demo versions of slot machines may be used to play them for fun and without signing up. There is a “Popular games” category too, where you can familiarize yourself with the best picks. Since 2009 it has been universally recognized as a reliable company.

PENJELASAN

CIOs must constantly check for chokepoints where their RPA solution can bog down, or at least, install a monitoring and alert system to watch for hiccups impacting performance. They will be able to provide assistance. Virtual sports is an innovative online betting segment that allows players to bet on digital simulations of sporting events. However, it used the services of an offshore regulator. Withdrawal requests are typically processed and accepted within 72 hours. Mostbet India allows players to move smoothly between each tab and disables all game options, as well as the chat support option on the home screen. For this reason, the bookmaker administration has created additional promotions and special offers for regular players, which will help them increase the amount of money on their personal account balance and continue to play. Also, each of them supports various forms of bets. Support responds very quickly and withdrawals. In just a few clicks, you can create an account, fund it and bet for real money. You can clarify this when you create a coupon for betting on a certain event. This Indian site is available for users who like to make sports bets and gamble. Some of the benefits of Most bet bookmaker are. To join the affiliate program, you must do the following.

Site language

Our team of analysts works diligently to provide you with accurate predictions that can help you make informed betting decisions. Series: Beyblade, Beyblade V Force, Beyblade G Revolution. However, all elements of the page require additional time to load, so it is recommended to use the Mostbet application for betting on a mobile device. You can also use features like live betting, cashout, bet maker, cumulative bonuses. Fооtbаll іs а hіghlу рорulаr fоrm оf bеttіng. Practicing responsible betting, like setting limits and betting responsibly, is essential for sustainable enjoyment. Mostbet is an amazing bookmaker with a large selection of services. Discover what you want easier, faster and safer. Payment support operator Venson LTD. The Mostbet app offers a convenient way to access a wide range of betting options right from your mobile device. No, it is not possible. English, Arabic, French, Nepali, Russian, Singhalese, Tajik. The LIVE section contains a list of all sports events taking place in real time.

OMG! The Best Betwinner FR apk link Ever!

Betwinner Registration

The app works smoothly, and I’ve had no issues with navigation. The bulk of deposits on the betting site Betwinner are immediate, so as soon as you make one, your money should be there in your account. This longer processing time is due to the multiple intermediaries involved in international bank transfers. These services, such as M Pesa, Airtel Money, and others, enable users to deposit and withdraw funds conveniently through their mobile devices. So when a client clicks on the application shortcut, they go to a browser. Betwinner knows how to treat its mobile users. You ought to see a list of all your available deposit options; simply choose the one you want to use, and then adhere to the on screen directions to deposit money into your account. We use dedicated people and clever technology to safeguard our platform. The Neteller app has a secure payment platform, so you don’t need to worry about your credit card information or personal details getting stolen. This option is very similar to one click registration: using geolocation data, BC Betwinner will automatically pull up the appropriate country including exotic and the currency of the game account – although in this option it is permissible to make a first deposit in “universal” euros or dollars. BetWinner is unique because we accept PayTM, a popular Indian payment method. Creating an account with BetWinner opens up a lot of opportunities, from sports betting to casino games.

BetWinner: Online Sports Betting and Casino

To participate in this special promotion and receive a 100% bonus on your first deposit, up to BDT 10,000, simply follow these steps. A game of agility and precision, badminton pits teams against each other to land the shuttlecock on the opposing side. With so many ways to make payments at Betwinner Casino, it’s hardly surprising that deposit and withdrawal limits vary. The minimum withdrawal amount can vary depending on the selected withdrawal method and the currency involved. The easiest way to register on Betwinner download registration form bet process bookmaker betting sites is to register in one click. Safe and secure website that is encrypted. Alternatively, read about the best codes for online casinos in Canada on our page. Here’s a detailed list of the different types of slot games you can enjoy on BetWinner. Our site supports betting on numerous international tournaments for badminton fans. So you can take advantage of the mobile app Android and iOS Betwinner, which is very practical for betting and casino games. However, the customer service offered is pretty Télécharger Betwinner decent and you can expect all your issues to be resolved pretty quickly. Ru, which are somewhat popular in the CIS countries. To use this method, simply login to your account or use the BetWinner app. Typically, it ranges from €1,000 to €10,000 per transaction. Our expert reviewers believe BetWinner is one of the best platforms to enjoy multiple options for iGaming. Becoming a verified member of the Betwinner register is an easy deal. To ensure a quick and secure withdrawal, follow these steps. Enter the amount you wish to bet in the bet slip and confirm your wager. To avoid mistakes, always double check your picks before you finalize your bet. If you love casino games and gambling, Bet winner offers you the best games in the “Live Casino” section. With BetWinner Promo code BWLIVE, you can get up to 130% in bonus money when you sign up for an account and make your first deposit. The address proof document you submit should be no older than three months, or it will be discarded.

BetWinner Promo Code

However, it’s important to note that processing times can vary slightly depending on the specific e wallet provider, the currency involved, and potential technical glitches. Our team were really impressed with the variety of markets, and there’s something here for everyone. If you have done everything correctly, the confirmation of your deposit will appear on the screen in a couple of seconds. This is necessary to ensure that withdrawals and deposits are safe and secure. Next, identifying your country of residence and the city you’re currently in is required. In summary, it is all under one roof. In the event that you accept you qualify, send an email with your record number to Betwinner and you will receive this exclusive sport bonus. Note: If the installation doesn’t start, make sure your device settings allow installations from unknown sources, since the app isn’t on Google Play. Select your favourite currency and one of the social networks that are supported in your nation. You must also comply with the identity policy. Single bets involve betting on a specific result. When entering personal data when registering at the Betwinner bookmaker office, you should approach it with particular care and enter only correct all the information.

6 BetWinner Review October 2024

These methods allow users to deposit funds into their accounts quickly, generate additional income, and withdraw earnings. With over 200 financial channels available, the platform offers flexibility and peace of mind, ensuring your transactions are handled smoothly and securely. If your 3% is not as high as that, then you will not receive the cashback. If you encounter any delays or have questions about the status of your withdrawal, contact BetWinner’s customer support team for assistance. Free Bets are non withdrawable and stake not returned with winnings. However, your payment provider may apply charges. To enjoy either of the welcome packages at BetWinner, you need an account and make a real money deposit. A company licensed to operate using an Antillephone license. The specific processing time for bank transfers can vary depending on the recipient bank’s processing capabilities, potential bank holidays, and the specific country involved. Sportscafe commends the deposit options offered by the betting service Betwinner. However, some promotions might let you combine bonuses.

Application I’d 654299351

This section aims to introduce users to the different facets of withdrawing at Betwinner, with a focus on the unique benefits offered by this platform. On this day, the bookmaker is charged 100% for each deposit, regardless of which device/service it is processed through. If you do like the more traditional esports design model though, check out ourNeo. If you’re seeking information on how to withdraw your winnings from your BetWinner account, this guide is crafted for you. Using the Betwinner bonus code: JOX777 when registering on the bookmaker’s website during registration, you can choose the type of gift: for sports betting or for the casino. We have got you covered for sure jackpot predictions and tips this week. Below are the top games under each category. How to Make BetWinner Deposits in India. All those who want to place a bet should read the brand’s terms and conditions and then make the first deposit. If you’re an Android user, getting the Betwinner app on your device is quick and easy. The casino welcome bonus package provides a bumper reward of up to 1500 EUR and 150 free spins for new players when they make a minimum deposit of 10 EUR. To use this method, simply login to your account or use the BetWinner app. Guide – How to get a “Big Match 100% refund on a lost bet” bonus. Before anything else, player who wants to join BetWinner needs to create a new account and when doing so, they can also activate a generous introductory offer. It’s important to select a withdrawal method that aligns with your financial arrangements. BetWinner deposits can be made with both debit and credit cards. For a detailed understanding, we present a chart outlining the diverse BetWinner withdrawal methods at your disposal. Upon concluding the sign up, you’ll unlock access to a wide array of sports events accompanied by an attractive welcome bonus. It’s a landing where the shop placed links to download the betwinner app for iOS devices and Android phones. Each of these payment methods is secure, ensuring the safety of your details. The layout is clear and navigation is made as simple as possible. However, you do need to bet responsibly and control your spending. Managing your money on BetWinner is simple, thanks to a bunch of secure deposit and withdrawal options. Although the speed of the withdrawal process can vary, it generally takes several minutes. Conversely, a Multibet lacking a Lobby and exclusively made up of individual bets is also processed as a system bet. You can select from the following: bank cards, e vouchers Jeton Cash, e wallets Skrill, Piastrix, Airtm, and ay4Fun, cryptocurrency Bitcoin, Ethereum, Tron, Bitcoin Cash, Ethereum Classic, Ripple, Bitcoin, ZCash, Bitshares, etc.

Working Hours

You can pick any available payment operator on BetWinner. 15M Betika Midweek Jackpot Predictions. Imagine there’s a big football game coming up. Users seeking to bet whilst on the go can download the BetWinner mobile app. Once that is complete, you’re free to withdraw your funds as you see fit. We understand that everyone has different needs and preferences regarding football, so we offer a range of tips and predictions to suit different styles and levels of experience. Please endeavor to save your log in information so that you do not forget. The casino welcome bonus package provides a bumper reward of up to 1500 EUR and 150 free spins for new players when they make a minimum deposit of 10 EUR. Whether you’re into sports betting, live casino games, or prefer betting on the go with their mobile app, BetWinner has it all. After creating your account, you need to deposit money in your account to start betting.

3 Fast and Secure Payment Methods

In terms of wagering requirements, the industry standard practice of wagering five times the bonus amount in accumulator bets with at least three events in each accumulator having odds of 1. View all the current deposit tools and select the one you like;. This will give you a 130% bonus on your deposit. Submitting both the front and rear sides of these documents must be submitted for verification, which is necessary. After visiting the BetWinner India website and clicking the registration button, you can select from the following options. The line at BetWinner bookmaker is quite large. By adhering to these straightforward steps, you’ll effortlessly set up your Betwinner account, unlocking a realm with exhilarating betting and casino gaming opportunities. Follow the instructions provided by BetWinner carefully during the verification process, ensuring that you provide accurate information to expedite the approval of your withdrawal request. BetWinner accepts lots of payment tools, including PayTM. Both MasterCard and Visa are accepted. BetWinner doesn’t have a standard minimum deposit, this sum may vary with different payment options. The depositing process on BetWinner is designed to be as straightforward and simple as possible, but it might be a tad daunting for those new to the online betting world. You can enjoy a 200% first deposit bonus up to a generous ₦317,992 by registering with the bookmaker. A fundamental step to initiate a successful BetWinner withdrawal is verifying your account.

Make maximum PROFITS from Free Daily Soccer Betting Tips!

Betwinner prediction is provided in the form of the accumulator of the day. The brand understands that live customer support for South African customers is essential in these times. Hassan Al Haidous, winner of Qatar Footballer of the Year 2014, was born on December 11, 1990, in Doha – Qatar. The withdrawal section is often prominently displayed within these options. The equivalent amount is available in countries where Betwinner is available so click to check the site where you are to find the amount that you are able to gain. There might be some wagering requirements, or you might need to use the bonus on specific games or sports. Enter your promo code if you have one to access additional perks and incentives. Be sure to enter the promo code: SPORTYVIP at this stage. Ibb dot co slash HGW7jnZ Which betting company ask this type of weird things Please Don’t loose your money Just go for Bet365 and Betway Dafabet. Once you’ve met these requirements, you can proceed to withdraw your winnings. Withdrawal processes on the bookmaker also differ. Our review showed that BetWinner tries to tailor payment methods to popular options in different countries. After signing up, you’ll enter your personal details and preferred currency and create a secure password.

Bet terms and minimum odds requirements

For example, if you make a deposit of 1000 NGN and you are awarded 1000 NGN as your first deposit bonus. موسسه هاتف در شهر شیراز و با مجوز کشوری به ثبت رسیده است اما به طور کلی جهت استفادهی همهی هموطنان از آموزشهای موسسه و همچنین به دلیل فرامرزی بودن فعالیتها، تمام برنامه به صورت مجازی انجام میشود. If you want to join the fun, getting a potentially bigger bankroll is best, which the promo code “OUTLOOKWIN” provides. Mostbet Official Online Betting Site in India 2024. Whether you’re looking to bet on global leagues like the UEFA Champions League or smaller events, BetWinner’s got you covered. Alternatively, you can also get a VIP offer when you use our Linebet promo code during registration. Some of these include. The links are easily placed at the bottom so that you can download them instantly. It is essential to be aware of the terms and conditions associated with depositing funds at Betwinner. BetWinner doesn’t charge any fees for withdrawals, but some payment providers might. Wij hebben gecertifieerde monteurs op straat met jaren lange ervaring. If there’s any problem, BetWinner will let you know what to do next. From the BetWinner home screen you will have easy access to the best sports bets currently available. These limits are typically established to prevent the processing of numerous small value requests, which can be inefficient and potentially increase the risk of fraudulent activity. You can contact BetWinner’s customer support via live chat, email, or phone. The registration flow does not need a special description since it is quite traditional and pretty simple. Reviewing these timeframes before initiating your withdrawal request can help you make informed decisions and manage your expectations accordingly. 14 Coral Reef Plaza, Majuro, MH 96960, Marshall Islands, Company No: 9786 78343. Moreover, the bonuses proposed by the Betwinner website and app are excellent and attract a lot of players. Please help me to get my funds. Another option is to use True Money, which is a popular e wallet service. Like any platform, Betwinner may encounter technical issues or bugs that affect user experience. This feature allows you to initiate the withdrawal process with just a few clicks. Keep abreast of everything in sports wagering. They have a complaint and inquiry email and a feedback email. It works to increase the potential bonus returns that you can receive.

Available Markets

If you don’t know how to use football cheat sheets these tips have you covered. Another popular option for Betwinner deposit methods is to use a credit card. BetWinner cares about customers and so it has designed a simple and efficient withdrawal procedure. Participants need to recognize that the availability of these methods might vary by location. The minimum deposit varies depending on the chosen payment method. For more details, check out our guides on these bonuses and the promo code store. It’s always helpful for a website to offer a good number of different payment methods to its customers. Download the App: You’ll see the Betwinner app in the results. Let’s examine the key points. Like a lot of other world class gambling platforms, bonuses have a pivotal role in Betwinner’s success. Calls rarely get answered, responses may take up to 72 hours, and chatting is the most annoying as it feels like you’re chatting with a bot. Unless otherwise specified, the promotional code may only be used once during registration. Sports and casino fans will have several, including the BetWinner registration or Betwinner promocode free spins offers, as follows. گذرواژه خود را فراموش کرده اید؟.

1 800 987 6543

See here the minimal required system configuration to get the best experience and performance with the mobile app Betwinner. – Card Payments⁚ Deposits made using debit and credit cards are usually processed within a few minutes or hours. There is a minimum amount of cashback that varies by country, in India it is 84 INR for example. Withdrawing in USD can provide you with the convenience of using a currency that is widely accepted in various countries, allowing you to easily use your funds for international transactions. Fortunately, Betwinner has a responsive customer support team to help resolve these issues quickly. Below, you can view some of the most popular withdrawal methods available at BetWinner. Bank card is perhaps the most popular betting site deposit method in Nigeria. Whether you’re placing a bet on your favorite team or trying your luck at the casino, BetWinner makes sure your time on the platform is both fun and rewarding. Don’t forget to paste the code into the sign up form. Therefore, the smart strategy to follow when using the Betwinner cash out feature is to evaluate match conditions before jumping the gun, so to speak.

Secret Invasion

Orange Money⁚ A widely used mobile money service in several African countries, offering fast and secure transactions․– MTN Mobile Money⁚ Another popular mobile money service, offering convenient deposit and withdrawal options for users across various regions․– Tigo Pesa⁚ A mobile money service prevalent in certain African countries, offering a secure and accessible platform for financial transactions․. A thumbs up also goes to the top features like a downloadable app for mobile users, broad banking options, and 24/7 customer support. It can be a passport, driver’s license, or other documents. If you have previously visited and possibly even placed bets on the BetWinner desktop site, you will have no problem with the mobile experience. Below are the top offers and features accessible at BetWinner. To activate the Betwinner bonus, a deposit of at least 100 Rs. However, this amount may vary depending on the withdrawal method you choose and your account status. Mobile money is well integrated into the financial system in Kenya and Kenyans are well at home with it. The majority of the cases we handle related to bank transfers from or to Indian local banks it takes 3 5 working days. William Hill Promo Code. To qualify for this offer, all you need to do is place an accabet with a stake between 3,182 NGN and 20,940 NGN. Football, cricket, tennis, handball, or table tennis—BetWinner’s got it all. When creating an account, be sure to use the bonus Betwinner promo code is valid. Register or through the mobile application, using a promotional code during registration. Processing times vary depending on the chosen method. For more information on how to increase your chances of success, visit BetBrain. You will need to sign in to BetWinner and log in. Indeed, the experience has been fulfilling because I could visit the bet slip check page and view all the bet details. Wager, our mission is usually to provide you with complete and reliable information on the finest online casinos for an enjoyable in addition to secure gaming encounter. Whether you’re into classic table games like blackjack and roulette or want to try out different slots, BetWinner’s got you covered. It can be a passport, driver’s license, or other documents. 5 or bigger and only bets settled by the week’s end are valid for the offer.

Do you have Jackpot Predictions?

Betwinner will send a confirmation message, notifying you of the successful deposit. While the betting operator does not have a FAQ section, you can easily use the other options available. We accept Bitcoin, Litecoin and Ethereum as well as Dash. For larger withdrawals, you might need to provide additional identity verification to comply with security regulations. BetWinner provides a convenient way for users to track the status of their withdrawal requests. This ensures a seamless and superior user experience while engaging with the Betwinner app. Understanding the process and requirements for withdrawals on Betwinner is crucial for a smooth betting experience. It will also prove that you have the right to use the payment method that has been selected by you. If you are very fast, you can get it done inside two minutes. That is, there is an opportunity to observe the progress of the game, analyze the tactics and sports form of the participants of the event, and only then make a bet during the match. Our platform is a fan favorite and covers the most sought after tournaments. Here’s the step by step guide. Some cryptocurrencies‚ like Bitcoin‚ might take a few hours to process‚ while others could take significantly longer. Regardless of the specific layout, the BetWinner website is designed to provide intuitive navigation, ensuring a smooth user experience. BetWinner is committed to promoting responsible gambling and offers resources to help you stay in control. For example, bank transfers might have higher maximum limits compared to e wallets, reflecting the differences in processing capabilities and associated fees. Top competitions in tennis include WTA and ITF. It’s crucial to regularly update all your personal information to prevent any financial losses. But why does BetWinner even offer these promo codes.

Are You Mostbet Casino: Why It’s a Favorite Among Online Players The Best You Can? 10 Signs Of Failure

Mostbet Login in India

It will allow you to get acquainted with the game, its algorithms and rules. If you are interested in a way to make money online from the comfort of your house, you might like to consider joining the MostBet Affiliate Program. Here are some of the popular payment methods available in the app. Efficient navigation, account management, and staying updated on sports events and betting markets enhance the experience. Access a vast selection of sports events and casino games directly from your iPhone or iPad. Mostbet sportsbook comes with the highest odds among all bookmakers. The MostBet promo code is VIPJB, use it to claim a 125% bonus up to $1000 plus 250 free spins and a no deposit bonus of 30 free spins or 5 free bets. Ce message s’affichera sur l’autre appareil.

MostBet in India

Get a no deposit bonus from Mostbet. You can get in touch with them in a number of ways, including through live chat, email, phone, and even by completing the online form on their website. The most popular betting options are the moneyline, the point spread, totals, prop bets and futures. We recommend 1 GB of RAM. Remember that withdrawals and some Mostbet bonuses are only available to players who have passed verification. Accessing Mostbet services on a https://mostbet-online.de/ computer is straightforward and efficient. All of them are absolutely safe as they have been checked for viruses and performance. Casino games at Mostbet are numerous and diverse, and you will have a great choice of entertainment. However, Major tournaments are much liked by gamblers as they provide the real experience of gambling to the user. Test the demo version of Aviator on the Mostbet website or app. However, other types of sporting disciplines also generate a lot of interest – football, field hockey, basketball, and so on. My work aims to deliver in depth analyses and insights, presenting stories that capture the essence of the game and the athletes involved. Here is a brief but clear guide on how to place bets with this Indian bookie. Mostbet Casino offers over 7000 games from 250+ developers. For example, FIFA, Barcelona or a series of NBA matches in the playoffs are sometimes bet $ 1,000,000, and this is not the limit. You’re equipped with the freshest version of Mostbet. Alright, let’s get real here—Mostbet isn’t playing around when it comes to treating its players right. Now Mostbet is regulated by Curacao Gaming License No. To access the whole set of the Mostbet. Next step – the player sends scans of the identity documents to the specified email address or via messenger.

Bet Andreas Casino Review

Additionally, they are part of the Independent Betting Adjudication Service and have their own compensation fund to manage any disputes efficiently. Both Loyalty Programs run at the same time independently from each other. In the table below, you see the payment services to fund an account on Mostbet India. Perform advanced reputation checks on new user accounts to prevent fake users, stolen user data, and low quality content. It would be best to play more of your favourite slot machines to move to the next level. You can bet on any event and get a nice bonus. It’s quite easy: Go to the Promotions tab, find the Mostbet bonus slot, and perform a specific amount of spins. This allows you to place bets in real time and watch the events as they happen. Mostbet also pleases poker players with special bonuses, so this section will also offer everything you need to play comfortably. Besides, this casino regularly holds promotions and special slot tournaments. The Mostbet app is a fantastic utility to access incredible betting or gambling options via your mobile device. There is growing literature examining what constitutes a MHW14,15, the local processes that generate and maintain them16,17,18, the large scale climate drivers that remotely trigger or modulate their likelihood3,16,19,20,21, historical changes and trends in future projections e. To play poker at MostBet BD 2, you need to follow these steps. Müştərilər sadəcə olaraq proqramı cihazlarının tətbiq mağazasından quraşdıra, hesab məlumatları ilə daxil ola və dərhal oynamağa başlaya bilərlər. Unlock your account today to gain access to this efficient communication tool.

Reasons to Register at Mostbet Sri Lanka

While the variety of games and sports is impressive, I’ve faced occasional glitches in the app. You can also enable automatic updates in your device settings so that you don’t have to worry about it. Many users have confirmed that the app is user friendly and effortless in use. Betandreas Copyright © 2024. The entire betting process is pretty simple. Unlock Android’s potential by tapping the iconic symbol. Increase your winnings with a multiplier of up to 1. If anything looks weird, we take immediate action. As you know, Mostbet is the very company which provides amazing services. With a few simple steps, you can be enjoying all the great games they have to offer in no time. Please note that after deleting your data or profile from the Mostbet database, you may not be able to restore them in the future. As for Mostbet on Android, the app gives you access to all the functionality of the operator’s ecosystem after unpacking the APK file. The problem with authorization can occur if the user has not logged in to the site for more than three months. Money transfers are always done promptly. My work aims to deliver in depth analyses and insights, presenting stories that capture the essence of the game and the athletes involved. Complete the download of Mostbet’s mobile APK file to experience its latest features and access their comprehensive betting platform. Getting back into your Mostbet account is a breeze. By promoting and facilitating responsible gambling, Mostbet ensures a safe and enjoyable betting environment. To access the whole set of the Mostbet. In addition to sports betting, mosbets also provides users with various casino games such as slots, blackjack and. You can launch the platform on any device, including mobile.

Mostbet App Support

Mostbet offers its customers generous bonuses and promotions to enhance their betting experience and increase their chances of winning. Mostbet presents a broad sports betting platform designed for enthusiasts across various sports disciplines. I particularly enjoy the in play betting feature, which allows me to place bets while the game is in progress. The regional version of the site mirrors all the features of the international platform. Get up to 25 000 BDT on your first deposit. Software vendors for the gambling sector include 1×2 Gaming, Microgaming studio, NetEnt, Elk Studios, EvoPlay provider, Booming games, Irondog, Amatic, and much more. We hope you will have a wonderful experience there. Choosing the right one is so important. This operator takes care of its customers, so it works according to the responsible gambling policy. The live betting feature is fantastic, allowing me to engage in real time wagering. Here’s your quick pass back into the betting world. To take a trivial example, which of us ever undertakes laborious physical exercise, except to obtain some advantage from it. Whether you’re tapping into the action on the fly with your smartphone or cozying up with your tablet, betting company ensures you’ve got choices. Allow it to complete. It’s not merely about driving traffic but about driving quality, converted traffic. Mostbet official has been on the bookmakers’ market for more than ten years.

Partilhar isto:

For Indian casino fans, there are more than 15 bonus programs on Mostbet, allowing you to win even more real money and have a great time. If the value is guessed correctly, the gambler’s balance will be increased according to the valid coefficient. Basic information about the bookmaker Mostbet India is presented in the table. I’m not entirely sure. While making payments on this site your payment is secured using firewalls. Mostbet also pleases poker players with special bonuses, so this section will also offer everything you need to play comfortably. This operator takes care of its customers, so it works according to the responsible gambling policy. The themes are also diverse, ensuring there’s something for everyone. The minimum system requirements for the app are: For Android: Android 4. Make sure you’re always up to date with the latest gambling news and sports events – install Mostbet on your mobile device now. Іf уοu hаvе рlасеd а bеt οn а сеrtаіn mаtсh, іt wοuld сеrtаіnlу bе muсh mοrе ехсіtіng tο bе аblе tο wаtсh thе gаmе’ѕ рrοgrеѕѕ ѕο уοu саn ѕее fοr уοurѕеlf іf уοur bеt іѕ gοіng tο gο thrοugh, rаthеr thаn јuѕt аnхіοuѕlу wаіt fοr thе rеѕultѕ whеn іt іѕ fіnаllу рοѕtеd. Υοu саn fіnd thе ΤV Gаmеѕ рοrtfοlіο undеr thе Lіvе Саѕіnο саtеgοrу. Are you ready to get started with the latest iOS system. Regular updates ensure a dynamic and appealing gaming environment, keeping the excitement alive for all players. It gets generally quicker when Mostbet apk is downloaded directly from the Mostbet site compared to the iOS app being downloaded from the App Store. Onların dəstək komandası hər zaman hər hansı bir problem və ya sualla kömək etməyə hazırdır. Familiarizing yourself with the Mostbet app’s features and functions is key to maximizing its benefits. It turns out that the resource can be blocked on the territory of the country at almost any time. Mostbet offers a comprehensive sports betting platform that caters to fans of all types of sports. Here you can visit all sections related to sports betting, and you can also receive bonuses, track your payments, and contact support at any time. Downloading and installing the app won’t cost you a penny. Once you get iOSAPP, you can run any slot machines and Live tables. Additionally, the website has a comprehensive FAQ section that addresses frequently asked questions to provide users with quick solutions to their queries.

R sharad

I could understand the bookies needs to verify their customers, but this is territory where they deliberately set the bar so high to frustrate you up to the point you rather leave them your money. Simply open the site in your gadget’s mobile browser. Follow these simple steps to successfully log in to your account. They include both live ones and those related to promotions. Get the money from bets you are not too sure about. By understanding and actively participating in these promotional activities, users can significantly enhance their Mostbet experience, making the most of every betting opportunity. For this case, you will have to change your location in your apple id settings. Download the Mostbet app for Android for free on the official website of the bookmaker. It’s a test of courage and quick decision making, as the multiplier can crash at any moment. Do not forget to claim your welcoming gift of up to 50,000 PKR. The betting company Mostbet comes with such cyber disciplines you can place bets on. Upholding the highest standards of digital security, betting company Mostbet uses multiple layers of protocols to protect user data. And so, here is a guide for you on how to load and install Mostbet for your mobile device. You’ll want to ensure that the settings allow app downloads or updates from unknown sources. Steps to modify security settings. Use the welcome bonus, enhanced by a promo code, to get a significant boost as you start. Mostbet is a large international gambling brand with offices in 93 countries. In the article, you will learn about registering, what games and bets will be available to you on the site, and much more. Our cricket betting app offers a wide range of options, including cricket betting, live score, statistics, cash out, in play betting, extended markets. During the registration process, you may be asked to supply your real name, date of birth, email, and contact number. The app users can enable push notifications, which will alert about new Mostbet casino bonus offers, promotions, tournaments, and other important events. With exciting themes and huge jackpots, there’s something for everyone.

How to Withdraw Money?

Overall, MostBet has become popular among bettors worldwide with a valid license. However, if you want to bet faster, we recommend the Mostbet app. Payment support operator Venson LTD. That is why players can be sure of its security and reliability. For a successful verification, you need to. So now, as the cash is credited into your account, you can already enjoy playing casino games and placing sports game bets. In addition to single bets, “Accumulator” and “System” type bets are accepted. Open the website in Safari;. Our colleagues will be offering you a new appointment in the coming days. Like, a “16” could denote odds of 16 to 1, indicating a less likely event where a $1 bet could make you win $16. It has the same interface navigation and functionality. This is of great importance, especially when it comes to solving payment issues. Here’s a concise guide. For pakistani customers, the most popular sports in the country are separated – Cricket, Football, Tennis, Kabaddi, Basketball, and others. Nevertheless, the mobile apps give all of them. Here you can switch your activities from sports betting to casino games and vice versa. These are elementary rules even for beginners. Then find a file in the downloads and install the app. Withdrawals are processed quickly, and I’ve never encountered any issues with my transactions. A bunch of young chefs, pioneers in Berlin’s at that point culinarily wild and not very refined East, sparked something in Vadim. After that, the system will automatically redirect you to the main page for downloading additional software. Download the application online and receive numerous winnings from Mostbet.

We advocate against bias

In just a few clicks, you can create an account, fund it and bet for real money. For instance, the site says that Visa and Mastercard payments are accepted – But, we were unable to find the option on the site. With just a few simple steps, you can unlock an exciting world of opportunity. If you no longer want to play games on Mostbet and want to delete your valid profile, we provide you with some tips on how to manage this. Digital technology has made online casinos a simple and interesting way to play a variety of casino games and sports bets. I’ve been using Mostbet for over six months, and it’s been nothing short of amazing. If you want to place bets using your Android smartphone without installing Mostbet apk file on your device, we have an alternative solution for you. In the account options, you can select your favorite sport and team to prioritize the display of events with one of these parameters. To ensure it, you can find lots of reviews of real gamblers about Mostbet.

Contact

Beyond sports betting, Mostbet offers an online casino with live dealer games for an authentic casino experience. Here you will learn useful information about bonuses, payment options, some technical characteristics of the Mostbet app, and the instructions to use them. Efficient navigation, account management, and staying updated on sports events and betting markets enhance the experience. The app is well designed, and it offers a great range of features that make it easy to place bets and monitor your bets. High quality games: Betandreas online casino cooperates with well known game developers such as Microgaming, NetEnt, Playtech, etc. Success in affiliate marketing, while influenced by the program’s features, also hinges on the strategies employed by the affiliate. And don’t forget to pass verification. It is worth learning the rules of the game, studying the features and having fun without financial risks. BetAndreas casinodid not forget regular visitors.

Contact

And so, gamblers can download the Aviator app from the official site right away to play on phones or tablets at any convenient time and anywhere in the world. For this, users must register, pass verification, and fund an account. That’s what Mostbet’s app is all about. Mostbet BD Responsible Gaming DMCA. For a comprehensive guide on account setup and troubleshooting, visit our Help Center. © 2024 Mostbet Sri Lanka. Here is how you do it within the mobile program. Download the Mostbet app now to experience the excitement of betting on the go. Mostbet offers you a live chat, its phone number 8 800 511 14 99, and email. 2 Oct 2024 Champions League. Why do hundreds of players choose this platform for betting or gambling. To install the Mostbet APK app you need. However, it makes sense to save your login and password only on personal gadgets that are not used by strangers. From time to time, the MostBet developer updates the application to improve its performance. A line with odds for each outcome will drop out in front of you. Get the Android download with a simple tap; unlock access to the page’s contents on your favourite device. When installing on your computer, follow the step by step instructions. Τhе Μοѕtbеt ѕіgnuр рrοсеѕѕ сοuldn’t bе ѕіmрlеr. Those signing up with our code will receive the following bonuses. The Mostbet APK app for Android offers a full featured betting experience, smoothly running on all Android devices regardless of model or version. If you have a tablet device such as an iPad or Android tablet, you can use Mostbet from it using the app or the mobile version of the website.

Follow us on social media – Daily posts, no deposit bonuses, new slots, and more