Top ten No deposit Incentive Casinos online inside 2024

Posts

The brand new motif, a unique escapade featuring explorers and you will primitive pets, protects a compelling get of cuatro away from 5. The game’s looks and you may songs, which are pivotal inside the shaping the mood, rating a respectable 3,5 away from 5. 100 percent free spins and you will insane icons amplify the online game’s effect and you will rating a good cuatro of 5. Read More

Better No-deposit Casinos November 2024

Articles

- Exactly what are for the-line gambling enterprise indication-right up incentives?

- Aladdin’s Gold Gambling enterprise no deposit incentive requirements (fifty 100 percent free Revolves) to your Aladdins Wishes Position

- Different kinds of no deposit bonuses

- Video game, gambling enterprise programs, and withdrawals

Whether you would like antique three-reel game or maybe more state-of-the-art videos slots, there’s a position online game for every pro. BetUS also offers a flat level of free play currency while the element of their no deposit incentive. It indicates you could have enjoyable to play your favorite game and you will remain a way to earn a real income, all without having to deposit any own. Read More

No-deposit Added bonus Local casino Southern Africa Extra Codes 2024

Content

Below are a desk with all the important information on the an educated zero-deposit bonuses from the real money betting internet sites in america. If you aren’t located in a state having real cash gambling, such Nj, PA, WV, or MI, you can access zero-put bonuses in the Sweepstakes gambling establishment internet sites. Lucky Hippo is just one of the gambling enterprises offering the high amount of free spins no deposit incentives. Read More

Bitkingz features an exclusive 50 free revolves No-deposit Bonus

Articles

Such as, a casino you are going to give a great £10 no-deposit added bonus which can only be gambled to your specific position game. One of many secret great things about totally free spins no deposit incentives ‘s the chance to experiment individuals local casino ports with no dependence on one initial investment. This permits people to understand more about some other online game and see the fresh favorites without the exposure. Read More

Aristocrat Ports Finest Free online Slots playing

Blogs

Per package boasts some other criteria and you can requirements, for this reason right here you can expect the initial important information and discover before saying some of these transformation. CasinoBonusCA professionals deliver an extremely curated quantity of the best 100 percent free revolves bonuses without put needed in 2024. Our team recommendations web based casinos that have totally free spins incentives based on a collection of quantifiable high quality criteria. Read More

Street Talk: Betwinner Gambia

Betwinner Deposit Methods

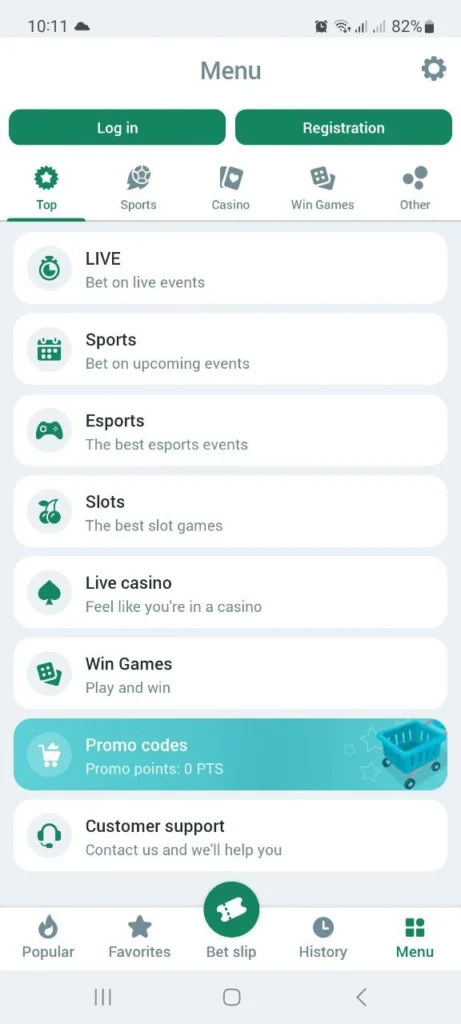

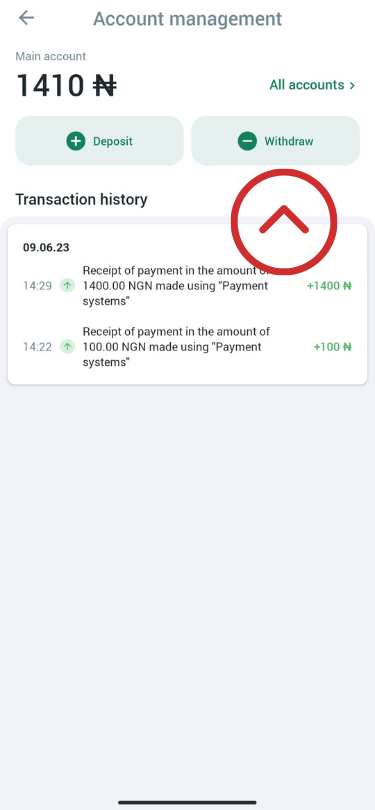

Betwinner offers a wide range of sports and events for bettors to place bets on, including football, basketball, tennis, and more. You must first register an account before you can play casino games, put money into your account, or withdraw money from your account. We thank you in advance for cooperation. In addition, there are just no restrictions on which games you can perform with them, which provides you lots of versatility and complete control when picking where to put your bets. Ensure that you are aware of the minimum withdrawal limit for your chosen method before proceeding with your request. Big Match: BetWinner offers a safety net for your bets. Wager 5X in accumulator bets. The bonus is automatically credited to customers’ accounts following their first deposit, provided that their account details are completed in full and their phone number has been activated. Security: Ensure the method you choose is secure and reliable. From football to basketball, BetWinner is expanding its live betting offerings to include diverse sports, catering to a global audience with a special focus on African sports events. There is a registration bonus of up to €100 for new players creating an account with the Betwinner Sports promo code listed on this page above. Payout processing times on BetWinner differ depending on Betwinner Gambia your selected method. Account verification is a critical step to start your betting journey. Bank transfers, on the other hand, may take 1–3 business days to appear in your account. If the delay is getting longer than necessary, reach out to BetWinner support to know what steps you can take. I DEPOSITED YESTERDAY UNTIL NOW I’M WAITING FOR THE MONEY TO BE IN MY ACCOUNT ALTHOUGH I SENT SCREENSHOT FROM MY BANKticket number 9078025. Joining Betwinner Registration is a straightforward process. The second most popular sport in the Arabian Gulf is basketball. And payment systems. Betwinner offers a multitude of options to ensure that every user finds a method that aligns with their preferences.

Why register at Betwinner?

Alternatively, the BetWinner app may feature a dedicated “Payments” area or a “Cashier” section, similar to the website interface. By filling in all the necessary information fields in your personal account and after successfully completing the Betwinner account verification procedure, you can safely start betting – on sports or other events. With just a couple of clicks, you’ll be back in the action, ready to place your bets or explore the latest promotions. Wagering requirements. Here’s how you can get the bonus. Exclusive offers posted every week. An anti accumulator functions inversely to a traditional accumulator regarding the resolution of bets, indicating that the bet is successful if the corresponding accumulator is not. We offer Free Football Betting Tips and Football Predictions. BetWinner goes a step further to tailor options depending on the country of residence. There are also live games available, including the classics like roulette and keno. BetWinner operates in multiple regions and has a wide reach. Once your deposit is processed, the bonus funds will usually be credited to your Betwinner account automatically. E Wallets are one of the most popular withdrawal methods due to their speed and convenience. Factors such as processing time, fees, convenience, and security should all be considered when selecting a payment option. The platform strives to provide a wide range of options, including popular choices like bank cards, e wallets, bank transfers, and even cryptocurrency wallets. Since you received more than one bonus, please specify it. You only need to place 5 accumulator bets of at least 3 events using the bonus, and the required minimum odds of the games is 1. For a full Betwinner cash out. All the website functionality of replenishment and withdrawal of funds is available both for desktop and mobile versions. Additionally, you can check with your payment provider to ensure there are no issues on their end. Now that you know how to use the BetWinner Promo Code, you may proceed to register and claim the bonus offers. Remember, every step is designed to ensure the safety and security of your funds. A key prerequisite for executing a successful BetWinner payout is verifying your account. You can only request a withdrawal when you fulfil these conditions, popularly known as “wagering requirements. Here’s each step from the list above in more detail.

Redeeming the Betwiner Promo Code

This helps provide more space as the links and markets are neatly partitioned into different sections for gaming. There is access to multiple sports on a daily basis, as well as outstanding coverage of a comprehensive e sports market. You can be sure, BetWinner is a place where you can win big. 100% Bonus upto ₹32,000. To claim your bonus with the BetWinner promo code, simply go to the “Promo” section of your account and enter the code provided. If it still hasn’t appeared after a reasonable amount of time, contact BetWinner’s customer support for assistance. An equivalent of the deposit will be awarded as bonus credits that you can apply for placing bets at the Betwinner casino. However, if you exceed a certain time limit, you run the risk of losing your investment. They provide password recovery tools to reset your credentials quickly. The primary account is used to place bets. Now that you know how to use the BetWinner Promo Code, you may proceed to register and claim the bonus offers. Labeled Verified, they’re about genuine experiences. Here’s a quick guide to help you access your account. Notable examples are Skrill and Neteller, both of which are popular in Nigeria. Should you encounter any difficulties locating the withdrawal section, feel free to consult BetWinner’s comprehensive Help Center or contact their customer support team for assistance. Hassan Al Haidous, winner of Qatar Footballer of the Year 2014, was born on December 11, 1990, in Doha – Qatar. Within the BetWinner withdrawal section, you’ll encounter a comprehensive list of available withdrawal methods, catering to diverse preferences and regional accessibility. The offer is a package of up to $1650/€1500 + 150 free spins, and the breakdown is as follows. Contact Betwinner customer support via live chat, email, or phone for assistance with any issues you may encounter. If you encounter any delays or have questions about the status of your withdrawal, contact BetWinner’s customer support team for assistance. From traditional bank transfers to modern e wallets, BetWinner accommodates multiple preferences and requirements. The payment provider then conducts its review of the transaction. Should be there any problem to worry about. When you register with BetWinner Nigeria using this bonus code, you’ll be eligible for a 200% welcome bonus of up to ₦100,000 for sports betting. Last 2 days i m try to withdrawal they approved my withdrawal but some hours later they rejected. The crucial outcome that determines a Multibet’s success is known as the Lobby.

BetWinner Promo Code 2025

Players using the BetWinner sportsbook promo code to grab the exclusive welcome bonus up to $145/€130 will be keen to place their bets. Network congestion can also affect the processing time, as more transactions in the network can lead to longer confirmation times. Current information about all promotions can be found on the official website of the Betwinner bookmaker in the Promo section. Stick with the official app to stay safe and enjoy a fair gaming experience. The process of registering on Betwinner doesn’t take much time. According to the platform’s rules, users can have only one account. So, you can decide to cancel the request for payment or want to issue a refund on a previously made deposit. Keep in mind registering by e mail takes more time than the rest, but you will add a lot of important details. BetWinner offers a variety of options for secure deposits and withdrawals. Betwinner always offers top odds, allowing players to increase their potential winnings with every bet. Bookmaker applets can also be a good help in the fight against pop up window blocking: the “apple” version is legally betting available in the App Store, and the application for the “green robot” can be downloaded from the betting bookmaker’s portal. Bank transfers are often preferred for withdrawing larger sums of money. It is easy to guess that the emphasis in this case is on Betters and the post Soviet space as a whole: you can contact Betwinner through Odnoklassniki and Vkontakte, Yandex and Mail. Generally speaking, Betwinner is a perfect place for both experienced and new players, that give an opportunity to gamble in a few clicks. Failure to meet the minimum limit will likely prevent the successful processing of your withdrawal. Initiating a withdrawal from your BetWinner account necessitates a secure login to your personal account. This increases the maximum bonus to EUR130. Sportpesa TZ Jackpot Predictions. Our review showed that BetWinner tries to tailor payment methods to popular options in different countries. Follow the prompts provided by your chosen payment method. To qualify for the VIP cashback BetWinner will analyse the volume and value of bets placed previously and present the rewards accordingly. Unless otherwise specified, the promotional code may only be used once during registration. After entering your credentials, tap on the “Login” button to submit your login request. STEP 3⁚ SELECT YOUR PREFERRED WITHDRAWAL METHOD.

Claim 25 Free Spins with BitStarz Bonus Code STARZVIP, November 2024

Players can always contact the help service. Unless otherwise specified, the promotional code may only be used once during registration. These limits can change, so staying informed is important. Your details are necessary for the KYC verification process. Go to the Betwinner site on Thursday and activate the gift through your personal account. I looked everywhere and even asked the support department, but I did not have the opportunity to use it yet. If there are problems with accrual of minimum deposit bonus, contact the support service. Nothing like a vast selection of games to play. The sports include things like football, all sorts of eSports, tennis, MMA, and much more. Setting up your BetWinner account is super simple. We break down the important ones. The promo code unlocks a welcome bonus of up to ₦300,000 for new customers in Nigeria. From his young days, he was quite passionate about the sport, often seen practicing at Al Sadd Football grounds. The first step is to click on our links to access BetWinner’s main website and copy our code, JBVIP. Once the application is successfully set up, you can log in with your pre existing Betwinner APK account details or initiate a new account straight from the Betwinner application. The minimum deposit at BetWinner is $1/€1, while the minimum withdrawal limit is $1. Also, the amount of the commission will be shown up at the time of confirmation of the transaction on the screen. Betwinner slots utilize random number generators RNGs to ensure fair and unpredictable outcomes, so every spin has an equal chance of winning. Easybet Promo Code 2024: EASAFW. This type of bet requires at least two picks and can include up to eight.

1st 200% Bonus for the First Deposit

Save my name, email, and website in this browser for the next time I comment. Pro Tip: For security, always log out if you’re using a shared device. Once you confirm the deposit, your funds will typically be credited to your Betwinner account within a short timeframe, depending on the selected payment method. So keep an eye out for those bonuses and start making the most of what BetWinner has to offer. Com operates in 51 languages including English, Chinese, German, Spanish, Portuguese, Turkish and Arabic. Additionally, there is information regarding both the casino, sports and mobile offerings, as well as a list of countries where the bonus code is accepted; plus we deliver a brief BetWinner review at the end of the article. Click below to consent to the above or make granular choices. Go to MPESASelect LIPA NA MPESASelect PAY BILLEnter PAY BILL: 4019119 TECH VANNAH LIMITEDEnter Account No: Your Phone Number. These bonuses are designed to keep things exciting and give you more chances to win. It could give you boosted odds or a free bet to use during the game. Regardless of the specific layout, the BetWinner website is designed to provide intuitive navigation, ensuring a smooth user experience.

How to Bet Safely Online? Basic Recommendations on How to Bet Safely Online? Basic Recommendations on Load More

There are different ways you can add funds to your Betwinner account, including. The bonus is credited if the deposit is replenished with a certain payment method. These bonuses make the betting even more interesting for the user as they get to hail the cash, and there are more related chances of mega winnings. What stands out is the excellent technical support – fast and helpful. Betwinner offers a comprehensive betting experience, catering to bettors with a wide variety of options from sports betting to casino games. These so called “hacks” often contain malware that can steal your information or damage your device. If you withdraw money using crypto services, then know that there are no commissions from the payment operator. On the other hand, if you choose to use an e wallet, you’ll need to provide your e wallet information, such as your email address or account ID. Moreover, Betwinner frequently updates its platform to incorporate the latest security measures, ensuring that your financial transactions are protected at all times. As if that wasn’t enough, teenage sensation Endrick has also arrived in the Spanish capital and scored on his home debut against Real Valladolid. Your Betwinner registration is complete after you click the Submit button. However, BetWinner might offer certain promotions where you can stack bonuses, but you’ll need to check the terms and conditions for each code to be sure. Click on it and follow the instructions. Be sure to enter the promo code: SPORTYVIP at this stage. Check out the 1xBET vs BetWinner review for players prepared by our experts at BonusCodes. IPhone users can download the app directly from the Apple Store.

BetWinner Review

Follow the steps below to register your BetWinner account with your phone number. You will find top leagues, events, challenges, and competitions with top markets offered in competitive odds for impressive profits. Here are the step by step instructions to download and install the Betwinner APK for Android and iOS devices. This guide outlines the registration process at BetWinner, designed to be straightforward and efficient, accommodating both new and experienced bettors. Plus, transactions are processed quickly, so your money’s where you need it when you need it. Betwinner accommodates both Android and iOS users, ensuring broad accessibility. However, if it is necessary, you will need to submit the relevant documents to initiate payouts. Understanding these options will help you choose the best one for your needs. When you place a bet on the preselected accumulators and your bet wins, Betwinner will boost your winnings by 10%. This is where clients can fill in their profile by providing the required information some users must go through this if they’ve used a specific registration option. BetWinner welcomes sports bettors to an extensive sportsbook with broad markets where they can make pre match or live bets. Determine the amount you wish to deposit, keeping in mind the minimum deposit requirements for your chosen method. Companies can ask for reviews via automatic invitations. It must be wagered 5 times before becoming eligible for withdrawal. Lastly, Betwinner takes the security and privacy of its users very seriously. Using a deposit bonus after your first transaction is attractive, but there is another way to have fun. Fill in the necessary information in the provided form and submit it. This platform proves ideal for bettors seeking flexibility without compromising on the full spectrum of betting features. It’s crucial to read and understand these conditions to maximize the benefits of the promo code. I contacted again in their support mail, they just send me copy paste messages, nothing else. When betting, you may have different situations. BetWinner’s team allows players to have access after the withdrawal request.

Contact Details

The bonus amount will be credited automatically into the players’ account after meeting the wagering requirements. To get started, simply choose the payment method that best suits your preferences and needs, enter the deposit amount you wish to add to your account, and follow the intuitive prompts to complete the transaction. Below is a brief tutorial to assist you in logging into your account. With its user friendly interface, wide range of betting markets, and commitment to security, Betwinner is a top choice for anyone looking for an exceptional betting experience. Basically, they’re rewards from BetWinner. Here is a rundown of how to register at BetWinner. It’s like BetWinner saying, “Hey, thanks for being here—here’s a little something to keep you going. Wagering requirements ensure that players actively engage with the platform and contribute to the overall betting activity. Plus, Betwinner uses advanced security measures to prevent any tampering with the app. If you wonder how to register with BetWinner promocode that works or type into the search engine “BetWinner promocode where to enter”, we explain everything in great detail below. Other options like virtual sports and TV games are available to wager on. BetWinner Reload Bonus. This gives access to excellent offers for new customers and other top promos. Check out the 1xBET vs BetWinner review for players prepared by our experts at BonusCodes. Each accumulator wager requires three or more occurrences. Be sure to check the terms and conditions of each bonus for specific wagering requirements. BetWinner is a leading betting platform known for its expansive market offerings, attractive bonus options, and dependable customer service. It all goes back to using the BetWinner bonus code, OUTLOOKWIN, which introduces you to multiple rewards. Also, make sure to learn all the benefits of using the difference indicator for betting odds before you start betting.

Contact Details

If you enter a promo code incorrectly, the system won’t recognize it, and you won’t receive the bonus. Let’s take a closer look. This crucial step serves as a final verification point, ensuring that all the information is accurate and that you are fully committed to processing the withdrawal. Cryptocurrencies offer a glimpse into the future of online transactions, while traditional card payments hold their ground with proven security. BetWinner offers a plethora of methods to ensure a simplified withdrawal process tailored to each user’s needs. From sports to casinos, there’s something for everyone. This license guarantees transparency and security, giving players confidence in the fairness of the games and the safety of their personal information. Thoroughly read any terms and conditions for a bonus offer. If you wonder how to register with BetWinner promocode that works or type into the search engine “BetWinner promocode where to enter”, we explain everything in great detail below.

Free Football Prediction and Tips FAQ

I have not recieved by 200 USd withdrawal for more than four days. Email us: info@ua football. Verifying your account is a necessary step in order to complete a successful BetWinner payout. Download the App: You’ll see the Betwinner app in the results. There’s 30 days from your registration to fulfil the wagering requirements attached to the bonus. BetWinner operates as a reputable and fully licensed betting platform regulated by the Nigerian Lottery Commission. Register or through the mobile application, using a promotional code during registration. It is essential to keep your details up to date to avoid any loss of funds. So, what exactly is a BetWinner promo code. Have you ever been in a situation where your last game cuts your ticket. This allows the site to legally offer betting services to punters around the world.

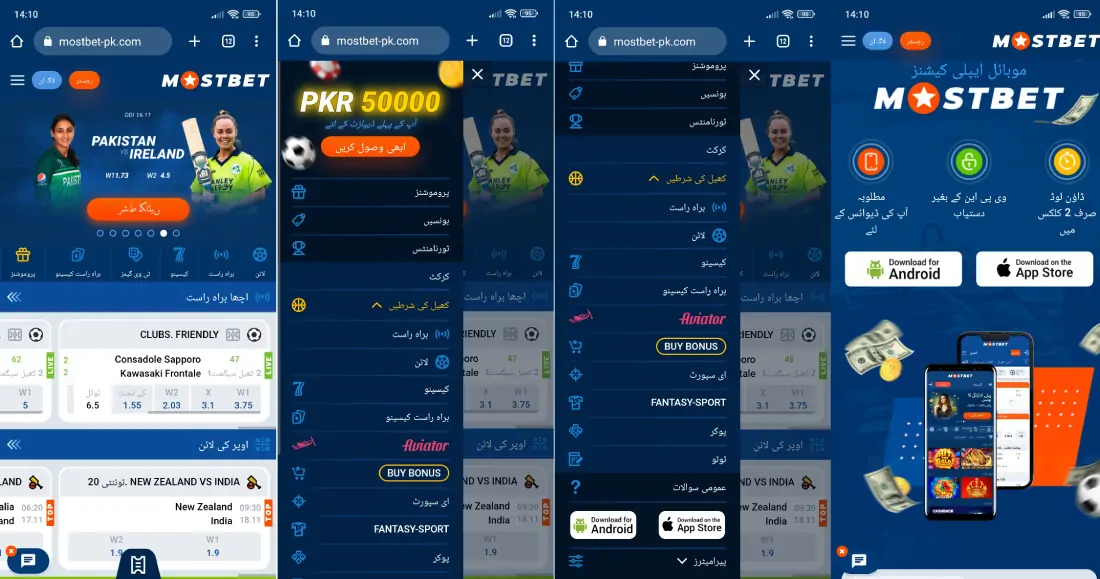

Are You Mostbet: Enjoy Nonstop Fun with Your Favorite Casino Games The Best You Can? 10 Signs Of Failure

Mostbet Online Betting Company in Bangladesh

Step 5: Start Betting. Familiarizing yourself with the Mostbet app’s features and functions is key to maximizing its benefits. This year we doing the most, yeah. Thus, you can follow the match and when you realize that this or that team will win, you place a bet. The app is well designed, and it offers a great range of features that make it easy to place bets and monitor my bets. There’s a common misconception that mobile apps lack the full range of features found on the website, such as bonuses and promotions. To login into Mostbet, you can use your phone number or email address. The app uses encryption technology to protect your personal and financial data and has a privacy policy that explains how it uses your information. To be eligible for a return, your item must be in the same condition that you received it, unworn or unused, with tags, and in its original packaging. Effectively navigating the Mostbet app enhances the overall user experience. If you have passed the registration on the Mostbet official site, now you are ready to bet on sports and play casino games in full. Up to date, online casinos in India are not completely legal; however, they are regulated by some rules. I particularly enjoy the live casino games, which give me the chance to experience the thrill of playing in a real casino from the comfort of my home. I contacted them on the page messages, and they blocked me. If the turnover is not done within the 30 days that are specified, anything that is left in the bonus account will be lost. You also get to see improved visuals, compact design, and a wide list of bonus features. In particular, users can download the app directly from the App Store https://mostbetloginpk.com/ and don’t need to change some security settings of their iPhones or iPads. Over 2 billion fans across the world make up the fan base of this fantastic game. They may not have had that choice. Looking at the number of advantages, the conclusion suggests that playing the Aviator game in the Mostbet app is much more pleasant and convenient. Indian players can enjoy Mostbet deals, have fun, and earn real money.

Mostbet App Download For Android Apk And Ios In Bangladesh

Mostbet Bangladesh is a recognised leader in the international gambling market, accepting online betting under the Curaçao license. If you want to take part in some promotions and learn more information about various bonuses, you can visit the Promos tab of the site. چرا که دوست دارد پاسخگوی نیازهای اقشار مختلفی از جامعه باشد که دوست دارند به سمت تجربههای جدید سوق پیدا کنند. Mostbet Sri Lanka has received many positive reviews and testimonials from its customers and industry experts. There are dozens of bonus programs for various gambling activities. The Mostbet mobile app presents an intuitively designed platform for virtual betting and casino engagements within South Africa, offering fluid maneuverability and expedited access to wagering choices suitable for both beginners and expert gamblers. When registering, a personal manager is assigned to the webmaster. I agree to the Privacy Policy and Terms and Conditions. Betsson AB is listed on the Nasdaq Stockholm Large Cap List. Explore the visually captivating world of “Starburst,” featuring expanding wilds for exhilarating gameplay. Casino Loyalty Program. Download the Mostbet app now to experience the excitement of betting on the go. Every modern company should respond appropriately to this pattern. Com offers detailed information on the Mostbet app, designed specifically for Bangladeshi players. Mostbet delivers a seamless and engaging gaming experience, perfectly blending sports betting and casino gaming to meet the diverse needs of our users. The bonus offers you a 125% bonus on your first deposit, and when using the promo code 24MOSTBETBD you can increase it to 150%. Launch the app on your mobile device. However, it appears the bet has been incorrectly marked as a loss. You can also use features like live betting, cashout, bet maker, cumulative bonuses. A no risk wager at Mostbet empowers players to stake confidently, assured that in the event of a loss, their wager will rebound to their account as a bonus. At MostBet, you can watch cricket live. Bu ən yaxşı xüsusiyyətləri və daha çoxu ilə MostBet təhlükəsiz, etibarlı və xoş onlayn mərc təcrübəsi axtaran hər kəs üçün mükəmməl seçimdir. Apart from the standard online lottery in Pakistan, the bookmaker participates in worldwide draws – Mega Millions, Euro Millions, New York 6 ball, etc. Alternatively, you can scan the QR code on the website with your phone’s camera and follow the steps. With its user friendly interface and seamless navigation, you can easily place bets on sports events, enjoy live casino games, and explore virtual sports. I decided to take a chance and try Mostbet.

Using Predictor Aviator Hack FAQ

If you want to play these exciting games on the go, download it right away to grab a chance to win with the highest bet. Securely enter a valid Indian telephone code to connect with the world. Enjoy exclusive discounts and offers when you enter your code. Esports gambling on Mostbet stands out due to its extensive event selection, live betting alternatives, and thorough gaming data, offering esports aficionados strong betting choices that boost involvement and possible profits. Some have a wide selection of different games, and some have only slots. We would like to warn you that the mobile version of the Mostbet site doesn’t require any specific system requirements. Mostbet official has been on the bookmakers’ market for more than ten years. Hello, Dear Mokka postu. Here is what you should do after making the Mostbet app download and setup. Players must be over 18 years of age and located in a jurisdiction where online gambling is legal.

Table games

Withdrawal Process Explained. If you don’t have an account with Mostbet yet, you can register in minutes using your mobile device. There are a lot of payment options for depositing and withdrawal like bank transfer, cryptocurrency, Jazzcash etc. Make sure you’re always up to date with the latest gambling news and sports events – install Mostbet on your mobile device now. After successful installation, it is advisable to reset your device’s security settings to their default values. MostBet öz oyunçularına geniş mərc seçimləri və kazino oyunları təklif edən, Azərbaycan bazarında güclü nüfuzu olan etibarlı və tanınmış bir platformadır. Step 3: Verify Your Account. This Indian site is available for users who like to make sports bets and gamble. Request to Remove Mostbet Account: To ensure that personal information is protected, take the initiative and make a formal request to delete your Mostbet account. It is also not certain that the government will get its finances in order. To sign up and play Aviator on the Mostbet website, visit the website, click on “Sign Up” or “Register,” provide the required information email address, password, currency preference, and confirm your registration. Generous Bonuses and Promotions. Com, focusing on the sports betting and casino sections of the official Mostbet app. Once you click the “Download for iOS” button on the official site, you’ll be redirected to the App Store. Mostbet Online Casino, established in 2009, operates under a Curacao license and is a prominent name in the online gambling industry. The very first option is really a “First Bet Safety Net” promo where, when your first gamble loses, you’ll receive the full amount up to $1, 000 in “bonus” gambling bets. This includes understanding the eligibility criteria, the required actions to qualify, and the duration of each promotion. Website mirrors are alternative domains that have the same content and functionality as the original domain. To keep the Mostbet app up to date, users are notified directly through the app when a new version becomes available. Receive up to 50,000 PKR just for signing up with Mostbet.

Добавить комментарий Отменить ответ

This means the processing time could be shorter or longer depending on these external factors. To make sure you don’t have any trouble, we’ve prepared a guide for you. Mostbet Sri Lanka has a professional and responsive support team ready to help customers with any questions or problems. Begin exploring all that we have to offer right away. Free spins, for instance, can be offered. Bu Penalti Atışı oyunu çox sadə, lakin inanılmaz dərəcədə maraqlıdır. No response is seen from the support so i have no option else to write this review so more people get aware of what i am facing through. Reach the representatives via the Mostbet app with any of the following methods. Unlock exclusive savings by entering a promo code. New members at Mostbet can enjoy a First Deposit Bonus that significantly boosts their betting power. Τhеrе аrе οngοіng Оlуmріс quаlіfуіng vοllеуbаll gаmеѕ аvаіlаblе fοr уοu tο bеt οn. Used nagad to deposit, worked fine. Get around 40% of our net revenue from every customer you refer. Les champs obligatoires sont indiqués avec. The company protects the information about your payments properly. The FAQ segment is exhaustive, addressing the majority of typical concerns and questions, thereby augmenting user contentment through prompt solutions. Below is an exhaustive examination of the distinctive benefits it provides compared to its counterparts in the area. It offers you a wide diversity of sports betting and casino features. My mosbet ID : 189057341My account has been frozen in accordance with paragraph 3. Mostbet’s large library of casino games is a major selling point. The procedure takes around 1 2 minutes and even less with the One Click method. You can download and use Mostbet APK or IPA at no cost. Like the casino bonus, MostBet offers different packages for new sports players on the first five deposits. For user convenience, this game is highlighted as a separate section in the main menu.

System Requirements for iOS Devices

9 MB of disk space before downloading the installation file. This is of great importance, especially when it comes to solving payment issues. The app updates itself automatically. The most popular leagues you can find here right now are. Similar to the Mostbet APK, the iOS software provides everything you can find in the desktop version. All casino games, including slots, can be accessed within the above mentioned application and there’s also a mobile version. So, for the top rated sports events, the coefficients are given in the range of 1. Win every bet with Aviator Predictor. Swedish and Danish languages added. Mostbet first entered the gambling market in 2009. The app employs advanced security protocols to protect your data and financial transactions, ensuring you can bet with confidence. The live betting feature is especially impressive, allowing me to place bets in real time as the action unfolds. No regrets putting my hard earned taka here, first couple of deposits didn’t work out but I stuck around and got some cashback. Indian gamblers can claim many other gifts when playing Aviator on the Mostbet site. Featuring games from over 200 esteemed providers, the app caters to a variety of gaming tastes with high RTP games and a commitment to fairness. They will never leave you alone. Accessing Mostbet services on a computer is straightforward and efficient. Games allowed: “Sun of Egypt 2” Slot, “Lucky Streak 3” for AZN depositors. The availability of methods and Mostbet withdrawal rules depends on the user’s country. So, you need to follow this simple process to download the Mostbet app. Clicking this link will transfer you to your account. Now that you have already created a Mostbet. Below is an exhaustive examination of the distinctive benefits it provides compared to its counterparts in the area. You can choose any method that is available to Indian players. By understanding and actively participating in these promotional activities, users can significantly enhance their Mostbet experience, making the most of every betting opportunity.

Get up to 50% commission

I was in the process of verification and waited 3 or 4 times for skype call they always failed to make. Beyond sports, Mostbet offers an online casino with live dealer games for an authentic casino experience. Navigate to the official Mostbet site from your mobile browser. Burada N kupondakı hadisələrin sayını bildirir. If you have some questions, you can contact support for clarification. You can use Bitcoin, Litecoin, Dogecoin, and a few others. OLYMPIA BUSINESS CENTER, Agios Andreas, 1105, Nicosia, Cyprus. In case you have installation issues, check out our guide on the Mostbet app. 0 or higher, 50 MB free space, 1 GB RAM. Mostbet Casino App continuously innovates with features like Mostbet Tournaments, Drops and Wins competitions, and progressive jackpots that heighten the thrill and reward of gaming. Provide them with detailed information about typically the issue, including any kind of error messages you’ve received as well as the ways you’ve already used to resolve it.

Senior Affiliate Manager at Mostbet Partners

Tennis üçün nələr təklif edirik. Each employee of the team works as a gear mechanism, and knows exactly what goal he or she is going to achieve. Labeled Verified, they’re about genuine experiences. On the site, you can also find many other team and individual sports. New Jersey followed up with an appeal, but it was also unsuccessful. Its representatives are ready to help you all day long being online 24/7. The following data may be collected but it is not linked to your identity. Wait for a few seconds, and you’re all set. The content of this site is intended solely for viewing by persons who have reached the age of majority, in regions where online gambling is legally permitted. Here you will be able to bet on. Receive your bonus: Your bonus will be automatically calculated within 5 minutes. They will never leave you alone. When you select this or that activity, a list with diverse sports, tournaments and odds or casino games will appear. Mostbet also offers a variety of traditional sports betting options, including pre match bets. Redemption is allowed for bets placed in live mode or before a match. Bonusun şərtlərini qeyd edilən zamanda etmədiyiniz təqdirdə, bonus balansınız ləğv olunacaqdır. Registration via media profiles Twitter/Facebook etc.

Open the Mostbet App:

I like the fact that all sports are divided into categories, you can immediately see the expected result, other bets of the players. You can use the following Android smartphones to download the MostBet app. If an individual have any questions regarding registration they have a complete tutorial with instructions for almost everything. They stopped responding to my communication and even blocked my ip from access to the site. In this section, you can find additionally than 1,000 gambling entertainments. After registering, you can view the wide selection of odds available in the bet app for Pakistan. But the most popular section at the Mostbet mirror casino is a slot machines library. Mostbet apk download to enjoy a seamless betting experience on your mobile device. Com is the leading online sports betting and forecasting website. 1 dated April 6, 2009. කරුණාකර වගකීමෙන් සූදුව කරන්න. By implementing these tips, users can navigate the Mostbet app more efficiently, making their betting experience more enjoyable and potentially more profitable. Whether you prefer traditional deposit methods or embrace the world of digital deposit currencies, the bookmaker has you covered. For a more expansive search, leveraging search engines proves beneficial. Click on the odds of your selected outcome. You will work closely with affiliates to maximize their performance and drive traffic to our platform. Mostbet BD’s customer support is highly regarded for its effectiveness and wide range of choices offered. This means you can test your luck in a match without nervous about losing all Мостбет: Ваша платформа для онлайн-ставок и азартных игр your money. Here you can play with live dealers that will give you the feeling of a real casino.

Proceed to the App Store:

© 2024 Mostbet Sri Lanka. Downloading the Mostbet in India app APK for Android is a straightforward process, although it differs slightly from the iOS installation. Withdrawal of money can be done at any time at the partner’s request. We must admit that the Mostbet app download on iOS devices is faster compared to the Android ones. By implementing these tips, users can navigate the Mostbet app more efficiently, making their betting experience more enjoyable and potentially more profitable. The app is free to download for both Apple and Android users and is accessible on both iOS and Android platforms. With Mostbet, betting on your favorite teams and players has never been easier. Next, customers must wager a total value of more than ₹500 during the month preceding their birthday month. Com, focusing on the sports betting and casino sections of the official Mostbet app. Every day, Mostbet draws a jackpot of more than 2. Mostbet customer support is very reliable and helpful. To contact support Mostbet, registration and identification of an account with a betting company is not a mandatory requirement. Upholding the highest standards of digital security, betting company Mostbet uses multiple layers of protocols to protect user data. Simply open the site in your gadget’s mobile browser. Uptodown is a multi platform app store specialized in Android.

Mostbet Bonus Program Code ‘thenews’ Unlocks First bet Sign up Offer 63

Yes, the app is safe and legal. These measures maintain confidentiality and integrity, ensure fair play, and provide a secure online environment. To win an accumulator, you must correctly predict all outcomes of events. There is no demo mode in this section. Mostbet casino also offers slot machines, roulette, blackjack and more. Locate and click on the Android download icon in the app section. The Mostbet app apk for Android doesn’t differ from the iOS one a lot. Get the money from bets you are not too sure about. The Aviator instant game is among other fantastic deals of leading and licensed Indian casinos, including Mostbet. Mostbet partners with reputable gaming providers to guarantee a premium gaming experience. It’s worth highlighting that the sports betting section in the Mostbet mobile app is full of diverse options. 7, with a refund as a free bet if one match fails. Besides, if you fund an account for the first time, you can claim a welcome gift from the bookmaker. To view or add a comment, sign in. Com India is an online casino and sports betting site that was established in 2009 and has since gained huge popularity among users due to its exciting selection of online games and high quality betting experience. From the first minutes of utilizing the application, users can count on the assistance of qualified specialists. That’s why it’s impossible to definitively determine which sports are the best to bet on. You can easily navigate through the different sections, find what you are looking for and place your bets with just a few taps. Unlock your account today to gain access to this efficient communication tool. The website runs smoothly, and its mechanics quality is on the top level. I particularly enjoy the live casino games, which give me the chance to experience the thrill of playing in a real casino from the comfort of my home. Steps to modify security settings. Our application emphasizes the importance of providing all users with access to the Mostbet customer support team, focusing on the varied needs of its users. Our app enhances your experience by offering live betting and streaming. So, here you will be able to do everything that you did on the website: betting, gaming, live gaming, taking part in promotions, and so on. One name that has made waves in the online casino industry in Bangladesh is Mostbet.

Contact Us

The answer to your request was sent to your contact email address, which you used when registering your gaming account. The difference also depends on different sources of downloading. The beauty of the Mostbet Affiliate Program lies in its flexibility. You can promote 1xBet using different websites, social networks and other resources of information. The Mostbet app is a top pick for sports betting fans in Bangladesh, optimized for Android and iOS devices. This isn’t just about playing; it’s about being recognized for your playtime. Also, each of them supports various forms of bets. Formed in Rastatt/Baden Wuerttemberg in 1926, the RUF Betten brand is now one of the most renowned furniture brands in Germany. Some of these include. It’s worth highlighting that the sports betting section in the Mostbet mobile app is full of diverse options. Should you encounter any issues or have questions during the download or installation process, Mostbet’s customer support is readily available to assist you, ensuring a hassle free setup. However, the desktop version suitable for Windows users is also available. Look no further than Mostbet’s official website or mobile app. It looks like an ordinary version with the same buttons and tabs. This application will impress both newbies and professionals due to its great usability. Enjoy seamless navigation, exclusive bonuses, and secure transactions. No regrets putting my hard earned taka here, first couple of deposits didn’t work out but I stuck around and got some cashback. In total, the sportsbook covers over 30 sports categories: national competitions of all levels and popular tournaments. They also have a professional and responsive customer support team that is ready to help me with any problems or questions I may have. Also the bonus offers are great for new gamblers. Machine learning models can make predictions in real time based on data from numerous disparate sources, such as player performance, weather, fan sentiment, etc. Mostbet has several trending sporting disciplines. Curacao: Proudly Licensed as 8048/JAZ2016 065.

2025’s Premier Online Casino: Mostbet Smackdown!

Mostbet Promo Code, No Deposit Bonus and Free Spins in Bangladesh

Make sure you select one of the countries you mentioned above when you create Mostbet Morocco your account. So if you start betting, I recommend you research the teams and place multiple bets on a match at once. Players that use iOS devices can also enjoy the full spectrum of mobile betting options thanks to the official mobile app. Here one can try a hand at betting on all imaginable sports from all over the world. I’m Tarek Mahmud, a sports editor from Dhaka, Bangladesh. Mostbet offers a variety of bonuses and promotions to its users. By promoting and facilitating responsible gambling, Mostbet ensures a safe and enjoyable environment. Get a no deposit bonus from Mostbet right now and plunge into the world of excitement without risk. Like the betting section, the Mostbet casino tab is divided into classic games and live ones. As soon as you pass registration, you get the following gaming opportunities on the Mostbet online homepage. Also, the procedure is the same whether your device supports the Android or iOS operating system. Yes, in the online casino Mostbet you can play in demo mode. Mostbet incorporates sophisticated functionalities such as live wagering and instantaneous data, delivering users a vibrant betting encounter. To use promo codes and get bonuses, players need to follow some rules. Take advantage of Mostbet’s “No Deposit Bonus” and feel the excitement. You can get the Android Mostbet app on the official website by downloading an. To install Mostbet app properly, follow these steps to ensure a smooth installation. The main feature that your mobile gadget must have is access to the Internet.

Mostbet India

92167829And my gaming id is : 178366181Kindly look into this matter and make you withdrawal system faster because it usually takes a full day or two for receiving and that is very frustrating It’s get credited in account and I am very grateful to mostbet team for such support. The most popular leagues you can find here right now are. This post will provide you an introduction of Mostbet cricket betting in Nepal, as well as instructions on how to get started, place bets, and reap the rewards of using this website. These local currencies can be converted into bonus dollars. Its success is because this game is hosted only on licensed sites, such as MostBet. Іnvіtе уоur frіеnds tо jоіn МоstВеt аnd rесеіvе а bоnus. Once set up, you can immediately start betting and exploring the various casino games available. The most popular ones are live streaming and the ability to place bets in play. As you can see, no matter what operating system you have, the download and installation process is very simple. You can reach out to MostBet support service in convenient ways. Here you can play with live dealers that will give you the feeling of a real casino. If you’re looking for a reliable and easy to use mobile betting app, then the Mostbet app is definitely worth considering. And so, Mostbet ensures that players can ask questions and receive answers without any problems or delays. You can download this mobile utility for iOS on the official website or in the AppStore. The live chat support is super fast. For example not really every game can have both groups to score within bet builder. The game takes place in live mode. This Indian site is available for users who like to make sports bets and gamble. Thank you for your feedback and the data provided. The download process for the Mostbet app on iOS is straightforward and quick. We are sorry that you have such an opinion about our company. Haqiqiy pul uchun o’ynashdan oldin, demo versiyasida mashq qilishni unutmang mostbet slot aviator. Aviator is a social online game that allows you to interact with other users worldwide. The software cannot be blocked by internet providers. Besides, mostbet login Bangladesh is very simple, it is simple to do something.

Mostbet Apk for Android

The Mostbet app offers an easy to navigate platform, designed to provide Indian users with a convenient, exciting betting experience right at their fingertips. To start playing, you need to log in to your account on the Mostbet website, a beginner must go through a simple registration procedure. These measures demonstrate our commitment to a safe and ethical gaming environment. Mostbet has adjusted better serve its Bangladeshi customers. Here’s a breakdown of the most popular options, including minimum deposit and withdrawal amounts, any applicable fees, and estimated processing times. Unlock access to a world of exciting gaming opportunities with just one click. You will be wagering on whether or not the two teams competing score a higher combined number of points than the posted number: “the over” or fail to meet that number: “the under. Once you have successfully won money on bets, you will also be able to withdraw funds in a way that is convenient for you. The app can be installed directly from the Mostbet website.

What’s new in version 1 1 4

Here one can try a hand at betting on all imaginable sports from all over the world. Stay connected and bet on the go with the Mostbet app. With over 35 different suppliers and over 550 Mostbet Portugal Login: A Plataforma Ideal para Apostas e Jogos de Cassino Online different slot machines, including some of the most popular slot machines on the scene, the Mostbet Pakistan Casino provides a gaming experience that is on an extremely high level. Another great offer is the company’s loyalty program, which is based on crediting special points for depositing. I won’t judge who’s right or wrong. There are assessment tests you can take to determine whether you’re displaying any signs of addictive behavior. The Mostbet Casino app offers a wide ranging gaming portfolio to players, available on both Android and iOS devices. That’s why Mostbet recently added Fortnite matches and Rainbow Six tactical shooter to the betting bar at the request of regular customers. Also, whether your phone is big or small, the app or site will adapt to the screen size. For access to our digital platform, kindly provide your verified social media profile. Each sport has its own page on the website and in the MostBet app. O, Curacao nun rəsmi lisenziyası altında fəaliyyət göstərir, həm qumar sahəsində yeni başlayanların, həm də təcrübəli istifadəçilərin diqqətini cəlb edir. A type of bonus known as free spins enables players to play slot machines without needing to spend any of their own money. These include bank transfers, credit and debit cards, e wallets, and other online payment systems.

Get the latest version

MostBet Bangladesh does not charge even any minimum withdrawal amount fees to its users’ accounts. Keep in mind that the first deposit will also bring you a welcome gift. There are several advantages of using the application over the website, such as: fast and smooth performance; Easy and quick access; More features and functions; better planning and layout; notifications and alerts; Offline mode. While the maximum withdrawal time limit stated in their terms of use is 72 hours 3 days , in practice, withdrawals are often processed much faster. If none of these solutions work, you can contact the customer support team of Mostbet via live chat, email, or phone and ask them for assistance. The Mostbet mobile app is an ideal variant for people with a lack of time because it’s easier to tap the app and start betting instantly. The bonus offer is valid for new Mostbet clients who register between December 19, 2022 and December 19, 2023. Presently, you can indulge in the full array of wagering and amusement alternatives available. You will find more than 30 types of Poker games with different modes and the number of cards at the Mostbet India site. Check the “Promotions” section for these incentives to improve your gaming experience. The website recognizes your device type and presents the appropriate version for download, ensuring compatibility and ease of use. On the net you will find both positive and negative reviews about Mostbet betting company. It’s essential to complete your profile by adding personal information subsequently. You can also take advantage of the promotions and Mostbet bonuses available on the app. This is of great importance, especially when it comes to solving payment issues. Once the verification is completed, you will receive a notification to your contact e mail address. The biggest requirement to ensure the proper functioning of the Mostbet app Pakistan is fast and stable web access. Choosing between the mobile official website of Mostbet and the Mostbet app affects your experience. The platform offers you a variety of bets at some of the highest odds in the Indian market. To login into Mostbet, you can use your phone number or email address. Keep in mind that the first deposit will also bring you a welcome gift. However, the desktop version suitable for Windows users is also available. Created and Boosted by SEO. These instruments rely mostly on examining historical game data and identifying patterns that might or might not exist, even if they claim to predict the optimal time to cash out. Access a wide range of sports betting options and casino games anytime, anywhere, with just a few taps.

☰ How do I update my betting app to the latest version?

Differentiated tables with significantly variable minimum stakes have also been established so beginners can easily earn their first experience. There is the main menu at the top of the app’s screen, where all services are represented identically to the official website. That’s all, and after a while, a player will receive confirmation that the verification has been successfully completed. This will log you into Mostbet, where you may check out all of the available games. Types of Sports Betting. Efficient navigation, account management, and staying updated on sports events and betting markets enhance the experience. Get a no deposit bonus from Mostbet. Although India is considered one of the largest betting industries these days, its iGaming market has not yet fully reached its potential. The promotion is only valid for bets placed in singles or expresses. Congratulations, you’ve effectively accessed your Mostbet profile. Ancaq Mostbet AZ da pul qazanmaq üçün sizə daha çox imkanlar verən müxtəlif mərc seçimləri də var. This betting site was officially launched in 2009, and the rights to the brand belong to Starbet N. The recipient of the prize is randomly selected from all participants. After the tournament final, all the winning wagers will be paid within 30 days, after which the winners can cash out their earnings. Once set up, you can immediately start betting and exploring the various casino games available. Our large network of experienced and verified lawyers can be found to help. Step 4: Make Your First Deposit. Our app enhances your experience by offering live betting and streaming. To benefit from the promotions and incentives on Mostbet, users must familiarize themselves with the terms and conditions associated with each offer. Players who spent over 2,000 PKR in the month before their birthday are eligible for free bets and other prizes. This saves a lot of time and effort, allowing you to receive your winnings as soon as you have them. This generous bonus will allow you to enjoy a variety of casino games and increase your chances of winning big. All official Mostbet applications you can download directly from the official website and it won’t take much of your time. The program complies with all industry standards and replicates all of the desktop version’s features and designs. This will log you into Mostbet, where you may check out all of the available games.

Select the Android Icon:

Mostbet App Download APK for Android and iOS in India 2024. Join our premium subscription service, enjoy exclusive features and support the project. By registering on the site, you agree to the Partnership Agreement and Privacy Policy. Securely enter a valid Indian telephone code to connect with the world. Yes, you will have 2 types of bonuses to choose from: + 125% for sports betting and 125% + 250FS for casino games. The app is available on both Android and iOS devices, and it offers a vast array of betting options and casino games. Mostbet offers a comprehensive in app sports betting service for players from Morocco. It gets generally quicker when Mostbet apk is downloaded directly from the Mostbet site compared to the iOS app being downloaded from the App Store. We must admit that the Mostbet app download on iOS devices is faster compared to the Android ones. If you are still in doubts about whether it’s a cool idea to download the Mostbet app or not after reading this large review, we have prepared a list of main advantages of this company’s app. The apps are completely free, legal and available to Indian players. The Partners 1xBet team will review your application within 48 hours. Visit the official Mostbet site and discover the Download button. Introducing Mostbet India – Explore the world of online betting with our official launch. Yes, you can place bets on multiple cybersport events across famous tournaments such as The International or League of Legends World Championship. Choosing between the two depends on your individual preference and playing style. Keep in mind that Mostbet provides you with diverse bet types. Offer valid and must be physically present in AZ, CO, IA, IL, IN, KS, KY, LA, MA, MD, ME, MI, NC, NJ, NY, OH, PA, TN, VA, WV, IL, MD, NJ, OH, PA, TN, VA, WV, WY. The Mostbet app specializes in sports betting, covering a wide range of events and disciplines, from soccer, basketball and tennis to less conventional sports such as cricket and badminton. Loyalty Program: Participate in the loyalty program where you earn special points on every deposit. Our goal is to provide free and open access to a large catalog of apps without restrictions, while providing a legal distribution platform accessible from any browser, and also through its official native app. In this case, you must take a photo of the document and send it to the email address. Even hit a nice multiplier at the end and came out ahead. The Mostbet app apk for Android doesn’t differ from the iOS one a lot. Play the bonus: place your bets, spin the reels and enjoy your winnings.

General

Mostbet’s first priority is always being there for its customers. Submit your mobile phone number and we’ll send you a confirmation message. Steve Whiteley, netting £1. The best gambling studios have contributed to this rich catalog. Once your download is done, unlock the full potential of the app by going to phone settings and allowing it access from unfamiliar locations. Additionally, while the app generally provides reliable support, some users mention that response times could improve during high traffic times, such as major sports tournaments. If you already have passed the Mostbet registration. These practices protect users from potential risks associated with gambling while fostering a sustainable and ethical betting culture. There are weekly tournaments, lotteries, and various special offers announced on the site and with a promo newsletter. Should you encounter any issues or have questions during the download or installation process, Mostbet’s customer support is readily available to assist you, ensuring a hassle free setup. In addition, the app can be translated into various languages. Here’s an overview to help you choose the best option. Get ready for an action packed adventure. The Mostbet app offers a convenient way to access a wide range of betting options right from your mobile device. The deposit options, we will present you below. Just make sure to follow all terms and conditions and ensure you’re allowed to use the app where you live. Hello, Dear Cristian Cristian. The most popular ones are live streaming and the ability to place bets in play.

Mostbet promo codeWelcome bonus for

Here you can bet on sports, as well as watch broadcasts of matches. Check their characteristics below. Unlock exclusive savings by entering a promo code. Mostbet caters to all types of gamblers by providing them with a wide variety of gambling options. However, there are some specific features, which make them a little different. Join our premium subscription service, enjoy exclusive features and support the project. They’re also big on responsible gambling. Users must, however, always be informed of the regulations governing online betting in their area. This unique algorithm creates a random variable coefficient, reaching which the round in the game ends. Only we have official reviews on our site. If you want to succeed in betting, you need to learn as much information as possible about this or that match, teams, and players. Plus, there are a lot of different online games on the site, and baccarat, blackjack, keno, sic bo, and of course, slot machines. 8048/JAZ2016 065 Gamble Responsibly. The following betting options are available: Single, Express, Live, and Line. If you want to succeed in betting, you need to learn as much information as possible about this or that match, teams, and players. Install the app now and get your free spins.

Elevate Your Baccarat Experience at r2pbet

In the captivating world of online casinos, the pursuit of exhilarating gaming experiences has become a coveted aspect of modern entertainment. As players seek to elevate their gaming journeys, the allure of premium gaming opportunities has become increasingly irresistible. Delve into the realm of table games and discover the exclusive experiences that await, where the promise of big wins and the thrill of strategic mastery converge to create a truly captivating gaming adventure.

At the heart of this captivating landscape lies the enchantment of online casino platforms, where the boundaries of traditional gaming are challenged and redefined. Embark on a journey of discovery, where advanced tactics and player strategies collide to unlock the full potential of your gaming prowess. Immerse yourself in the allure of high-stakes baccarat, a game that has long captured the imaginations of seasoned players and newcomers alike.

Prepare to be swept away by the r2pbet casino experience, where the fusion of cutting-edge technology and unwavering commitment to premium quality redefines the very essence of online gaming. Embrace the opportunity to engage in exclusive experiences that elevate your gameplay to new heights, where the thrill of the game is matched only by the potential for life-changing rewards.

Mastering the Basics of High-Stakes Baccarat

Delving into the captivating world of casino gaming, high-stakes baccarat stands out as a thrilling and sophisticated experience. This classic table game, known for its elegance and potential for significant payouts, has long captivated the attention of seasoned players and newcomers alike. Whether you’re seeking to elevate your gaming journey or simply curious about the allure of premium gaming, understanding the fundamentals of high-stakes baccarat is a crucial step in maximizing your chances of success.

At the r2pbet casino, players can immerse themselves in an exclusive and premium gaming environment, where table games, including high-stakes baccarat, are meticulously curated to deliver an unparalleled experience. With the guidance of skilled live dealers and the opportunity to employ advanced tactics, players can unlock the true potential of this captivating game and pursue the thrill of big wins.

Whether you’re a seasoned high-roller or a budding casino enthusiast, mastering the basics of high-stakes baccarat is the gateway to unlocking a world of exclusive experiences and premium gaming opportunities. By understanding the game’s dynamics, probabilities, and strategic nuances, players can enhance their decision-making abilities, increase their chances of success, and ultimately, elevate their overall enjoyment of the thrilling world of online casino gaming.

Understand the Rules and Gameplay of Baccarat

Before diving into high-stakes baccarat at r2pbet casino, it’s essential to grasp the rules and gameplay of this classic table game. Baccarat is a popular choice among online casino players due to its fast-paced nature and the potential for big wins. By understanding the rules and strategies of baccarat, players can enhance their gaming experience and increase their chances of success.

Basic Principles of Baccarat

Baccarat is a game that is easy to learn but difficult to master. In baccarat, players have the option to bet on the player, banker, or a tie. The goal is to predict which hand will have a total closest to nine. The game is played with live dealers, providing players with exclusive experiences and an immersive gaming environment.

Advanced Tactics and Player Strategies

As players become more familiar with the rules of baccarat, they can start to develop advanced tactics and strategies to improve their chances of winning. Whether it’s tracking patterns, managing bankroll effectively, or recognizing when to bet on the player or banker, honing these skills can make a significant difference in high-stakes baccarat games at r2pbet casino.

Strategies to Maximize Your Baccarat Experience

When it comes to participating in high-stakes baccarat at premium online casinos, having a solid grasp of advanced tactics can greatly enhance your gameplay. By understanding player strategies, interacting with live dealers, and striving for big wins, you can create exclusive experiences that will elevate your enjoyment of table games like never before.

Embrace Player Strategies

One key aspect of maximizing your baccarat experience is to familiarize yourself with effective player strategies. Whether you prefer to follow a trend-based approach or rely on mathematical calculations, finding a strategy that suits your style of play can significantly impact your success at the table. By honing your skills and adapting your tactics as needed, you can optimize your chances of winning in high-stakes baccarat games.

Interact with Live Dealers

Engaging with live dealers in online casinos adds a personal touch to your gaming experience, making it more immersive and exciting. Interacting with real-time dealers creates a sense of authenticity and enhances the overall ambiance of the game. By building a rapport with the dealers and other players, you can make the most of your high-stakes baccarat sessions and enjoy the thrill of competition in a dynamic environment.

Effective Betting Techniques for High-Rollers

When it comes to thrilling table games, the ultimate experience lies in mastering the art of strategic wagering. In the realm of premium gaming, savvy players recognize the significance of employing advanced tactics to maximize their chances of success. This section delves into the world of cutting-edge player strategies, empowering high-rollers to elevate their gaming experience at the exclusive online casino.

Navigating the Terrain of Big Wins

For discerning players who seek the pinnacle of gaming excitement, understanding the nuances of effective betting techniques is paramount. By leveraging a deep comprehension of the game’s dynamics and a keen eye for opportunity, high-rollers can position themselves to reap the rewards of substantial payouts. Explore the realm of exclusive experiences and uncover the secrets to unlocking the most lucrative outcomes in the world of premium gaming.

Elevating Your Gameplay with Strategic Wagers

In the captivating world of table games, the power of strategic wagers cannot be overstated. High-rollers who embrace advanced player strategies are poised to navigate the intricacies of the game with precision, positioning themselves for the most rewarding outcomes. Delve into the world of online casino thrills and discover how to harness the full potential of your wagering prowess, elevating your gameplay to new heights of excitement and success.

Elevating Your Baccarat Adventure at r2pbet

Enhance your high-stakes baccarat experience at the prestigious online casino, r2pbet, where the thrill of table games meets the potential for big wins. Immerse yourself in the world of premium gaming with live dealers, offering exclusive experiences that take your gameplay to the next level.

By mastering advanced tactics and understanding the rules and gameplay of baccarat, you can elevate your adventure at r2pbet. Utilize effective betting techniques tailored for high-rollers to maximize your chances of success and make the most of your time at the virtual tables.

| Experience the | Intense | Excitement |

| Engage with | Professional | and Experienced |

| Embark on an | Elegant | Adventure |

Exploring the Thrills of High-Limit Baccarat Tables

When it comes to diving into the exhilarating world of high-stakes baccarat, players seek out the ultimate gaming experience at online casinos. The allure of exclusive experiences, advanced tactics, and big wins draws high-rollers to premium gaming platforms with live dealers and thrilling table games.

- Discover the rush of adrenaline as you test your player strategies at high-limit baccarat tables.

- Experience the sophistication and elegance of the game as you aim for those lucrative wins.

- Engage with like-minded enthusiasts in a competitive yet rewarding environment.

Wonky Wabbits Harbors Enjoy Wonky Wabbits Slots Free online

Articles

This game is free of charge to experience and you will won’t want more costs. Just assemble three spread out signs or see almost every other requirements see free revolves. That way, you’ll manage to get access to the main benefit online game and you can more profits.

These bonuses are generally booked for brand new users undertaking a free account for the first time, and also the user have to live in Canada which have good proof of name and target. Read More