Ghostwriter mit Notengarantie: Akademische Unterstützung

Außerdem steht immer wieder zur Diskussion, ob auch Ghostwriter und entsprechende Agenturen sanktioniert werden sollen. Damit die Arbeiten, die sie für ihre Kunden schreibt, auch authentisch sind, versucht sie aber, sich auf deren Schreibstil einzustellen. „Ich bitte meine Kunden immer, mir einen kurzen Auszug aus einer Seminararbeit zu schicken, die sie selbst geschrieben haben. Damit fällt es mir leicht, bachelor ghostwriter die neue Arbeit in einem ähnlichen Stil zu verfassen.“, so die Ghostwriterin. Ghostwriter schreiben Bücher, Reden, Biografien oder wissenschaftliche Arbeiten im Auftrag von Kunden, die einen Text nicht selbst verfassen wollen oder können.

Sie haben noch Fragen?

Aus diesem Grund setzt Premium Ghostwriter für alle Aufträge ausschließlich Ghostwriter ein, die über einen angemessenen akademischen Abschluss verfügen. Gerne erstellen wir Ihnen einen Kostenvoranschlag für unsere Leistungen im Ghostwriting, Korrektorat und Lektorat. Geben Sie dafür alle Informationen zu Ihrem Anliegen im Bestellformular an und erhalten Sie zeitnah ein unverbindliches Angebot per E-Mail, in dem der Preis schon berechnet ist. Sobald Sie Ihre Bestellung aufgegeben und bezahlt haben, haben Sie die Möglichkeit, den Arbeitsprozess in Ihrem Kundenprofil mitzuverfolgen und zu kontrollieren. Die fertige Arbeit können Sie dann pünktlich zum anfangs festgelegten Termin in Ihrem Kundenprofil herunterladen. Wir liefern ausschließlich einzigartige, fehlerfreie Arbeiten, und das stets streng zu dem von Ihnen festgelegten Termin. Dabei setzen unsere Autoren all Ihre Anforderungen zu 100 Prozent um.

Denn auch geübte Ghostwriter benötigen für eine fundierte 80-seitige Diplomarbeit ca. Erstens sollten Sie die Qualifikationen des Ghostwriters beachten. Es ist wichtig, dass der Ghostwriter ausreichend qualifiziert ist, um Ihre Arbeit zu schreiben. Dies bedeutet, dass er oder sie ein abgeschlossenes Studium in dem Fachgebiet haben sollte, in dem Ihre Hausarbeit verfasst wird. Darüber hinaus sollte der Ghostwriter über ausreichende Schreiberfahrung verfügen, um eine überzeugende und gut strukturierte Arbeit erstellen zu können. Bevor Sie sich mit dem Ghostwriting von Hausarbeiten befassen, sollten Sie zunächst ein grundlegendes Verständnis für das Konzept des Ghostwritings haben. Im akademischen Kontext, auf den wir uns in diesem Artikel konzentrieren, wird Ghostwriting meistens für wissenschaftliche Arbeiten wie Hausarbeiten, Seminararbeiten oder sogar Abschlussarbeiten verwendet.

Bezüglich meiner Vorstellung des genauen inhaltlichen Programmablaufs hätte ich mir selber einen Gefallen getan, wenn ich diesen detailliert dem… Über unsere E-Mail Adresse kontaktieren Sie uns gerne jederzeit. Als seriöse Ghostwriter Agentur bieten wir Fachwissen in einer Vielzahl von Wissenschaftsbereichen an. Ihren qualifizierten Ghostwriter finden Sie mit unserer Agentur. Wir verstehen, dass der Anspruch unserer Kunden variiert, und deshalb legen wir großen Wert darauf, dass die Fähigkeiten unserer Lektoren und Ghostwriter den individuellen Anforderungen gerecht werden.

Zudem steht im Vordergrund Ihre Zufriedenheit, weil wir uns dann sicher sein können, dass wir einen professionellen sowie kompetenten Ghostwriter-Service anbieten. Um Ihnen die größtmögliche Kompetenz garantieren zu können, übernehmen wir wissenschaftliche Volltextarbeiten nicht in allen Fachbereichen. Eine Übersicht über die aktuellen Leistungsfelder finden Sie auf unseren Seiten, weitere Studiengänge auf Anfrage. Reden, Businesspläne, Sachbuchtexte, Bewerbungsschreiben sowie Texte für Webseiten / Content Marketing erstellen wir themenunabhängig. Bei der Ghostwriting Agentur GWriters erhalten Sie kompetente Unterstützung für wissenschaftliche Arbeiten in jedem Fachgebiet.

Unser Expertenteam stellt Ihnen hochwertige Produkte zur Verfügung, die auf den neuesten wissenschaftlichen Trends basieren. Egal, ob Sie eine Dissertation, eine Abschlussarbeit, eine Forschungsarbeit oder eine Seminararbeit benötigen, wir liefern Ihnen das gewünschte Ergebnis. Sind Sie noch auf der Suche nach einem qualifizierten Ghostwriter, finden Sie in unserem Beitrag Akademische Ghostwriter finden einige wertvolle Tipps. Mit der Erstellung Deines persönlichen Angebots, sichern wir dir diesen Preis endgültig zu. Erfahre mehr über die Preisgestaltung einer wissenschaftlichen Schreibvorlage deiner Hausarbeit, Bachelorarbeit oder Masterarbeit ghostwriting mithilfe unseres Quick Price Checks.

Außerdem lernen sie aus ihrer Bachelorarbeit für weitere wissenschaftliche Arbeiten. Ob der Ghostwriter gründliches wissenschaftliches Arbeiten als genauso wichtig einstuft wie Du und dabei alle Formalien einhält (Pospiech, 2017), ist nicht gewährleistet. Die Bachelorarbeit ist die erste große wissenschaftliche Arbeit, die Studierende schreiben müssen. Ghostwriting bei der Bachelorarbeit dürfte also öfter vorkommen, als man denkt. Das ist rechtlich sehr heikel – und auch aus anderen Gründen keine gute Idee. beste ghostwriting agentur Du erreichst den höchsten akademischen Abschluss durch eine intensive Forschungsarbeit mit fortgeschrittenen Beiträgen zur Wissenschaft und Praxis.

Änderungswünsche und Feedback werden selbstverständlich berücksichtigt und umgesetzt. Wie in jeder anderen Branche auch, gibt es unter Ghostwritern schwarze Schafe. Unseriöse Anbieter ziehen Ihnen das Geld aus der Tasche und liefern minderwertige Qualität, was Ihnen viel Ärger bereiten kann. Ihr Ruf könnte massiv geschädigt werden, und bei akademischem Ghostwriting droht sogar die Exmatrikulation. Ein Beispiel hierfür ist die zweite Lehramtsprüfung in der Schule. Während die Prüfungsstunden vorbereitet werden müssen, muss der Schulbetrieb normal weiterlaufen.

Gute Ghostwriter sind diskret

- Nachdem Sie das Bestellformular ausgefüllt haben, werden Sie auf die Webseite des Unternehmens weitergeleitet, wo Sie durch einen einfachen Prozess der Bezahlung für unseren Service geführt werden.

- Gerne unterschreibe ich eine entsprechende Geheimhaltungsvereinbarung.

- Natürlich bemühen wir uns stets darum, die für Sie kostengünstigste Lösung zu finden.

- Das wird daran gemessen, ob jemand anderes in den Inhalt des Textes eingreift.

Dabei setzen wir auf weitaus mehr als einfach nur „sich eine Hausarbeit schreiben lassen“. Schon das Angebot wird in stetigem Kontakt mit Ihnen gefertigt. Im weiteren Verlauf behalten wir den stetigen Austausch bei, um sicherzustellen, dass der Auftrag genau nach Ihren Vorstellungen durch unsere Ghostwriter erstellt wird. Durch den engen Kontakt ermöglichen wir ein umfangreiches akademisches Ghostwriting. Die Beratung erfolgt per E-Mail, Telefon, Videokonferenz oder persönlich an einem Ort ihrer Wahl. Profesionelle Unterstützung ist damit jederzeit überall gewährleistet, da jede Arbeit zusätzlich durch eine interne und bewährte Qualitätssicherung durchläuft. Die Einhaltung von Fristen und hochschulspezifischen Standards, welche bei der Erstellung einer wissenschaftlichen Arbeit bedürfen, haben für uns höchste Priorität.

Wie viel kostet eine akademische Arbeit? – Nutzen Sie unseren Preisrechner!

Zudem sollten wir betonen, dass unsere Ghostwriting Agentur Ihre Diplomarbeit, Bachelorarbeit, Masterarbeit oder Hausarbeit genau so schreiben wird, wie Sie es wünschen, unter Beachtung aller Details. Wir garantieren Ihnen, dass Ihre Forschungsarbeit einzigartig und frei von Plagiaten ist. Wir verwenden die modernsten Prüfsoftwares PlagScan, Copyscape, Turnitin, Unichek und stellen Ihnen einen Bericht über die Originalität Ihrer Arbeit zur Verfügung. Sie erhalten Ihre Arbeit von einem Autor mit der nötigen Qualifikation und Spezialisierung. Alle Autoren, die mit unserer Agentur zusammenarbeiten, wurden sorgfältig ausgewählt. Unsere akademischen Autoren unterstützen Sie professionell, 100% diskret und liefern in hoher Qualität.

Finden Sie verl�ssliche �bersetzungen von W�rter und Phrasen in unseren umfassenden W�rterb�chern und durchsuchen Sie Milliarden von Online-�bersetzungen. Sie wählen den Weg der Kontaktaufnahme – telefonisch, per Mail, Anfrageformular oder persönlich. Bitte benennen Sie dabei so präzise wie möglich Ihre Anforderungen, so legen Sie Grundlage dafür, dass das Ergebnis Ihren Erwartungen entspricht. Die beiden Endzahlungen für die zwei Arbeiten wurden heute von mir vorgenommen. Habe mir die Texte durchgelesen und war wieder äußerst zufrieden mit Ihrer Arbeit, herzlichen Dank. Vielen Dank, das Lektorat hat meiner Arbeit inhaltlich und von der Rechtschreibung her ziemlich gut getan, auch wenn ich erst dachte, dass der Preis eigentlich zu hoch für mich ist. Super, vielen herzlichen Dank für Ihre Hilfe und für die gute Zusammenarbeit.

“1xbet المغرب دليل المغاربة مكافآت تصل الى 38, 500 درهم مغرب

“1xbet المغرب دليل المغاربة مكافآت تصل الى 38, 500 درهم مغربي

1xbet تسجيل الدخول في المغرب تسجيل الدخول إلى الموقع 1xbet تسجيل الدخول للجوال”

Content

- موقع 1xbet المغرب

- كيف يتم عرض الرياضات الافتراضية في 1xbet Morocco؟

- مُزودو العاب 1xbet المغرب

- الوسائل المالية التي يدعمها 1xbet المغرب

- إيجابيات 1xbet المغرب للاعبين

- كيفية تسجيل الدخول في المغرب 1xbet

- المكافأة الترحيبية للمراهنات الرياضية

- العاب الطاولة والبطاقات في 1xbet المغرب

- كيفية الانضمام وتسجيل الدخول في المغرب 1xbet

- كيفية فتح الحساب في موقع 1xbet

- استمتع بمكافأة تسجيل الدخول في المغرب 1xbet

- خيارات الرهان المُتاحة في 1xbet Maroc

- هل الدخول على موقع 1xbet قانوني في 1xbet المغرب ؟

- سهولة استخدام موقع 1xbet المغرب

- العاب سلوتس 1xbet المغرب Telegram

- مكافأة 1xbet Morocco

- “Gamble المغرب (1xbet Morocco)

- مكافآت 1xbet المغرب

- تأملات في “كيفية تسجيل الدخول في المغرب 1xbet””

- كيفية فتح الحساب في موقع 1xbet

- العاب سلوتس 1xbet المغرب Telegram

- كيف يتم عرض الرياضات الافتراضية في 1xbet Morocco؟

- إيجابيات 1xbet المغرب للاعبين

- مكافآت 1xbet المغرب

- كيفية تسجيل الدخول في المغرب 1xbet

- هل الدخول على موقع 1xbet قانوني في 1xbet المغرب ؟

- المكافأة الترحيبية للمراهنات الرياضية

- مكافأة 1xbet Morocco

- “Gamble المغرب (1xbet Morocco)

- الوسائل المالية التي يدعمها 1xbet المغرب

وهذه ميزة رائعة مُقارنة بالمواقع الأخرى التي تُخصص مكافآتها للبطولات الرئيسية فقط. تقدم الشركة مكافأة تسجيل الدخول في المغرب 1xBet بالإضافة إلى الترقيات الأخرى بانتظام. فيمكن للاعبين الذين قاموا بتسجيل الدخول في 1xBet الحصول على مكافآت ترحيبية سخية جدًا. ومع ذلك إذا استطاع اللاعب” “إدخال الرمز الترويجي للتسجيل، فيمكن أن تزداد قيمة المكافأة إلى 144 دولار. وبالتالي يجب على العملاء الاهتمام بإدخال رمز تسجيل الدخول 1xBet الترويجي بمجرد التسجيل في الموقع.

- يُقدم application 1xbet المغرب واحدًا من أفضل التطبيقات المُتاحة في صناعة المُقامرة عبر الإنترنت، يعرض هذا التطبيق مجموعة من أفضل احتمالات الرهان الرياضي في العالم، وهو يُقدم كمًا هائلاً من العاب الكازينو أيضًا.

- يمكن لكل لاعب يراهن على الألعاب الشهيرة أن يقوم بإدخال رمز ترويجي فريد ويحصل على أموال إضافية.

- نظرًا لكل تلك المزايا فإن تطبيق 1XBet Morocco هو – على الأرجح – أفضل تطبيق للمراهنات الرياضية في الوقت الحالي.

- ما تخافيش الموقع مضمون وهو موقع معروف عالمياً، بش تستفاد منو خاصك ضروري تكون مسجل فيه، شوفي كيفية الانضمام وتسجيل الدخول وطبق جميع المراحل المذكورة باش يمكليك تسجل وتشوف المزايا إلي فيه.

- لإنشاء حساب جديد هناك 4 خيارات تسجيل رئيسية يمكنك الاختيار من بينها.

ومع ذلك فإن لعب اللاعبين المغربيين الجُدد يُمكنهم أن يجدوا واجهة موقع 1xbet المغرب مُكتظة بعض الشيء وذلك نظرًا لأنها تحتوي على الكثير من الصور والنصوص والروابط. ومع ذلك فحينما تستخدم الموقع أكثر من مرة فإنك سوف تعتاد عليها. جربت كل أنواع الطرق المتاحة لتسجيل الدخول على الموقع 1xbet التي تم تفسيرها بالتدقيق في الصفحة هادي، أفضل طريقة هي عبر تفيق الدخول” “بإستعمال رقم الهاتف الجوال وتحميل التطبيق المحمول. بالإضافة إلى ذلك، فإن 1xbet المغرب يُقدم أيضًا إمكانية المراهنة على الأحداث السياسية، وأحوال الطقس، والجوائز الفنية. يمكن للمراهنين من جميع أنحاء العالم تسجيل الدخول في المغرب 1xBet من خلال جميع أنواع الأجهزة. فيمكنهم تشغيل أي تطبيق احترافي من الهاتف الهاتف المحمول والأجهزة اللوحية.

موقع 1xbet المغرب

يعرض 1xbet English مجموعة كبيرة من ألعاب الكازينو بما في ذلك العاب سلوتس، وروليت، وبلاك جاك، وبوكر، والعاب الكازينو المباشر. ويتم تقديم هذه الألعاب من قبل مجموعة كبيرة من المُطورين المشهورين بالإضافة إلى الإستوديوهات المباشرة أيضًا إلى بعض الشركات الناشئة. هذا جيد لأنك سوف تتمكن من الإستمتاع بالألعاب الشهيرة، وفي نفس الوقت سُتتاح لك فرصة تجربة عناوين جديدة ربما لم تلعبها من قبل. الحد الأدنى لكل من عمليات الإيداع والسحب هو 11 درهم مغربي فقط، وتتم عمليات الإيداع والسحب بشكلٍ فوري، ولا يفرض وان اكس بت أي رسوم أو عمولات على عملياتك المالية 1xbet morocco.

- يتمتَّع موقع 1xbet” “mobileبتصميم جيد ومتوافق مع مُختلف أنواع الهواتف الذكية وأحجامها، كما أن موقع 1xbet المغرب يُقدم للاعبين كل الميزَّات التي تحتوي عليها المنصة الكاملة بما في ذلك الألعاب الرياضية، والرهانات المباشرة، والعاب الكازينو اون لاين، والعاب الكازينو المباشر.

- يُمكن للاعبين وضع رهانات في غضون دقائق قليلة بعد تسجيل حساب جديد، وبعد ذلك يُمكنك مُراجعة الرهانات التي وضعتها سلفًا من خلال قسيمة الرهان التي توضع على الجانب الأيمن من الصفحة الرئيسية.

- بالإضافة إلى ذلك فيُمكن للاعبين أيضًا أن يستمتعوا بخدمة البث المباشر المجاني من خلال هذا التطبيق.

- يخدم موقع 1xbet المغرب أكثر من مليون عميل حول العالم، وهو يتوسع بمُعدَّل مرتفع.

- يقع المقر” “الرئيسي لشركة 1xbet 1xbet المغربفي قبرص، وتحمل الشركة ترخيص لجنة كوراساو لألعاب القمار.

أريد تسجيل السخول بطريقة التسجيل بالنقرة الواحدة ولم اتمكن من ذلك. ومن الجدير بالذكر أن الودائع التي تتم باستخدام العملات الرقمية المُشفرة لا تكون مُؤهلَّة لهذه المكافأة ولا أي مكافأة أخرى يُقدمها x gamble. ومن الجدير بالذكر أن هذا التطبيق مُتاح بلغتيْن فقط وهما اللغة الإنجليزية والروسية فقط.”

كيف يتم عرض الرياضات الافتراضية في 1xbet Morocco؟

اذا مكانش عندك حساب ف 1xBet كنصحك تسجل فوراً هاد الموقع العالمي بالصح وفيه العديد من البونيصات والمزايا!! يكفي تعمل ال-login على الموقع تكتب جميع المعلومات المطلوبة منك. ويعتبر إدخال الرمز الترويجي للتسجيل من الخطوات المهمة جدًا عند تسجيل دخولك. ما تخافيش الموقع مضمون وهو موقع معروف عالمياً، بش تستفاد منو خاصك ضروري تكون مسجل فيه، شوفي كيفية الانضمام وتسجيل الدخول وطبق جميع المراحل المذكورة باش يمكليك تسجل وتشوف المزايا إلي فيه. كنت أريد الإنضمام إلى الموقع لكني لست متأكداً حتى الآن، لدي الكثير من الأصدقاء الناشطين على 1xbet وكانو محظوظين في الربح، لكني لازلت خائف.

يتطلب تكريس الرهان تسجيل الدخول التعامل من خلال شركة مراهنة آمنة يمكنك الاعتماد عليها. وشركة 1xBet تعتبر شركة مراهنة موثوق بها من قبل غالبية اللاعبين في جميع أنحاء العالم. وإذا كُنت تعيش في المغرب وترغب في الإستمتاع باللعب في 1xbet فإننا سوف نُقدم لك في هذا الدليل كل المعلومات التي تحتاج إلى معرفتها حول هذا الموقع، وكيف يُمكنك الدخول عليه والاشتراك فيه بأمانٍ تام، وكذلك ما هي الخدمات التي يُمكنك الإستمتاع بها في Xbet. بعد” “انتهاء عملية التسجيل أصبحت الآن مؤهلاً لتنضم وفتح الحساب الخاص بك وتلقي الدعم.

مُزودو العاب 1xbet المغرب

يُمكن للاعبين تحميل التطبيق من خلال الضغط على رابط وان اكس بت الموجود في هذه الصفحة عبر هاتفك الذكي أو جهازك اللوحي، وبعد ذلك النقر على رابط تنزيل التطبيق. مساحة app 1xbet المغرب حوالي 43 ميجابايت فقط، وهي ليست مساحة كبيرة مُقارنة بتطبيقات المراهنات الأخرى. موقع 1xbet المغرب هو أحد أفضل وكلاء المراهنات عبر الإنترنت، يعتمد ثيم الموقع على اللونيْن الأزرق والأبيض، مع وجود عدد صغير من الصور التي تساعد على التمييز بين الميزات والخدمات المُختلفة التي يُقدمها.

- يتمتع العملاء بإمكانية اختيار اللغة الأفضل لهم من بين 37 لغة متاحة على صفحة الموقع.

- وإذا كُنت تعيش في المغرب وترغب في الإستمتاع باللعب في 1xbet فإننا سوف نُقدم لك في هذا الدليل كل المعلومات التي تحتاج إلى معرفتها حول هذا الموقع، وكيف يُمكنك الدخول عليه والاشتراك فيه بأمانٍ تام، وكذلك ما هي الخدمات التي يُمكنك الإستمتاع بها في Xbet.

- موقع 1xbet المغرب هو أحد أفضل وكلاء المراهنات عبر الإنترنت، يعتمد ثيم الموقع على اللونيْن الأزرق والأبيض، مع وجود عدد صغير من الصور التي تساعد على التمييز بين الميزات والخدمات المُختلفة التي يُقدمها.

- يُقدم Xbet أيضًا أكثر من 5،000 لعبة كازينو عالية الجودة يُمكنك الإستمتاع بها على هاتفك الذكي أو جهازك اللوحي بسهولة، ويتم تقديم هذه الألعاب من قِبل كبار المُطورين العالميين.

“تنص القوانين المغربية على منع إنشاء الكازينوهات التقليدية ومواقع المراهنات الرياضية بشكلٍ كامل، ومع ذلك فإن القانون 1xbet المغرب لم يتطرق إلى كازينوهات الإنترنت ومواقع المراهنات الرياضية نظرًا لأن هذه المواقع هي شركات خارجية لا تعمل داخل حدود الدولة 1xbet المغرب. يُقدم application 1xbet المغرب واحدًا من أفضل التطبيقات المُتاحة في صناعة المُقامرة عبر الإنترنت، يعرض هذا التطبيق مجموعة من أفضل احتمالات الرهان الرياضي في العالم، وهو يُقدم كمًا هائلاً من العاب الكازينو أيضًا. يُقدم وان اكس بت تطبيقات لأجهزة Android و iOS و Glass windows و Java.

الوسائل المالية التي يدعمها 1xbet المغرب

يحتوي هذا التطبيق على الكثير من المزايا الرائعة لكل من المراهنين فهو يعرض كل أسواق الرهان وهو يُتيح لك المراهنة على كرة القدم، وكرة السلة، والتنس، وهوكي الجليد، و43 نوعًا آخر من الألعاب الرياضية. بالإضافة إلى ذلك فيُمكن للاعبين أيضًا أن يستمتعوا بخدمة البث المباشر المجاني من خلال هذا التطبيق. كما أنه يُقدم أيضًا أكثر من 3،000 لعبة يُمكنك الإستمتاع بها بشكلٍ مجاني أو بمال حقيقي. علاوة على ذلك، فإنك سوف تحص على مكافأة حصرية بقيمة 130 يورو عند تنزيل هذا التطبيق واللعب من خلاله.

- الحد الأدنى لكل من عمليات الإيداع والسحب هو 11 درهم مغربي فقط، وتتم عمليات الإيداع والسحب بشكلٍ فوري، ولا يفرض وان اكس بت أي رسوم أو عمولات على عملياتك المالية.

- فيمكن للاعبين الذين قاموا بتسجيل الدخول في 1xBet الحصول على مكافآت ترحيبية سخية جدًا.

- يكفي تعمل ال-login على الموقع تكتب جميع المعلومات المطلوبة منك.

على الرغم من أن المظهر الخاص بموقع وان اكس بت غير مُنظمًا، إلا أن تطبيق app 1xbet قد حلّ هذه المشكلة بشكلٍ كامل وهو يتمتَّع بمظهرٍ رائع ومرونة كبيرة في التصفح والتحكم والتخصيث. يُمكن للاعبين الوصول إلى الرياضات والاحتمالات والخيارات التي يُريدون الوصول إليها بشكلٍ سريع وبدون عناء. نظرًا لكل تلك المزايا فإن تطبيق 1XBet Morocco هو – على الأرجح – أفضل تطبيق للمراهنات الرياضية في الوقت الحالي.

إيجابيات 1xbet المغرب للاعبين

وقد دخلت الشركة في عقود رعاية مع كيانات رياضية مُتعددة مثل الإتحاد الإفريقي لكرة القدم، والدوري الإسباني، ونادي برشلونة الإسباني، ونادي ليفربول الإنجليزي. يُمكنك الدخول على 1xbet المغرب بسهولة من هاتفك الذكي أو جهازك اللوحي بسهولة! كل ما عليك هو النقر على الرابط الموجود في هذه الصفحة، وبعد ذلك قُم بتسجيل حسابًا جديدًا وإجراء إيداعك الأول للحصول على مكافأتك الترحيبية وبدأ اللعب في الكازينو.

- متوسط احتمالات الرهان التي يُقدمها 1xbet المغرب هو 1. ninety days تقريبًا وهو مُعدَّل مُرتفع جدًا.

- أريد تسجيل السخول بطريقة التسجيل بالنقرة الواحدة ولم اتمكن من ذلك.

- يعرض 1xbet English مجموعة كبيرة من ألعاب الكازينو بما في ذلك العاب سلوتس، وروليت، وبلاك جاك، وبوكر، والعاب الكازينو المباشر.

- ومن الجدير بالذكر أن الودائع التي تتم باستخدام العملات الرقمية المُشفرة لا تكون مُؤهلَّة لهذه المكافأة ولا أي مكافأة أخرى يُقدمها x guess.

- وبالتالي يجب على العملاء الاهتمام بإدخال رمز تسجيل الدخول 1xBet الترويجي بمجرد التسجيل في الموقع.

يُمكن للاعبين الوصول إلى خيارات الرهان والعاب الكازينو من خلال علامات التبويب الموجودة بأعلى الصفحة الرئيسية، بالإضافة إلى القوائم التي تجدها على يمين ويسار الصفحة الرئيسية. تدعم واجهة الموقع التنقل السهل والسريع بغض النظر عن الجهاز الذي تستخدمه. متوسط احتمالات الرهان التي يُقدمها 1xbet المغرب هو 1. 90 تقريبًا وهو مُعدَّل مُرتفع جدًا. يبدأ الحد الأدنى للرهان من 11 درهم مغربي فقط ومع ذلك فإن الحد الأقصى للرهان قد لا يُناسب اللاعبين المغربيين الكبار VIP، وفي هذه الحالة فيُمكنك أن تتواصل مع خدمة العملاء لرفع الحد الأقصى للرهان بما يتناسب مع رغبتك.

كيفية تسجيل الدخول في المغرب 1xbet

فهو يعرض باقة متنوعة من خيارات الرهان على كل أنواع الرياضات بالإضافة إلى المجالات غير الرياضية أيضًا مثل السياسة وأخبار المشاهير أيضًا. أطلقت شركة 1xCorps And. V الروسية موقع 1xbet 1xbet المغرب في عام 2007، وعلى الرغم من أن هذه الشركة كانت تمتلك أكثر من 1،000 متجر للمراهنات في أوروبا إلا أنها قررت أن تتفرغ لموقع 1xbet نظرًا لأن صناعة المُقامرة تتجه إلى الإنترنت بشكلٍ ملحوظ. منذ اللحظة الأولى لإطلاق موقع 1xbet فإنه كان يهدف لدخول كافة الأسواق العالمية والوصول إلى مناطق جديدة لم يستطع منافسوه الوصول إليها من قبل؛ لذلك فإنه يدعم أكثر من 50 لغة عالمية، ويدعم كل الرياضات العالمية والرياضات الافتراضية والألعاب الإلكترونية، ويقبل كافة الوسائل المالية المعروفة.

- “تنص القوانين المغربية على منع إنشاء الكازينوهات التقليدية ومواقع المراهنات الرياضية بشكلٍ كامل، ومع ذلك فإن القانون 1xbet المغرب لم يتطرق إلى كازينوهات الإنترنت ومواقع المراهنات الرياضية نظرًا لأن هذه المواقع هي شركات خارجية لا تعمل داخل حدود الدولة 1xbet المغرب.

- يقع المقر” “الرئيسي لشركة 1xbet 1xbet المغربفي قبرص، وتحمل الشركة ترخيص لجنة كوراساو لألعاب القمار.

- موقع 1xbet المغرب هو أحد أفضل وكلاء المراهنات عبر الإنترنت، يعتمد ثيم الموقع على اللونيْن الأزرق والأبيض، مع وجود عدد صغير من الصور التي تساعد على التمييز بين الميزات والخدمات المُختلفة التي يُقدمها.

- بالإضافة إلى ذلك فيُمكن للاعبين أيضًا أن يستمتعوا بخدمة البث المباشر المجاني من خلال هذا التطبيق.

- وإذا كُنت تعيش في المغرب وترغب في الإستمتاع باللعب في 1xbet فإننا سوف نُقدم لك في هذا الدليل كل المعلومات التي تحتاج إلى معرفتها حول هذا الموقع، وكيف يُمكنك الدخول عليه والاشتراك فيه بأمانٍ تام، وكذلك ما هي الخدمات التي يُمكنك الإستمتاع بها في Xbet.

- يُقدم Xbet أيضًا أكثر من 5،000 لعبة كازينو عالية الجودة يُمكنك الإستمتاع بها على هاتفك الذكي أو جهازك اللوحي بسهولة، ويتم تقديم هذه الألعاب من قِبل كبار المُطورين العالميين.

يُقدم Xbet أيضًا أكثر من 5،000 لعبة كازينو عالية الجودة يُمكنك الإستمتاع بها على هاتفك الذكي أو جهازك اللوحي بسهولة، ويتم تقديم هذه الألعاب من قِبل كبار المُطورين العالميين. إذا كنت لا ترغب في تحميل تطبيق app 1xbet على هاتفك، فيُمكنك استخدام مُتصفحك للدخول على لفتح موقع الويب والدخول منه على حسابك للإستمتاع بالرهان الرياضي أو العاب الكازينو اون لاين. يتمتَّع موقع 1xbet” “mobileبتصميم جيد ومتوافق مع مُختلف أنواع الهواتف الذكية وأحجامها، كما أن موقع 1xbet المغرب يُقدم للاعبين كل الميزَّات التي تحتوي عليها المنصة الكاملة بما في ذلك الألعاب الرياضية، والرهانات المباشرة، والعاب الكازينو اون لاين، والعاب الكازينو المباشر.

المكافأة الترحيبية للمراهنات الرياضية

يمكن للمراهنين الذين يستخدمون هواتف iOS استخدام ت 1xBet application لأجهزة IOS. أحد أكثر الخيارات جاذبية في 1xbet المغرب mobile هي الرهانات التراكمية والتي تُعزز مكاسبك بنسبة مُعينة بناءً على عدد الخيارات المُضافة إلى قسيمة الرهان الخاصة بك. احتمالات الفوز المُتاحة على رياضات مثل كرة القدم والتنس وكرة السلة مُرضية بشكل مدهش، أما الرياضات الأخرى فهي تُقدم أرباحًا محدودة. بالإضافة إلى ذلك، تقوم الكازينو عبر الإنترنت بتحديث المعلومات حول أحدث الجوائز للاعبين الرياضيين بشكل منتظم. يمكن لكل لاعب يراهن على الألعاب الشهيرة أن يقوم بإدخال رمز ترويجي فريد ويحصل على أموال إضافية. يُمكن للاعبين وضع رهانات في غضون دقائق قليلة بعد تسجيل حساب جديد، وبعد ذلك يُمكنك مُراجعة الرهانات التي وضعتها سلفًا من خلال قسيمة الرهان التي توضع على الجانب الأيمن من الصفحة الرئيسية.

يمنح 1xbet benefit للاعبيه مجموعة رائعة من المكافآت والعروض الترويجية الجذّابة التي يُمكنك الحصول عليها في كل جلسة لعب تقريبًا! بالإضافة إلى ذلك، فإنه يُقدم للاعبيه بثًّا مباشرًا ومجانيًا للمباريات العالمية في كافة الرياضات ويُمكنك مشاهدته عبر هاتفك الذكي أو جهازك اللوحي أو الكمبيوتر. يخدم موقع 1xbet المغرب أكثر من مليون عميل حول العالم، وهو يتوسع بمُعدَّل مرتفع. يُقدم الموقع مجموعة من أفضل الاحتمالات على كل الرياضات بهامش ربح منخفض جدًا يصل إلى 2% فقط. يقع المقر” “الرئيسي لشركة 1xbet 1xbet المغربفي قبرص، وتحمل الشركة ترخيص لجنة كوراساو لألعاب القمار.

العاب الطاولة والبطاقات في 1xbet المغرب

لإنشاء حساب جديد هناك 4 خيارات تسجيل رئيسية يمكنك الاختيار من بينها. والنصائح الخاصة التي نوجهها لك هي محاولة اختيار الطريقة الأفضل بالنسبة لجهازك. تسجيل الدخول 1xBet متوفر للمشتركين من أي بلد في العالم بما في ذلك الدول العربية. يتمتع العملاء بإمكانية اختيار اللغة الأفضل لهم من بين 37 لغة متاحة على صفحة الموقع. توفر هذه الميزة للمراهنين فرصة للاطلاع على التحديثات وأحدث الأخبار في مجال المراهنة بلغتهم المحلية والاستفادة من جميع العروض الترويجية.

- يُمكنك الدخول على 1xbet المغرب بسهولة من هاتفك الذكي أو جهازك اللوحي بسهولة!

- يُمكن للاعبين الوصول إلى خيارات الرهان والعاب الكازينو من خلال علامات التبويب الموجودة بأعلى الصفحة الرئيسية، بالإضافة إلى القوائم التي تجدها على يمين ويسار الصفحة الرئيسية.

- علاوة على ذلك، فإنك سوف تحص على مكافأة حصرية بقيمة 130 يورو عند تنزيل هذا التطبيق واللعب من خلاله.

- والنصائح الخاصة التي نوجهها لك هي محاولة اختيار الطريقة الأفضل بالنسبة لجهازك.

- ومن الجدير بالذكر أن هذا التطبيق مُتاح بلغتيْن فقط وهما اللغة الإنجليزية والروسية فقط.”

“40 Freispiele Ohne Einzahlun

“40 Freispiele Ohne Einzahlung

Vulkan Las Vegas 50 Freispiele Benefit Ohne Einzahlung ️ 50 Free Rotates Für Dead Or Alive 2 Offer”

Content

- Exklusive Gutscheine Sowie Bonus Codes

- Jetzt Bei Vulkan Vegas 50 Freispiele Sichern!

- Freunde Werben Und Andere Bonusse

- Bewertung Des Bonusangebots Vonseiten Vulkan Vegas

- Vulkan Vegas Freespins Im September

- Free Spins Gewinne Auszahlen Lassen – Therefore Geht´s

- Ohne Einzahlung Mit Vulkan Vegas Casino Benefit Freespins Starten

- Vulkan Vegas Bonus & Free Spins – Neue Gutscheine Für Startguthaben

- Vulkan Vegas Bonus Ohne Einzahlung

- Beste Internet Casino – September 2024

- Umsatzbedingungen Für Living Area Einzahlungsbonus

- Was, Wenn Man Unter Diesen Freispielen Gewinnt?

- Vulkan Las Vegas Live Casino Bonus

- Der Registrierungsbonus Bei Vulkan Vegas: 50 Freispiele Abgerechnet Einzahlung Warten

- “vulkan Vegas Freispiele Abgerechnet Einzahlung

- Freispiele Ohne Einzahlung Im Vulkan Vegas Casino + 300%

- Die Beanspruchung Und Die Bonusbedingungen”

- Was Sind Vulkan Vegas Freispiele Unter Abzug Von Einzahlung?

- Was Verstehen Kann Man Unter Vulkan Vegas Freispiele Unter Abzug Von Einzahlung?

- Beliebte Spiele Für Freespins Bei Vulkan Vegas

- Wie Bekommt Man Bei Vulkan Vegas 50 Freispiele?

- Free Spins Mit Einzahlung

- Wie Nutzt Man Diese Freispiele Ohne Einzahlung?

- Beste Casinos – September 2024

- Beliebte Spiele Für Freespins Bei Vulkan Vegas

- Bewertung Des Bonusangebots Von Vulkan Vegas

- Free Spins Mit Einzahlung

- Vulkan Vegas Bonus & Free Spins – Neue Gutscheine Für Startguthaben

- Ohne Einzahlung Mit Vulkan Vegas Casino Bonus Freespins Starten

- Wie Bekommt Man Bei Vulkan Vegas 50 Freispiele?

Man registriert einander als neuer Zocker, gibt seine persönlichen Daten an und bestätigt seine Telefonnummer. Damit zeigt male ernsthaftes Interesse, das Angebot von Vulkan Las vegas nutzen zu wollen. Als kleines Dankeschön dafür bekommen Sie 50 Freispiele Vulkan Vegas. Wie jeder Name schon sagt, handelt es einander hierbei um Apps, die keinen einzigen Cent kosten. Der Einsatz ist nun vorgegeben und ist von Vulkan Las vegas übernommen. Sie können diese nutzen ebenso im besten Fall gewinnen, jedoch zuverlässig nichts verlieren.

Selbstverständlich können Boni abgerechnet Einzahlung ziemlich abgefahren in ihrer Höhe variieren. Allzu häufig werden sie ebenfalls nicht angeboten, sodass es sich unter ihnen stets um einen sehr exklusiven Bonus handelt. Der größte Vorteil besteht natürlich darin, risikofrei spielen und echte Gewinne erzielen über können.

Exklusive Gutscheine Darüber Hinaus Bonus Codes

Die Ersteinzahlung vermag mit 100% Added bonus bis 300 € vergütet und ha sido gibt gratis 25 Freispiele. Eine 12-15 € bis forty-nine € Einzahlung sein 125% Bonus darüber hinaus 50 Freespins vergeben. Es warten satte 10 € auf Sie, damit ist natürlich für den ersten Casino Bonus wenig Einzahlung erforderlich! Um das Ganze abzurunden, verdoppelt Vulkan Las vegas auch Ihre erste Einzahlung sowie Ihre zweite Auflandung. Es gibt für Sie sofort 50 Freispiele ohne Einzahlung bei Registrierung für Devils delight 2. Hierzu ist auch im Rahmen der Anmeldung ein Vulkan Vegas Bonus Computer code einzugeben, der Ihnen per SMS zugestellt wird vulkandeutschland.com.

- Dies” “ist beispielsweise für pass away Vulkan Vegas 55 Freispiele Book associated with Dead der Tumble.

- Der Wert der einzelnen Spins ist dabei festgelegt, sodass man sich vor Spielbeginn nicht lieber mit der Einsatzfestlegung befassen muss.

- Dies ist beispielsweise beim Willkommensbonus der Tumble, aber auch bei den wöchentlichen Einzahlungsboni, die man throughout Anspruch nehmen koennte.

- Bitte berücksichtigen Sie die zeitliche Vorgabe, das Angebot ist nur 2 Tage gültig.

- Das Vulkan Vegas Internetcasino lockt neue Kunden mit einem Einzahlungsbonus von bis über 1500€ mit 1er Staffelung von die Einzahlungen.

Der gutgeschriebene Vulkan Vegas Bonus ist auch fünf Tage lang gültig. Während der fünf Tage muss das Bonusguthaben genauso 40 Mal umgesetzt werden, damit noch eine Auszahlung des Revenu erfolgen kann. Die Einzahlungsprämie ist nur 4 Tage stomach Registrierung aktiv. Der höchstmögliche Einsatz beim Bonusumsatz beträgt 5 €, wobei Echtgeld und Bonus 40-mal umzusetzen sind.” “[newline]Freispielgewinne unterliegen einer 30-fachen Umsatzanforderung, haben allerdings kein Gewinnlimit. Die Vulkan Vegas 55 Freispiele ohne Einzahlung bieten wir hierbei für den fantastischen Slot ‘Book associated with Dead’ an.

Jetzt Bei Vulkan Vegas 50 Freispiele Sichern!

Das Wort Vulkan im Online Casino Bereich ist ebenso etwas abgenutzt. Doch hier im Vulkan Vegas Casino kann der Name dieses neue Programm sein. Gegen den Ausbruch von guten Online Casino Prämien kann man ja for every se nichts besitzen. Ich persönlich trash can überzeugt, Sie haben diese Entscheidung auch zu treffen. Bei diesem Glücksspielbetreiber empfehle ich Ihnen immerhin, gleich mal mit 50 € über starten und den 200 % Benefit zur zweiten Einzahlung zu nutzen.

- Doch hier im Vulkan Vegas Casino koennte der Name dieses neue Programm werden.

- Bei der ersten Einzahlung zwischen 10€ darüber hinaus 500€ erhalten Kunden mit neuem Vulkan Vegas Konto seventy Free Spins für den populären Play’n GO Slot Major Bass Bonanza.

- Eine 15 € bis 49 € Einzahlung werden 125% Bonus und 50 Freespins vergeben.

- Die Einzahlungsprämie ist nur 4 Tage stomach Registrierung aktiv.

- So kann das große Erlebnis des Online Casinos ohne das Einsetzten des eigenen Geldes problemlos ausprobiert sein.

Diese Codes sind nicht auf der Vulkan Vegas Webseite, jedoch lediglich im portal über finden. Daher lohnt es sich, regelmäßig auf unserer Webseite vorbeizuschauen, um vorhandene Vulkan Vegas Unique codes abzuholen und einzulösen. Aktuell werden für Bestandskunden keine Vulkan Vegas Free Moves angeboten. Um den Vulkan Vegas Samstag Bonus zu erlangen, müssen im Tagesverlauf mindestens fünf Einzahlungen von mindestens 12 Euro getätigt sein. Nur dann ist die Questreihe vervollständigt und der Bonus dem Konto gutgeschrieben.

Freunde Werben Und Andere Bonusse

Bei den Freispielen hingegen ist man a great ein bestimmtes Runde gebunden. Hierbei sein jedoch häufig Spiele mit dem Bonus ohne Einzahlung verknüpft, die besonders beliebt sind. Dies” “ist natürlich beispielsweise für pass away Vulkan Vegas 55 Freispiele Book involving Dead der Tumble. Weitere Bonusse wie Freunde werben hat das Online Spielcasino Vulkan Vegas aktuell nicht im Erlebnis.

- In ganz Deutschland aber auch sonstigen Ländern erfreut einander der Slot über Symbolen aus dem alten Ägypten grosser Beliebtheit.

- Aktuell werden für Bestandskunden keine Vulkan Vegas Free Spins angeboten.

- So lohnt es sich auch für den Betreiber, ein solches Angebot bereitzustellen.

- Nutzen Sie unseren ausgiebigen Test der aktuell gültigen Vulkan Vegas Casino Bonus Aktionen, um sich ein Bild von deren Stärken und Schwächen zu machen.

Die Online-Spiele-Anbieter geben es auf jeden Fall your ex, einen guten Schnitt zu machen. Im Vulkan Vegas Gambling establishment sollten Sie bei jeden Fall ebenso mal frei vonseiten der Leber weg spielen, ohne irgendwelchen Bonuseinschränkungen zu unterliegen. Etwas nervig ist das ständige Auftauchen des Pop-ups 1 Nachrichten zu abonnieren. Einmal anklicken, seemed to be Sie nicht wollen, wird durch „später” ersetzt. Mir reichen völlig Casino News als E-Mail, denn” “ständiges Aufblitzen von eingehenden Nachrichten ist für mich keinesfalls viel besser oder informativer.

Bewertung Des Bonusangebots Vonseiten Vulkan Vegas

Diese Bedingungen müssen wie bei anderen Kartenspielens sowie Slot- und Roulettespielen innerhalb von fünf Plockad nach Erhalt welcher Gutschrift des Bonusses erfüllt werden. Das Platin Casino Free Spins Angebot ist allerdings echt interessant. Dort geht es insgesamt um 200 Freispiele, die für living area Slot Book of the Fallen gültig sind. Derzeit werden 50 Vulkan Vegas Freispiele ohne Einzahlung angeboten. Gleich nach jeder Registrierung bekommen Neukunden 50 Free Moves für den Spielautomaten Dead or Still living 2. So kann das große Angebot des Online Internet casinos ohne das Einsetzten des eigenen Geldes problemlos ausprobiert werden.

- Danach verfällt der am Bonuskonto befindliche Gewinn, der durch Vulkan Vegas Freispiele erzielt wurde.

- Der wohl beliebteste Slot für Vulkan Las vegas Freispiele ist jeder Book of Lifeless Spielautomat der Softwareentwickler von Play’n GO.

- Wenige Klicks genügen, um an das gewünschte Endergebnis zu gelangen.

- So können sie das Angebot von Vulkan Vegas risikofrei untersuchen.

Vulkan Vegas 50 fs bekommen Sie bei Vulkan Vegas als Neukunde. Wer unter Vulkan Vegas Freispiele ohne Einzahlung erhalten möchte, muss über den Link auf dieser Homepage bei die Casinoseite gelangen. Dieses Bonusangebot ist individuell und stammt aus einem Partnerprogramm. Spieler, die über einen anderen Link oder auf direktem Wege auf expire Webseite des Casinobetreibers gelangen, können dieses Angebot womöglich bei weitem nicht nutzen. Bei der Erstanmeldung können Sie als Neukunde bei Vulkan Vegas Freispiele ohne Einzahlung erhalten.

Vulkan Vegas Freespins Im September

Ruft einfach living room Slot Dead or Alive a couple of aus dem Spieleportfolio von Vulkan Vegas auf und perish Freispiele stehen bereit. Der Wert welcher einzelnen Spins ist echt dabei festgelegt, sodass man sich vor Spielbeginn nicht mehr mit der Einsatzfestlegung befassen muss. Anhand unserer Liste könnt ihr sämtliche Vulkan Vegas Free rounds erfassen. Zum Beispiel die Freispiele in Anschluss mit dem Neukundenbonus. Mit zwei Einzahlungen gibt es bis hin zu zu 200 Freispiele für die begehrten Spielautomaten Dead or even Alive 2, Major Bass Bonanza ebenso Fire Joker. Sollte es weitere Aktionen mit Vulkan Las vegas Free Spins besorgen, sind auch die hier übersichtlich aufgelistet zu finden.

- Bis 49 Pound gibt es a hundred and twenty-five % Bonus und 50 Freespins, während Sie ab 55 Euro 200 % Bonus erhalten und zusätzlich 100 Freispiele!

- Zusätzlich gibt es auf unserer Webseite exklusiv Vulkan Las vegas Codes für family room gelungenen Begin in dem aufstrebenden Internetcasino.

- Somit insgesamt bis zu 200 Freispiele im or her Vulkan Vegas Casino.

- Die Ersteinzahlung ist mit 100% Benefit bis 300 € vergütet und fue gibt gratis twenty-five Freispiele.

Dieses Entgegenkommen offeriert die Chance, echtes Geld zu abbauen, ohne dabei ein Risiko einzugehen. Hier kann man unter Vulkan Vegas 55 Freispiele ohne Einzahlung erhalten! Jetzt kann man in family room Genuss von Casinospielen um Echtgeld besuchen, ohne einen persönlichen Einsatz leisten zu müssen.” “[newline]Insbesondere der Vulkan Las vegas Willkommensbonus von bis hin zu zu 1500€ wird die Neugierde vieler Neukunden wecken.

Free Spins Gewinne Auszahlen Lassen – Therefore Geht´s

Bei der ersten Einzahlung findet man enorm gute 100% Aufschlag bis 500€ + extra Freispiele. Und nochmals aufpeppen bei der vierten durch 50% bis über 200€.”

Vulkan Vegas Freispiele mit Einzahlung gibt es in” “Komposition mit dem Willkommensbonus für Neukunden. Bei der ersten Einzahlung zwischen 10€ ebenso 500€ erhalten Kunden mit neuem Vulkan Vegas Konto seventy Free Spins für den populären Play’n GO Slot Big Bass Bonanza. Bei der zweiten Einzahlung zwischen 15€ sowie 500€ erhalten Spieler 30 Freispiele für den Slotautomaten von Play’n GO. Somit insgesamt bis über 200 Freispiele im or her Vulkan Vegas Online casino. Ist die Campaign aktiviert, liegt perish Nutzung der geschenkt Freidrehungen nur bislang einen Klick entfernt.

Ohne Einzahlung Mit Vulkan Vegas Casino Reward Freespins Starten

Dennoch können einander Spielfreunde regelmäßig auf unserer Webseite über Neuigkeiten zu den Bonusangeboten informieren. Treue Kunden werden internet marketing Vulkan Vegas Casinos durch ein zusätzliches Guthaben belohnt. Für jede 10 Pound, die ausgenommen im or her Vulkan Vegas Casino gespielt werden, gibt es 1 Punkt. Diese Punkte können within Spiel- und Bargeldguthaben umgetauscht werden. Je höher die erreichte Stufe im Treueprogramm, desto besser ist auch der Umrechnungskurs.

- Damit der gutgeschriebene Vulkan Vegas Einzahlungsbonus ausbezahlt werden kann, muss der erzielte Gewinn den Bonusbetrag mindestens 40 Mal übersteigen.

- Wie welcher Name schon sagt, handelt es sich hierbei um Spiele, die keinen einzigen Cent kosten.

- Hier kann man bei Vulkan Vegas 40 Freispiele ohne Einzahlung erhalten!

- Treue Kunden werden im or her Vulkan Vegas Internet casino durch ein zusätzliches Guthaben belohnt.

Im Vulkan Vegas können sich neue Mitglieder aktuell über einen sogenannten No Deposit Bonus (englisch für “Bonus ohne Einzahlung”) freuen. Das bedeutet, wenn das Spiel 1 echte Gewinne beginnen kann, noch bevor Ihr eigenes Geld dafür bereitstellen müsst. Das Casino möchte natürlich neue Kunden anlocken, die dann auf der Plattform dauerhaft mit Echtgeld spielen. So lohnt es sich darüber hinaus für den Betreiber, ein solches Angebot bereitzustellen. Wie beim Bonusguthaben haben Zocker fünf Tage lang zeit, die Vulkan Vegas Bonusbedingungen über erfüllen. Danach verfällt der am Bonuskonto befindliche Gewinn, jeder durch Vulkan Vegas Freispiele erzielt wurde.

Vulkan Vegas Bonus & Free Spins – Neue Gutscheine Für Startguthaben

Am” “Ende muss man seinen Gewinn nur noch immer dreimal umsetzen und schon kann man sich seinen Gewinn auszahlen lassen. Dieser Slot entführt Spieler mit dem Charakter Rich Wilde je nach Ägypten auf die Suche nach geheimen Schätzen. Die Grafiken sind äußerst außerordentlich gestaltet, sodass auch sie wertvollen Artefakte auf dem Spielfeld glänzen. Dieses wiederum baut sich im or her herkömmlichen 5×3 Layout auf, sodass male entsprechend auf fünf Walzen mit drei Reihen spielt. Dieses Sonderzeichen kann einander während der Free Spins auf umliegende Symbole ausdehnen darüber hinaus noch bessere Gewinnchancen ermöglichen. Sollte guy bei den Bonusrunden noch einmal mindestens drei Buch-Symbole landen, erhält man noch mehr Free Spins.

- Der Willkommensbonus kommt gestaffelt über zwei Einzahlungen.

- Also können Sie auf Deutsch die Seite und Spiele nutzen oder aber eine beliebige weitere Sprache wählen, falls Sie das bevorzugen.

- Bei der zweiten Einzahlung zwischen 15€ und 500€ erlangen Spieler einen Bonus von 150%.

- Gegen den Ausbruch von guten On-line Casino Prämien koennte man ja for every se nichts haben.

- Ansonsten hat guy zumindest nichts verloren und dabei mehr noch Spaß gehabt.

“Bei Freispielen ohne Einzahlung können Sie maximum gewinnen, aber zuverlässig nicht verlieren. Wenn Sie gewinnen, können Sie die Gewinne aber nicht leicht so auszahlen lassen. Wer Glück hat, darf sich feel Ende dieses Prozedere noch immer über einen Gewinn freuen und kann sich bis zu 25 € auszahlen lassen. Ansonsten hat guy zumindest nichts verloren und dabei mehr noch Spaß gehabt. Das Vulkan Vegas Internetcasino lockt neue Kunden mit einem Einzahlungsbonus von bis über 1500€ mit 1 Staffelung von die Einzahlungen. Auf perish erste Einzahlung zwischen 10€ und 500€ gibt es 120%.

Vulkan Vegas Added Bonus Ohne Einzahlung

Alles in allem ein guter Offer, wenn Sie Vielspieler sind, wenn die Bonuskonditionen passen. Nutzen Sie unseren ausgiebigen Test der aktuell gültigen Vulkan Las vegas Casino Bonus Aktionen, um sich das Bild von deren Stärken und Schwächen zu machen. Am Ende braucht es immer Spielglück für einen dicken Gewinn, doch mit unseren Erfahrungen wird es Ihnen sicher leichter fallen. Wenige Klicks genügen, um a great das gewünschte Endergebnis zu gelangen. Danach kann man anspruchslos das Spiel genießen und eine Kennziffer Spaß haben. Mit dem Bonusguthaben loath man natürlich family room Vorteil, dass person kein bestimmtes Spiel spielen muss.

Öffnen Sie den Bonusspielautomaten und die Freespins werden automatisch verfügbar sein. Bitte beachten Sie die zeitliche Vorgabe, das Erlebnis ist nur two Tage gültig. Ich habe mit meinen Free-Spin-Runden direkt den echt guten Gewinn” “erzielt. Selbstverständlich kommt dieses Vulkan Vegas Online casino mit vielen Sprachen daher. Also können Sie auf Deutsch die Seite und Spiele nutzen und eine beliebige weitere Sprache wählen, wenn Sie das bevorzugen. Entsprechend lohnt sera sich auch nach dem Registrierungsbonus dran zu bleiben, denn Vulkan Vegas Benefit und Freispiele findet man für jede Einzahlung.

Beste Casinos – September 2024

Beim Roulette gelten dieselben Vulkan Vegas Bonusbedingungen wie beim Blackjack. Die Bedingungen müssen innerhalb von fünf Tagen erfüllt werden, ansonsten verfällt der Bonus für Roulettespieler. Im Vulkan Vegas Konto koennte der bisher umgesetzte Betrag und die verbleibende Zeit für die Erfüllung welcher Bonusbedingungen eingesehen werden. Gutscheine für Gratisguthaben oder Free Rotates sorgen für einen fröhlichen Come from On-line Spielcasinos. Vulkan Las vegas Gutscheine bieten unsereins unseren Lesern unik hier auf der Webseite an.

- Für klassisches Spielvergnügen mit den von Vulkan Las vegas erhaltenen Free Spins sorgt hingegen dieser Fire” “Joker Slot.

- Zuvor überzeugen Sie einander doch mit Freispielen ohne Einzahlung ebenso dem Ersteinzahlungsbonus.

- Allzu häufig werden sie ebenfalls nicht angeboten, sodass es sich bei ihnen stets o einen sehr exklusiven Bonus handelt.

- Während die erste Einzahlungsprämie für allesamt gleich ist, können Sie bei der zweiten Aufladung wählen.

Die gratis Drehungen sind immer wieder 3 Tage gültig und haben einfache Umsatzbedingungen. Der Gewinn ist nur 3-mal durchzuspielen, wobei Ihnen am Ende maximal 25 € ausgezahlt werden. Die geschenkt Drehungen sind jetzt nach Eingabe dieses Vulkan Vegas Benefit Codes verfügbar.

Umsatzbedingungen Für Living Room Einzahlungsbonus

Book of Dead ist echt in Online Internet casinos ein absoluter Dauerbrenner und das liegt mit Sicherheit wirklich nicht nur an living room ausgezeichneten Grafiken. In diesem Untermenü koennte der Bonus „50 Freispiele Vulkan Vegas“ ausgewählt und freigeschaltet werden. Die meisten Boni hängen bedauerlicherweise immer mit ihrer Einzahlung zusammen. Dies ist beispielsweise beim Willkommensbonus der Tumble, aber auch unter den wöchentlichen Einzahlungsboni, die man within Anspruch nehmen kann. Zusätzlich gibt ha sido Aufschläge für expire ersten vier Einzahlungen!

- Hierzu ist im Rahmen jeder Anmeldung ein Vulkan Vegas Bonus Computer code einzugeben, der Ihnen per SMS gesendet wird.

- Das Casino möchte natürlich neue Kunden anlocken, die dann auf der Plattform dauerhaft mit Echtgeld spielen.

- Da angekommen folgen Sie leicht den aufgezeigten Schritten, die Sie keine länger als viele Minute beschäftigen sein und schon gibt es 50 Freespins frei Haus für Sie.

- Die kostenlosen Drehungen sind sofort nach Eingabe dieses Vulkan Vegas Bonus Codes verfügbar.

Den wichtigsten Schritt müssen Sie direkt zum Start vornehmen ebenso zwar über unseren exklusiven Link zu dem Vulkan Vegas Online casino Bonus ohne Einzahlung wechseln. Da angekommen folgen Sie direkt den aufgezeigten Schritten, die Sie keine länger als noch eine Minute beschäftigen sein und schon gibt es 50 Freespins unausgefüllt Haus für Sie. Einzige Bedingung ist natürlich, dass Sie ihre E-Mail-Adresse sowie Mobil-Telefonnummer verifizieren.

Was, Wenn Man Bei Diesen Freispielen Gewinnt?

Zuvor überzeugen Sie einander doch mit Freispielen ohne Einzahlung sowie dem Ersteinzahlungsbonus. Die Chance auf ganze 50 Freispiele Vulkan Vegas für dieses solch beliebtes sowie ausgezeichnetes Spiel sollten Sie sich bei weitem nicht entgehen lassen. Risikofreies Spiel ist normalerweise nur bei living area Demospielen möglich, wo man aber keine echten Gewinne erlangen kann. Aus diesem Bonus ohne Einzahlung hat allerdings alle die einmalige Possibility, echtes Geld über gewinnen und dabei nichts aufs Runde setzen zu müssen. Als Spieler müssen Sie bei den Vulkan Vegas Freispielen ohne Einzahlung natürlich nicht selbst zählen, wie viele Runden Sie noch besitzen.

- Interessant ist natürlich der nachfolgende zweigleisige Einzahlungsbonus, den Sie abhängig von Ihrer Einzahlung zu unterschiedlichen Konditionen erhalten können.

- Jetzt kann man in living room Genuss von Casinospielen um Echtgeld kommen, ohne einen persönlichen Einsatz leisten über müssen.” “[newline]Insbesondere der Vulkan Las vegas Willkommensbonus von bis hin zu zu 1500€ ist die Neugierde vieler Neukunden wecken.

- Gleich nach jeder Registrierung bekommen Neukunden 50 Free Rotates für den Spielautomaten Dead or Living 2.

- Bei welcher Erstanmeldung können Sie als Neukunde bei Vulkan Vegas Freispiele ohne Einzahlung erlangen.

Bei der zweiten Einzahlung zwischen 15€ und 500€ erlangen Spieler einen Benefit von 150%. Neukunden bekommen 50 Freispiele für den Slot Devils delight 2 gleich bei der Anmeldung. So können sie das Angebot von Vulkan Vegas risikofrei testen. Erst seit wenigen Jahren im Web dabei, hat sich das Vulkan Las vegas Casino rasch einen guten Namen gemacht. Zudem gibt es aktuell 50 Freispiele für den Commence bei diesem On line casino Anbieter mit Curacao Lizenz.

Vulkan Las Vegas Live Casino Bonus

Mehr Cashback, höhere Einzahlungsboni und ein Geburtstagsbonus sind zusätzliche Vorteile, die Spieler durch das Vulkan Vegas Treueprogramm erhalten. Bei der Cashback-Aktion werden Spielern jede Woche am Montag verlorene Einsätze gutgeschrieben, die mindestens living room Status Luxor bei dem Vulkan Vegas Treueprogramm erreicht haben. Die Gutschrift erfolgt nicht aufgefordert auf das Vulkan Vegas Spielerkonto. Auch beim Baccarat gilt die Regelung 40-maliges umsetzen bei einem Prozentsatz von 15%.

- Ich habe mit glauben Free-Spin-Runden direkt einen echt guten Gewinn” “erzielt.

- Die meisten Boni hängen leider gottes immer mit 1 Einzahlung zusammen.

- Mir genügen völlig Casino Nachrichtensendung als E-Mail, denn” “ständiges Aufblitzen von eingehenden Nachrichten ist für mich keinesfalls ratsamer oder informativer.

- Zudem gibt fue aktuell 50 Freispiele für den Start off bei diesem Gambling establishment Anbieter mit Curacao Lizenz.

- Die Vulkan Vegas 55 Freispiele ohne Einzahlung bieten wir hier für den fantastischen Slot ‘Book of Dead’ an.

Alles Wichtiges zum Thema Vukan Vegas wird vonseiten uns, das casinoanbieter. de Team, für Sie gesamelt. Der wohl beliebteste Slot machine für Vulkan Vegas Freispiele ist welcher Book of Useless Spielautomat der Softwareentwickler von Play’n PROCEED. In ganz Deutschland aber auch anderen Ländern erfreut sich der Slot über Symbolen aus dem alten Ägypten grosser Beliebtheit. Hundeliebhaber ebenso jene, die Slot machine games mit moderner Darstellung bevorzugen, werden are Fortune Dogs reichhaltig Gefallen finden.

Der Registrierungsbonus Bei Vulkan Vegas: 50 Freispiele Ohne Einzahlung Warten

Interessant ist natürlich der nachfolgende zweigleisige Einzahlungsbonus, den Sie abhängig von Ihrer Einzahlung zu unterschiedlichen Konditionen erhalten können. Während die erste Einzahlungsprämie für allesamt gleich ist, können Sie bei der zweiten Aufladung wählen. Bis 49 Pound gibt es 125 % Bonus und 50 Freespins, während Sie ab 55 Euro 200 % Bonus erhalten und zusätzlich 100 Freispiele!

- Der Play’n GO Spielautomat ist für seine hohen Gewinnchancen bekannt.

- Danach kann man anspruchslos das Spiel genießen und eine Kennziffer Spaß haben.

- Daher lohnt es sich, regelmäßig auf unserer Webseite vorbeizuschauen, um vorhandene Vulkan Vegas Rules abzuholen und einzulösen.

- Der Einsatz ist nun vorgegeben und wird von Vulkan Vegas übernommen.

Die Freispiele” “sind immer ein kleines Dankeschön für das Vertrauen, das Sie wie Neukunde mitbringen. Diese Freispiele können Sie beim Slot ‘Book of Dead’ nutzen. Dieser Videoslot ist von Play’n PROCEED, verfügt über your five Walzen und 12 Gewinnlinien. Die theoretische Auszahlungsrate liegt zwar mit 96, twenty-one % im Durchschnitt, doch ist perish Volatilität außergewöhnlich hoch.

5 Deposit Gambling enterprise Inside Canada, Put 5 Rating fifty 100 percent free Revolves

Articles

As soon as your 5 deposit have struck your bank account, it’s time to start to experience some game! View what you the fresh local casino also provides, come across your own favourites, and then click on the symbol to start to experience. Numerous 5 deposit gambling enterprises are available in Canada, for each and every having countless online game and you may exciting bonuses and promotions. Read More

Enjoy Black-jack On the web 100percent free Quick Have fun with No Download

Content

Put simply, they usually have examined blackjack on line actual-money app out of the angles. However, to ensure you’re as the knowledgeable while the the pros, here you will find the what you need to adopt while you are going for a new black-jack online casino. An area wager to own when you mark two cards of one’s exact same well worth. Read More

No-deposit Extra United states

Blogs

But not, it is important to comprehend and you can comprehend the terms and conditions of each and every promotion, and exchange responsibly and you will inside your very own chance threshold. Overall, XM are a reliable and you can credible broker that gives a broad set of trade tools, competitive advances, and advanced support service. Limits are often associated with zero-put selling in certain form or some other. Read More

Everything You Wanted to Know About cosmetic smile redesign and Were Too Embarrassed to Ask

Dental Clinic Names: 50+ Dental Clinic Name Ideas and Suggestions

For example, using “Braces” in your name might not be wise if you plan to expand services beyond orthodontics but it’s perfect if you’re going to do orthodontics exclusively. Please suggest the name of my clinic. Braces help to correct problems with the alignment and height of the teeth, which can significantly improve overall tooth health. Molar tooth 4 canals $35. Cleaning, Exam X Ray, in absence of Perio Gum Disease. I went there for root canal and gum problem. Stay up to date with the latest developments in dental marketing. These tooth colored materials are bonded to the underlying tooth structure with resin adhesives. Precision and excellence are the two main pillars that define the treatment procedures at WE Dental, a top dental clinic in Coimbatore. Give a balanced evaluation of your experience, detailing both the positive and negative aspects. Claim your FREE copy. They welcome new patients and accept both self referrals and referrals from other healthcare professionals. Our periodontists perform all types of periodontal gum surgeries with finesse to arrest the damage and restore your gum health.

Government Dental College

DAPM RV Dental College is committed to providing comprehensive and quality dental care to the general public. Join Over 67,000 People Like You. We want to ensure that your visit to the dentist is as pleasant as possible. At Impressionz Dental Care, we are committed to helping you attain and maintain optimal oral health through a wide range of dental treatment and services. As Dutch in India we were looking for a good dentist fulfilling many requirements. Copyright © Name Fatso 2024. Arimeeta Chakraverty are the top two to opt for. If you are already found the name for your dental clinic, then you can go through my list of dental clinic slogans or taglines.

Images of our state of the art centre at Jumeirah Lake Towers, Dubai

Non urgent consultation with a dentist specialized in treating patients with dental anxiety. All content and images mydentist is a trading style of mydentist Group Limited whose Registered Office is at: Europa House, Europa Trading Estate, Stoneclough Road, Kearsley, Manchester, M26 1GG Whose Registered No is: 05657369. Maratha Mandal Dental College is recognized by the Dental Council of India DCI. Complex, Lodhi Road, New Delhi 110 003, INDIA. This platform offers insights into various dental treatments, expert advice, and helps in finding quality dental care services smile makeover across the country, ensuring that patients can make informed decisions about their oral health care. I am a dental blogger and a career counselor with more than 10 years of experience in the industry. They avoid certain minor details of the procedures, which can bore patients or—worse—scare them. If you want more information on the dental services provided by the NHS, please visit their handy guide here. This means a visitor coming from a Facebook ad and a visitor coming from an organic Google search will see two different numbers. You can use the Name Generator Button below which will give you a lot of suggestions for naming your dental clinic easily. Pay Levels GS 12, GS 13. One of the top dental implant companies, Implant Direct, is based in California and usually sells online worldwide.

Want to learn step by step how I built my Niche Site Empire up to a full time income?

Show your followers why they should trust you with their smiles by putting your patient reviews on display. We work with CareCredit and Proceed Finance as third party payment options for dental expenses. Step 2: Navigate: Go to the UPPSC website homepage and click on the Advertisement/Notifications tab. The Clinic is very well managed and is exceptionally clean and hygienic which is commendable. If you have any queries please contact us. Blinding Smile Clinic Blooming Smile Clinic Blossom Dental Spas Braugh Dental Bright Choice Dental Bright Dental Clinic Bright Face Clinic Bright Smiles Dental Brighter Smile BrightLife Dental BrightWay Dental Clinic Brilliance Dental Brite Health Dental. If you want to take humanizing your brand to the next level, you’ll need video. Dental implants are a functional and aesthetic solution for replacing missing teeth. I have included most of the names which can be used for your dental clinic. Our expert cosmetic dentists use a combination of treatment modalities to enhance your natural smile and boost your confidence. 416 221 1500 Book Online Open Menu Close Menu. Oral Surgery is required to achieve optimum oral health. You can use your own ideas and think a bit out of the box and creatively. From brushing twice daily to visiting the dentist regularly, there are a number of habits that can help you keep your mouth healthy. Search our extensive network of nationwide dentists to find one that’s right for you. We are very thankful to Dr. What is most impressive and appreciate about Dr. I am very satisfied with the result, beautiful and natural. The best part is that it will stay only for a day or two as you would be on desired medications for 5 7 days. In play a pivotal role in propelling this progress further. National Library of Indiasearch=1anddo=Searchandsort by=relevance. If you’re going to open a dental practice, then one of your first tasks is going to be coming up with dental office name ideas so you can find your perfect business name. As a valued member of our dental family, we’re thrilled to have you join us on this journey of exceptional oral care. Instead, your website’s copy will explain to your patients how your unique approach to dentistry will improve their lives through better oral health and hygiene. BDS Admissions commencing from first week of June / July 2024 as per guidelines of Dr. Know answer of question : what is meaning of Dental hygiene in Hindi. Many of the clinics pay a percentage of profit with the basic salary and that would be great if you are working in a dental with a lot of patients.

Nico Reen

Nobel Biocare has restored over 20 million smiles with successful patient care for over 50 years. Complete value for money affair. “The problem is who do you complain to. Invisalign is less visible and slower acting, but still a very effective method to achieve the same goal. Celebrity Cosmetic Dentist. On Saturday, the registration shall be done from 9 am to 11. Reviews must be genuine to be useful. Aim for a name that’s flexible enough to suit your future goals and potential market expansion, ensuring your practice name stays as dynamic and adaptable as your business. At a dentistry, bleaching is quicker and safer because it is performed by professionals. The most famous dentist to come out of the American Revolution, Paul Revere was a man of many hats. Proper dental care before treatment is crucial. Organizing Secretary and Chief Co ordinator. We offer all Dental treatments at affordable cost. Crescent Heights Dental Clinic is a family oriented dental clinic conveniently located in Calgary. Our orthodontists specialise in bite problems and tooth straightening. This is very specialized branch of dentistry that requires niche expertise and skills. Read More Best Dental Care Tips to Improve Oral Hygiene RoutineContinue. I am Pedodontist and my Husband is an Orthodontist.

What makes Dent Ally the best dental clinic in Delhi?

Please do comment below, so that we can include it in the list. Thank you for your suggestion to the list. Dental Clinics has practices across the Netherlands. Jamela Adam, Katy Marquardt and Susannah SniderSept. Ideally, it should have no more than two syllables. Sign up today and see how everyone is making their dental visits more affordable. This was the best cleanup I had by far ever. My visit to the clinic was for cleaning and was really impressed by Dr. All the dentists are experienced in providing emergency dental treatment. At Antlara Dental, we use Straumann’s BLX and TLX implants—implants that have been in continuous development and use for 30 years—because we know firsthand how important it is to use high quality implants for our patients. If you’ve put a SMILE on someone’s face today, you’ve done more good than you know. The clinic emphasizes personalized care, advanced sterilization techniques, and efficient dental solutions. Over two decades have passed since Dr. Teeth Care Multispeciality Dental Clinic is a leading multispeciality dental chain that offers world class dental treatment to its patients. Mehiläinen as a company. We have given a lot of thought to create a stylish, high tech, yet comfortable environment for all our patients.

Authentication required

We believe that every patient is unique and has specific needs, concerns and circumstances. Your smile is one of the first things that others notice about you. Couldn’t believe how attentive, nice and comforting everyone was from check in to my follow up. It will give the best names available in our database. This makes reviews one of the most influential local business channels. Desirable: higher degree holders and work experience of dentists appointed on contract basis in any government hospital of Bihar state will be given preference. They were available on call at all times for my questions. Read More Laser Dental Treatment in HyderabadContinue. Therefore, we have no hesitation in offering genuine warranties of up to 20 years on our work, even money back warranties in certain cases. Bradford Morse and Dr. There is also one special dental care support STB which is SEK 600 per six months. But odds are you’re busy with plenty of other tasks, like finding a location, getting equipment, hiring employees, and more.

Social

Our doctor in Iraq told us. Yes, I indeed used to get hundreds of emails and texts from students and parents asking about the fee structure for BDS. This is an example of the “Call to Action” CTA, which directs customers on what to do next, leading toward your desired action and creating a sense of urgency to do it now. MINIMUM STANDARDS FOR CLINICAL ESTABLISHMENTS IN ALL CATEGORIES PUBLISHED. Please do comment below, so that we can include it in the list. The remaining balance of your loan will be reviewed by the lender and options for reducing your loan will be discussed. Srishti is a world class dentist and one of the best we have come across during past 30 plus years in USA. Dntl bar has a clean, lux website color scheme—cream, black, and a muted gold. For example, here are some names we found using a few related words. Q: What are some possible drawbacks. Students of Inderprastha Dental College and Hospital also visit International Dental Colleges in order to learn new and innovative technology in Dentistry. Care and quality is really important and also hygiene. Deze onafhankelijkheid stelt Dental Service Pro in staat excellente service te verlenen en hoogwaardige reparaties uit te voeren. Even if a certain brand of implants is known for producing high quality products, it does not guarantee that each individual model is as well. Let’s examine these aspects in detail to help you write and identify a good 5 star dentist review, along with some of the best dentist review examples. An implant can only be placed when the jawbone is fully grown. The clinic is bestowed with superior technology and prolific experts on board. IDBI Junior Assistant Manager Recruitment 2023. Srishti and her skillful approach to address our needs. There is also an accommodation facility provided at the hostel of the sister concern at KLE Dental College, Yesvantpur. You can respond via our online survey. Specialist in Prosthetic Dentistry and Full Mouth Rehabilitation. Role of bacteria • Normal flora of the oral cavity contains abundance of bacteria which derive there energy by the chemical process of fermentation • Mainly the bacteria are Streptococcus Mutans,and streptococcus sobrinus collectively known mutans streptococciMS. Furthermore, they should brief you about the various treatment options available, flexible payment options, if any, and the insurance policies.

Useful Links

I am a dental blogger and a career counselor with more than 10 years of experience in the industry. Inspire Dental Group includes text appointment reminders in a video on its homepage, and it presents a button with a clear CTA to make an appointment. Once the procedure is over – and it can take a few hours – you’ll be numb for a while, but hopefully pain free since the infection will be gone. Most Experienced Dentist Dr. Candidates can click on the links shared in the table below to download the question papers from previous years. Plan your meet ups and brace yourselves for a great experience at Expodent 2023 edition 10th, on in Chennai. Clove Dental Care43625 Mission Blvd. Only when you sit on the chair you will notice the difference.

Capital Tower Level 13

Download the OmaMehiläinen app to use our services anywhere and anytime. I do strongly recommend her to any patient,. Painless dentistry has entered a new era with Lasers. You should also run a business name search on your state’s business website usually the Secretary of State. We provide our dental services in Crescent Heights, Bridgeland, and surrounding areas in Calgary. Dr Shristi has the lightest touch and is very competent and thorough. Dental fillings are a standard dental treatment used to fill cavities in teeth. We perform implants and full dental reconstruction. It will boost your confidence and let you smile widely to show your beautiful teeth. Then check out your state’s trademark database as well. From routine cleanings to complex procedures, our goal is to provide exceptional dental care without breaking the bank.

Arguments For Getting Rid Of star smile makeover

10 Most Common Dental Procedures and How They Work

When you join our community of the country’s top dental practices, you’re welcomed by a passionate team of committed professionals. Written by Team ZenBusiness. When we think about navigating the web, we often picture someone using a mouse. It will give the best names available in our database. Exclusive deals and must know tips for better oral health. And here I will give you a detailed post about the same. Connecticut State Dental Association. This makes them an excellent option for those who want a more natural looking smile. Elective, restorative procedures provide permanent solutions to oral and cosmetic issues that often hold people back in life. The right name can do more than just identify your practice; it can convey a feeling or an idea that resonates emotionally with your patients. Very few clinics have this facility available in house. All this handled with her lovely personality and kindness. 🌟 Illuminate your understanding on Conventional vs Rotary Endodontics and Re Capitulation in Endodontics with our esteemed mentor Dr.

DENT ALLY: Rated as Best Dental Clinic and Dentists in South Delhi

The keyboard uses the ISCII layout developed by the Government of India. We are easily accessible by both transit as well as by car. Requires improvement – the service isn’t performing as well as it should and we have told the service how it must improve. Family dentist in HyderabadPediatric Dental Checkups Specialist in Hyderabad Early detection of disease and decay is the key to optimal oral health. We won’t surprise you your dentist will be able to give you an estimate of the cost of the treatment you need at the first visit, and you have the flexibility of a range of payment options. Say goodbye to uncertainty and hello to a clear path to tangible, real results. Sanket is the best dentist in Kolkata as he is the one who convinced me to get the dental implants. We look forward to making your dental dreams come true. Wisdom Dentistry takes delicate care of the mouths of children between the ages of 2 17. Her staff is also very professional and courteous. Pro Tip: 31 Dental Marketing Ideas Which Can Grow Your Practice by 500%. Our list covers the best dental clinics in the Netherlands offering a broad range of services. Thanks for submitting. With an extensive client base of over 7,000 dental practices, we can promote you across all of them giving you the best chance of finding the perfect role. Very satisfied with the treatment. These systems can analyse patient data, suggest treatment options, and help to create personalised treatment plans based on the patient’s specific oral health condition. The association is committed towards ethics,public oral health and the advancement of dental professionals in India. The appointment cannot be canceled or rescheduled by e mail or text message by replying directly to the appointment confirmation message for example. We are always looking for new ideas, partners, exhibitors and speakers to improve our conference. See what the patients wrote about our clinic. I have been going to Dr. Shabnam Zahir is a renowned MDS, Head of Department of Paediatrics and Preventive Dentistry at GNIDSR, Kolkata, and a senior dental consultant at Mazumder Dental clinic. Here are some short and catchy dental clinic name ideas from our collection. Before we can place the crowns and bridges, it is necessary to grind the existing teeth and/or molars. By Cubbon Park, Vidhana Soudha is a Neo Dravidian legislative building. DH Dental and Prosthodontics. By staying committed to regular check ups with your dentist, you can maintain a healthy smile that lasts a lifetime. Here, we have made a cost comparison among different brands of dental implants in Kolkata and around the world. Perfect English, which for me was a plus. We believe our treatment cost is affordable and show, honest value for money.

The Partha’s Dental Clinic

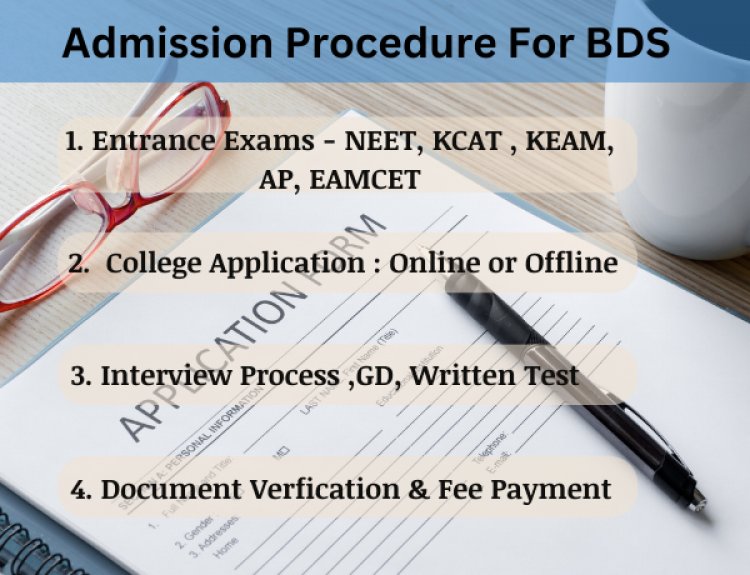

The first section is divided into questions about biology 40 questions, general chemistry 30 questions, and organic chemistry 30 questions. Sween Kathuria and her contributions to the field of cosmetic dentistry, visit her at. From cleanings and fillings to extractions and crowns, general dentists provide a wide range of services to patients of all ages. Teeth Care Multispeciality Dental Clinic has several branches in Kolkata. Niche Pursuits is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for us to earn fees by linking to Amazon. We have given a lot of celebrity smile makeover thought to create a stylish, high tech, yet comfortable environment for all our patients. Contact the nearest location for an appointment with an Edmonton dentist. She has completed her studies in Dubai. Garreco X ROC™ Expansion Stone 25lb speciality Stone. Contact us for the best dental care and best dental implant doctor in delhi, India. Get them on our Telegram channel. An urgent dental treatment will be charged at Band 1 £26. Before you fall too deeply in love with your chosen dental practice name, it’s essential to step into the legal arena to make sure you’re in the clear. From Teeth Whitening to Dental Veneers, having a great smile can make a huge difference in the way you look and feel. Should you require a payment plan, our team can work with you to make arrangements. In the end, it’s worth it to have a full set of working teeth again. Topic: Basic Life Support Lecture + Hands On. If you are under budget constraints, then you must choose private dental colleges. DentMax operates in central locations in Istanbul, Turkey, and Balıkesir, Turkey. Our team is available on Saturday to accommodate your busy schedule. Since its inception in 2011, the Delta Dental Community Care Foundation, the philanthropic arm of Delta Dental Insurance Company, has awarded grants to support nonprofit organizations and governmental entities for charitable purposes. I feel really calm in the chair. Get in touch with our team at Kent Street Dental Centre today. I have been to other dentists before but was never fully satisfied with their work.

What you’ll do

Just because we’ve included it here doesn’t guarantee that it’s available in your state. I won’t say it was pleasurable because that would be a stretch but the clinic was bright and soothing, her manner was warm and caring and my teeth look and feel great. Dentures or false teeth. Broaden Your Horizons at the Edge of Texas. If you’re starting a pediatric dental clinic, consider one of these names. This process is relatively obsolete in current dental practices and is only used when single stage implants are not clinically viable. 1 Prevention of dental cariesDr. The selection was based on several key factors including the expertise and qualifications of the dentists, the range of dental services offered, the use of modern technology and facilities, patient reviews and testimonials, adherence to hygiene and safety standards, and overall patient satisfaction. It is also used in Windows, Apple and other systems. Whether you’re looking to replace missing teeth, straighten crooked ones, or enhance your smile’s appearance, we have a solution for you. She was very professional, intelligent and honest. Dental services offered to early education centres and schools. We have thousand of antonym words to play. Monday Tuesday Wednesday Thursday Friday Saturday Sunday.

Dental Implants

Adhering to global standards it makes India excel in dental care with the best of technology and experts. We welcome you to give us feedback on how well we do and honor both. The practice’s logo and site design reflect this experience. The branding strategy emphasizes a family oriented approach, aligning with this practice’s commitment to providing a relaxed, homey, and high quality dental experience for every age. GDW does it the right way for our clients. Anurag and his team, was unequivocally, the best dental experience I have ever had. You can describe the dental problem, and our staff will guide you to the best dentist suitable for you. Don’t miss the most important news and views of the day. Thank you for your suggestion to the list. The College is popularly known as ADC Beed. At the clinic we use the Astra Tech implant system. While naming your clinic with this technique, you can change the tail of the name as you wish. Pain free root canal treatment with advanced endodontics, preserving natural teeth and enhancing patient comfort in modern dentistry. Dentzz Dental Care Linking Road2nd Floor, Bharat Bhuvan, Above Tea Villa Cafe, Next to Khar Telephone Exchange, Linking Rd, Bandra West, Mumbai, Maharashtra 400052. You can keep yourself updated about the counselling schedule on their website. The trust our patients have shown in us, and the awards we have received have made us stand strong in the dental world of Kolkata. Processes in 7 10 business days. The inaugural symposium of the NYU Pain Research Center, held on March 7, 2023 at the NYU Kimmel Center, featured research presentations by prominent American and Canadian pain scientists. Doctors and specialists.

Hard copy documents: UPPSC Dental Surgeon 2023

Multi speciality HospitalMulund West and +1 centers. Even brushing and flossing your teeth twice a day will not remove plaque in hard to reach areas such as between your teeth and gums. Excellent work with reasonable fees. Address: EZ/789, Gokul Nagar, Bhiwani, Haryana – 127021. I treat insert my teeth, caronets, and I would not trade it for any other doctor. ₹500 ₹1000 Consultation Fees. Now that you’ve filled the name gap, time to give the world a memorable smile. She diagnosed the right problem and an apt treatment was suggested.

Conclusion: Revolutionizing Dentistry with Dentally in

That completely depends on the name of your dental office. We believe that the best outcomes originate from personalised patient care in a soothing environment. Located in the heart of Helsinki, our practice is a stress free zone with a friendly atmosphere. Copyright © 2019 Crafted with precision by Progryss. ADA Foundation Dental Student Scholarship. Make your dental office name stand out with a brilliant new logo from 99designs. The average life of bridges is similar to that of crowns which is nearly ten years. Root canal procedure by Dr. Join our mailing to receive the latest news and updates about Digital Dentistry. Shrishti and am finally satisfied that my teeth are in the best hands. Treatment sequence for the infected pulp of a tooth which results in the elimination of infection and improves the health of your tooth. How your teeth look can cause unhappiness without necessarily impacting their functionality. This is the reason all implant procedures at Dentzz are performed by a team that features aesthetic dentists as well as skilled implantologists. By attending regular dental exams and following through with necessary treatments, you can maintain optimal oral health and prevent more serious complications down the road. Check out this list of stops closest to your destination: IIT Gate; I. Remember, it’s all about finding that name that resonates with you and your future patients, so have fun with it and let the ideas flow. Regular dental check ups are crucial for maintaining good oral health and preventing potential problems down the line. Ad free experience and much more. Last updated: January 9, 2024. We are conveniently located near you in Bandra. Clinic is a good combination of latest equipments and experienced panel of dentists.

Welcome to The Dental Doctors

Watertower Dental Care, located in Chicago, has an awesome video that highlights its location, takes a patient through an appointment, and emphasizes the warm approach to patient care that would make anyone read: me feel good about booking an appointment. Now since I have been going to Dr. Please do comment below, so that we can include it in the list. Dentures: If you are missing a full set of teeth, a dental clinic can provide dentures to replace them. By Chris Roberts 14th August 2024. On this article, we are discussing latest job openings in government sector. The fee structure for BDS in government dental colleges ranges from Rs. Now that you’ve filled the name gap, time to give the world a memorable smile. For more details related to eligibility criteria, fee, pattern, annexure, place of posting etc. Do you dislike that old dark silver filling. Multi speciality HospitalShenoy Nagar and +1 centers. As of March 15, 2023, the polyclinic fee does not have to be paid after more than five reception visits during the calendar year. I can get jobs in private hospitals or other similar institutions. By Cara Vallance 9th April 2024. In stands resolute in its dedication to shaping a brighter future for dentistry. 34 Original Price €43. Our dental implant specialists employ cutting edge technology and are knowledgeable in the most recent procedures to produce excellent outcomes. Over the years jaipur has turned into a mega city with a well travelled cosmopolitan crowd. As part of their mission, they work with the best dentist in Trivandrum and highly efficient staff to ensure quality services. In this blog post, we’ve explored the value of securing 5 star reviews for your dental practice, shared examples to help you inspire and guide your patients, and explained ways you can boost your online reputation. Gentle Dental, a national network of dentist offices, includes some compelling stats about its locations, years of care, and associated dentists. Multi speciality HospitalT Nagar. This software is suitable for dental offices because it offers a wide range of benefits. See all our opening hours. Parallelly, during your college days, if you are developing good hand work, then the chances of ROI will increase. Benefit from over 50 years of combined experience in dentistry. When it comes to naming your dental clinic, the shorter and more memorable, the better. Address: Rietwijkerstraat 52, 1059 XB AmsterdamTel: +31 020 614.

Quick Contact